Ethereum buyers have been actively managing their positions throughout current value swings, in response to blockchain analytics agency Glassnode.

Based on the agency, after a pointy rally to $2,500, Ethereum’s value retraced to $2,050, a value area the asset final witnessed in November 2023. Information reveals that buyers moved capital strategically throughout totally different value ranges, seeking to navigate the dip.

How Key Ethereum Holders Behaved

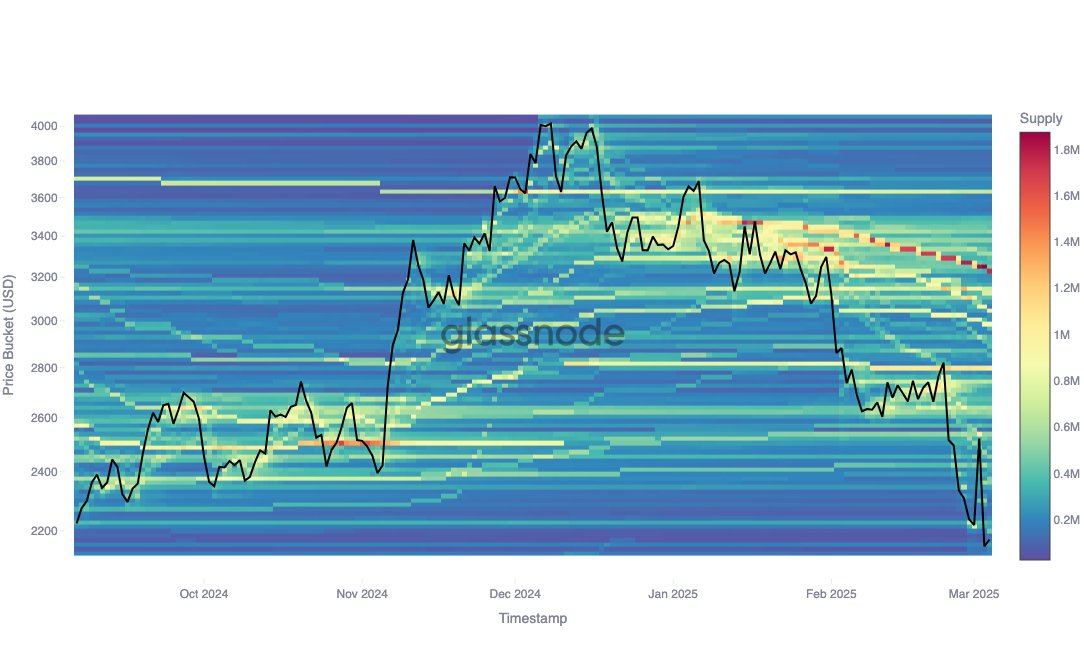

Per a three-month evaluation, buyers who initially acquired ETH at $3,500 adjusted their publicity considerably in February. They entered the market at the height of $2,500 and the current low of $2,050. These buyers now maintain 1.75 million ETH at a mean price foundation of $3,200, successfully lowering their preliminary entry value by round 10%.

Glassnode additionally revealed that on March 1, buyers amassed roughly 500,000 ETH at round $2,200. Nevertheless, they shortly redistributed these holdings when the worth touched $2,500.

Moreover, a significant resistance zone has emerged at $2,800, the place market members collected roughly 800,000 ETH. This means that if Ethereum’s value rebounds, $2,800 shall be a vital degree for merchants to observe.

Different analyses affirm the rising accumulation amongst whales. Market pundit Ted pointed out right this moment {that a} whale investor not too long ago bought 17,855 ETH, value roughly $36 million, at a mean value of $2,054.

This whale’s complete Ethereum holdings now exceed $2.5 billion. Notably, this displays the buildup pattern, as giant buyers see the present value as a chance.

Ethereum in a Favorable Place?

