February 21 has emerged because the worst day for the inventory market in 2025 thus far, after most equities recorded important capital outflows, elevating issues {that a} potential crash is likely to be on the horizon.

Particularly, the market misplaced $900 billion in a single day, with main indices such because the S&P 500 main the downturn.

A breakdown of the losses signifies that semiconductor big Nvidia (NASDAQ: NVDA) plunged 4.05%, Microsoft (NASDAQ: MSFT) misplaced 1.90%, and Google mum or dad Alphabet (NASDAQ: GOOGL) dropped 2.71%. Amazon (NASDAQ: AMZN) misplaced 2.83% of its market worth.

Monetary shares additionally contributed to the rout, with banking big JPMorgan Chase (NYSE: JPM) slipping 0.56% and Goldman Sachs (NYSE: GS) shedding 1.02%.

The sell-off in client discretionary shares was additionally notable, with Tesla (NASDAQ: TSLA) down 1.46% and House Depot (NYSE: HD) dropping 2.87%.

UnitedHealth recorded one other standout drop (NYSE: UNH), which fell 7% after the Division of Justice introduced a civil fraud probe into the corporate’s Medicare billing.

S&P 500 erases all-time excessive beneficial properties

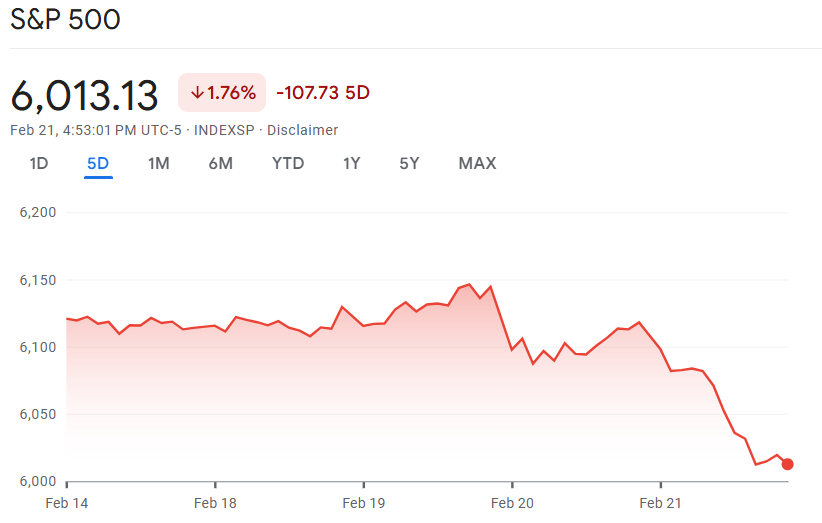

These losses have seemingly erased the S&P 500’s current beneficial properties, which noticed the index hit an all-time excessive of 6,146 on February 19. Nonetheless, the benchmark index ended the final buying and selling session down 1.7%, whereas on a weekly timeframe, it plunged 1.67%.

Financial issues and coverage uncertainty have pushed the present market bearish sentiment. Traders appear rattled by rising costs triggered by President Donald Trump’s proposed tariffs, weak financial information, and inflation expectations.

Sustained promoting stress menace

Moreover, shares may face additional downward stress as institutional traders undertake a cautious outlook.

On this case, information shared by monetary market commentary platform The Kobeissi Letter in an X post on February 21 indicated a pointy decline within the funding unfold for institutional traders, dropping practically 50 foundation factors to its lowest stage since August 2024.

The metric tracks institutional demand for lengthy inventory publicity through futures, choices, and swaps. In line with the info, the present lows have been initiated after the Federal Reserve’s December 18 assembly, a time of heightened market uncertainty. The establishment signaled a potential slowdown in implementing fee cuts on the time.

An analogous speedy decline in funding spreads occurred in December 2021, earlier than the 2022 bear market. The S&P 500’s pullback from current highs raises additional issues a couple of potential broader downturn.

Due to this fact, if establishments stay cautious, shares may face extra promoting stress. Nonetheless, the market might stabilize if they begin shopping for within the present dip.

Inventory market 2025 resilience

Amid the uncertainties, the market has largely demonstrated resilience in 2025, as evidenced by the S&P 500’s report excessive. Some gamers anticipate additional progress above 6,500.

This resilience was constructed on investor optimism that surged in late 2024 following Trump’s election victory, as he was seen favorably for shares.

Conversely, traders stay on edge as issues persist concerning the sustainability of momentum in main sectors, notably know-how.

As an example, Nvidia, a prime tech inventory, is rising from current huge losses following the DeepSeek sell-off. This transfer sparked fears of a potential synthetic intelligence bubble burst that might have spillover results on the broader market.

Featured picture through Shutterstock