US President Donald Trump signed an govt order on March 7 establishing a Strategic Bitcoin Reserve (SBR) and a “Digital Asset Stockpile.” Each will initially be capitalized with cryptocurrency seized through authorities felony and civil forfeiture proceedings, with future acquisitions potential underneath budget-neutral situations.

Moments after the information went public, BTC’s value slipped from roughly $91,200 to about $84,667—a drop of greater than 7%—in what many observers are calling a traditional “promote the information” second. Some market contributors seem dissatisfied that the manager order shouldn’t be instantly extra aggressive in shopping for Bitcoin. But key trade voices keep that the market might have misinterpret the long-term implications.

Is The Strategic Bitcoin Reserve A Disappointment?

In response to David Sacks, White Home AI and crypto czar, who announced the event through X: “Only a few minutes in the past, President Trump signed an Government Order to ascertain a SBR. The Reserve shall be capitalized with Bitcoin owned by the federal authorities that was forfeited as a part of felony or civil asset forfeiture proceedings. This implies it is not going to price taxpayers a dime.”

Sacks added that the US owns about 200,000 Bitcoin. Nonetheless, he additionally clarified that “there has by no means been an entire audit” and that “the E.O. directs a full accounting of the federal authorities’s digital asset holdings.” Notably, the US President Trump commits to not promoting “any Bitcoin deposited into the Reserve. Will probably be saved as a retailer of worth. The Reserve is sort of a digital Fort Knox for the cryptocurrency usually known as ‘digital gold.’”

Moreover, the Secretary of Treasury and Commerce—led by well-known Bitcoin bull Howard Lutnick—is permitted to develop budget-neutral methods for buying extra Bitcoin. Though particular strategies stay unclear, the transfer might result in additional US authorities BTC accumulation. “The Secretaries of Treasury and Commerce are approved to develop budget-neutral methods for buying extra Bitcoin, supplied that these methods don’t have any incremental prices on American taxpayers,” Sacks writes through X.

Separate from the SBR, the manager order establishes a US Digital Asset Stockpile, which can embody seized digital belongings apart from BTC. In response to Sacks, this stockpile is not going to be actively expanded past no matter cash the federal government beneficial properties through forfeiture. Its objective, he defined, is to train “accountable stewardship of the federal government’s digital belongings underneath the Treasury Division.”

Within the midst of the value volatility, trade leaders struck an optimistic tone. David Bailey, CEO of BTC Inc, wrote on X: “The worldwide response to tonight’s information shall be fast. That is the shot heard around the globe. Couldn’t be extra pleased with this second or extra excited for what comes subsequent. See you on the moon.”

Nic Carter, normal accomplice at Fortress Island Ventures stated through X: “Announcement couldn’t have gone higher: Marketing campaign promise saved. Bitcoin Reserve clearly distinguished from altcoin Stockpile. Bitcoin will get official USG seal of approval, no different coin does. No taxpayer $ spent to amass cash (so no backlash). Future acquisition of cash seemingly left to Congress, correctly.”

Bitwise Chief Funding Officer (CIO) Matt Hougan listed 4 the reason why the manager order has main bullish impacts on Bitcoin:

1) Dramatically reduces the chance the US authorities will some day “ban” Bitcoin;

2) Dramatically will increase the chance that different nations will set up strategic Bitcoin reserves;

3) Accelerates the pace at which different nations will contemplate establishing strategic Bitcoin reserves, as a result of it creates a short-term window for nations to front-run potential extra shopping for by the US;

4) Makes it a lot more durable for establishments — from nationwide account advisor platforms to quasi-governmental companies just like the IMF — to place Bitcoin as one way or the other harmful or inappropriate to carry.

Famend crypto analyst MacroScope (@MacroScope17), commented: “The market has been uncertain there would even be a strategic reserve. Now, not solely will there be one, really buying extra BTC appears to be like seemingly. The fast sell-the-news response apart, over the long term, that is vastly bullish in comparison with the market’s expectations up so far.”

The analyst expects that this information will ignite a “nation-state arms race psychology”. Additionally, he expects to see extra 13F filings by sovereign wealth funds who waited for this announcement. “Essential to observe this in coming weeks and months,” he concluded.

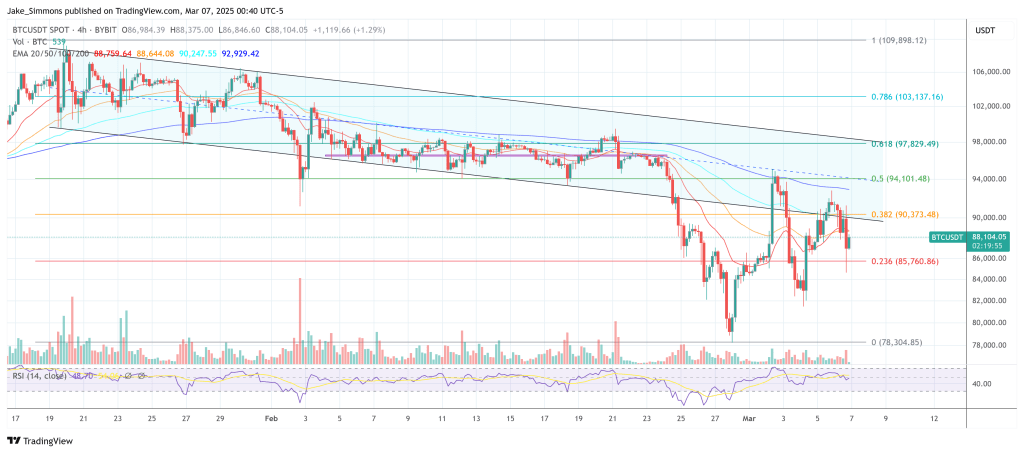

At press time, BTC traded at $88,104.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.