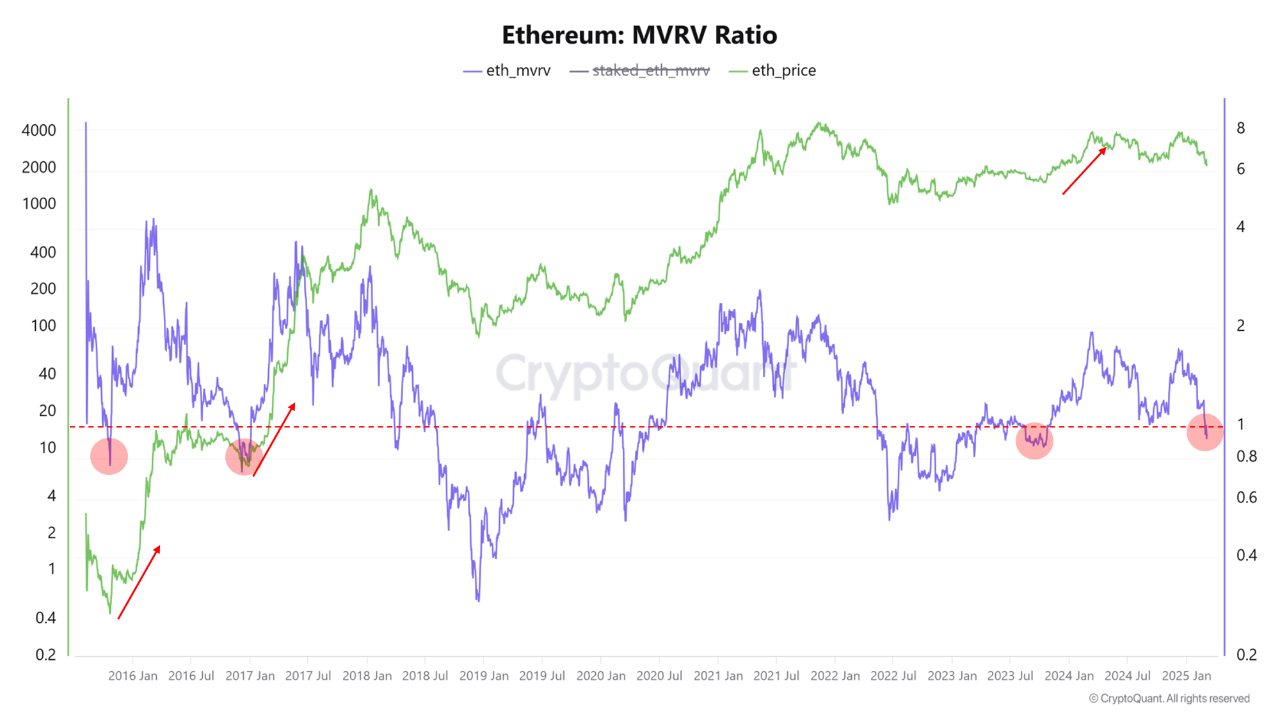

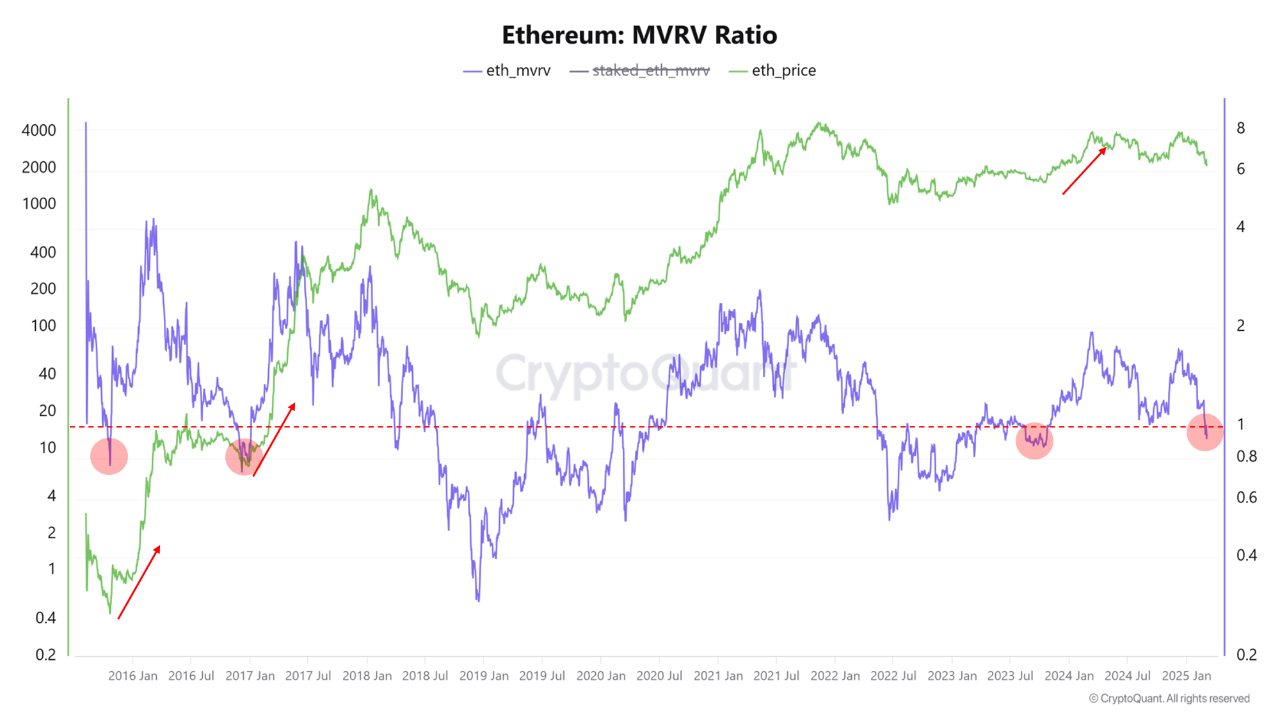

Furthermore, CryptoQuant analyst MACD suggested that ETH could be in a good place regardless of the present value struggles. Based on him, the MVRV ratio has dipped beneath 1, signaling an undervalued zone. In earlier bull cycles, this degree preceded important value surges.

As well as, he famous that the variety of Ethereum accumulation addresses, which obtain ETH however by no means withdraw it, has additionally risen sharply. This means that institutional buyers are constructing their positions through the present downturn.

Regardless of these bullish indicators, MACD burdened that broader financial circumstances nonetheless affect the crypto market. He famous that U.S. liquidity insurance policies, tariff measures, and financial methods may proceed to create downward stress on asset costs.

Best Purchase Alternative

Curiously, Ethereum’s technical patterns, market analyst Crypto Rover suggests the altcoin presents a horny purchase alternative. Information from his chart reveals that ETH has been buying and selling inside a horizontal channel since March 2024.

That is the BIGGEST $ETH purchase alternative I’ve ever seen! pic.twitter.com/rgdbB4LL9V

— Crypto Rover (@rovercrc) March 5, 2025

Each retest of the trendline has led to a pointy transfer in the wrong way. Since its surge to $4,097 in December 2024, Ethereum has been in a downward pattern, not too long ago touching the decrease trendline once more. If historical past repeats, a breakout to the upside may observe.

In the meantime, one other analyst, Da Crypto Normal, highlighted Ethereum’s efficiency towards Bitcoin. Based on him, ETH/BTC has reached a significant assist degree and is displaying bullish momentum after retesting the low cost zone.

He additionally believes this is a perfect shopping for alternative, each for short-term merchants in search of scalps and for long-term buyers including to their holdings.

DisClamier: This content material is informational and shouldn’t be thought of monetary recommendation. The views expressed on this article might embody the writer’s private opinions and don’t replicate The Crypto Fundamental opinion. Readers are inspired to do thorough analysis earlier than making any funding selections. The Crypto Fundamental will not be answerable for any monetary losses.