Bitcoin accumulation addresses simply recorded an influx of over $2 billion price of BTC amid the most recent market droop.

That is in keeping with a disclosure from main on-chain analytics useful resource CryptoQuant. Notably, the platform referred to as consideration to an enormous influx into the Bitcoin Accumulation Addresses, a cohort of wallets with balances every exceeding 10 BTC and no historical past of outgoing transactions.

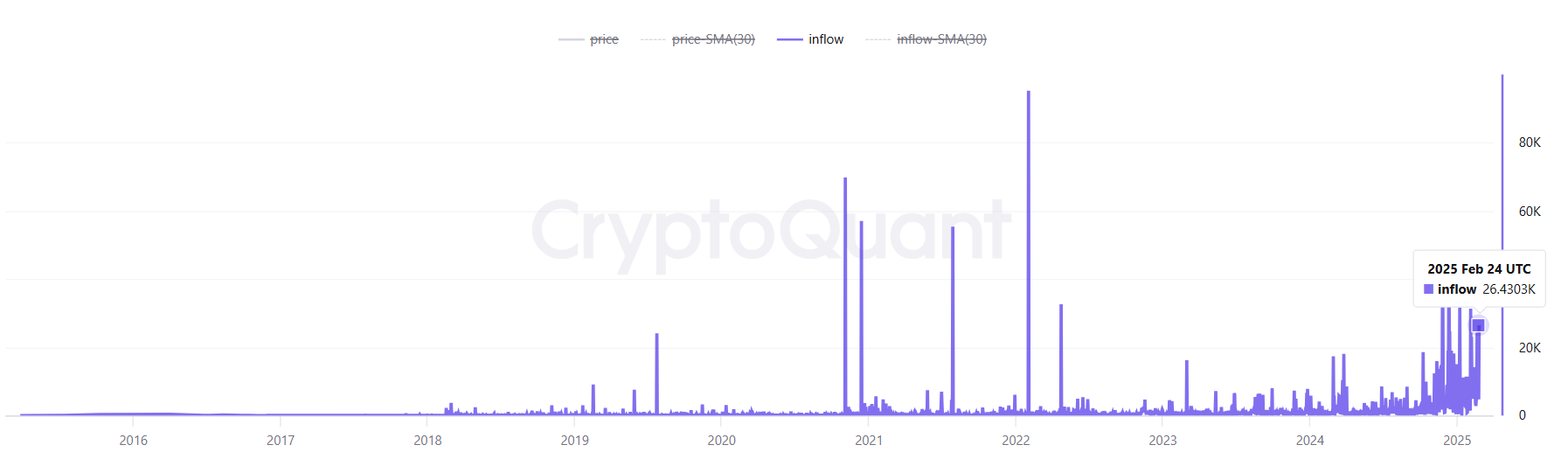

Bitcoin Accumulation Wallets Cop 26,430 BTC

Notably, Ki Younger Ju, founder and CEO of CryptoQuant, set an alert for when these addresses witness substantial inflows involving over 20K BTC. The alert was set off as we speak following the current motion of precisely 26,430 BTC price $2.35 billion into the addresses yesterday, Feb. 24.

What’s attention-grabbing is that the buildup spree comes on the again of a current worth crash that has seen Bitcoin lastly quit the $90,000 mark for the primary time since mid-January. Presently altering arms round $88K, BTC is down greater than 7.8% over the previous two days of the brand new week as macroeconomic headwinds loom.

Regardless of the bearish stress this week, accumulation appears to be on the excessive aspect, as evidenced in the current 26,430 BTC influx. Apparently, this marks the best quantity of influx into these addresses in over three weeks. The final time they witnessed a better quantity was on Feb. 3, involving 31,272 BTC.

Notably, that day, Bitcoin noticed a formidable 3.87% worth acquire, ultimately reclaiming the $100K worth mark and shutting the day above it. Nevertheless, bearish forces retook management of the scene, resulting in a consolidation that has persevered all through the month till the current dump.

A Persistent Accumulation Development

A more in-depth have a look at the buildup addresses confirms that the continuing influx development picked up since final November, following Donald Trump’s victory within the U.S. elections. As an illustration, the addresses copped 47,305 BTC on Dec. 11, 2024, the most important every day influx in over two and a half years.

Though the revival of the influx development coincided with Bitcoin’s resurgence final November, with the asset ultimately hitting a brand new all-time excessive of $109K final month, the current worth crash has not notably discouraged the buildup, as they’ve persevered all through February.

This means that whales stay assured in Bitcoin’s potential however the short-term bearish pull. For one, Technique (previously MicroStrategy) has continued to acquire extra Bitcoin tokens, not too long ago accumulating 20,356 BTC price $1.99 billion to deliver its stash near the 500K BTC mark.

After yesterday’s dip, which noticed Bitcoin crash 6%, Technique Chairman and Bitcoin permabull Michael Saylor urged that the main crypto asset was now “on sale.” Basically, Saylor regards the present dip as a chance to acquire BTC at a reduction, a sentiment apparently held by different long-term buyers.

A number of indicators verify this. For instance, the CryptoQuant Binary CDD metric now has a 0 worth, indicating that extra long-term holders are holding onto their cash. As well as, Bitcoin exchange reserve has continued to drop, presumably signaling an intention amongst buyers to HODL their tokens in chilly wallets.

Presently, Bitcoin trades for $88,886, down 2.81% as we speak after a extra substantial 4.89% droop yesterday. Regardless of the bearish worth motion, Younger Ju insists that the bull market stays intact even when BTC drops to $77,000.

DisClamier: This content material is informational and shouldn’t be thought-about monetary recommendation. The views expressed on this article might embrace the writer’s private opinions and don’t mirror The Crypto Primary opinion. Readers are inspired to do thorough analysis earlier than making any funding selections. The Crypto Primary will not be chargeable for any monetary losses.