Bitcoin confronted an enormous promoting occasion yesterday as U.S. commerce battle fears triggered a pointy market-wide decline. The uncertainty surrounding world financial situations triggered panic promoting, driving BTC and plenty of altcoins considerably decrease. Traders are on edge because the market makes an attempt to seek out stability after probably the most unstable periods of the yr.

Prime analyst Axel Adler shared an evaluation on X, revealing that Bitcoin is reacting strongly to escalating commerce battle tensions. In response to his knowledge, BTC’s max drawdown final quarter was -17%, whereas the present drawdown sits at -16%, signaling that BTC is approaching a vital level. If promoting stress persists, BTC might face a deeper correction earlier than discovering stable help.

This sudden shift in market sentiment highlights how macroeconomic elements proceed to play an important function in Bitcoin’s value motion. Whereas long-term fundamentals stay intact, short-term volatility stays a problem for traders. Analysts at the moment are watching key help ranges intently to find out whether or not BTC can stabilize or if additional draw back is on the horizon. The approaching days shall be essential in assessing whether or not BTC can reclaim momentum or if this selloff marks the start of a protracted consolidation section.

Bitcoin Faces Volatility Throughout Bull Market

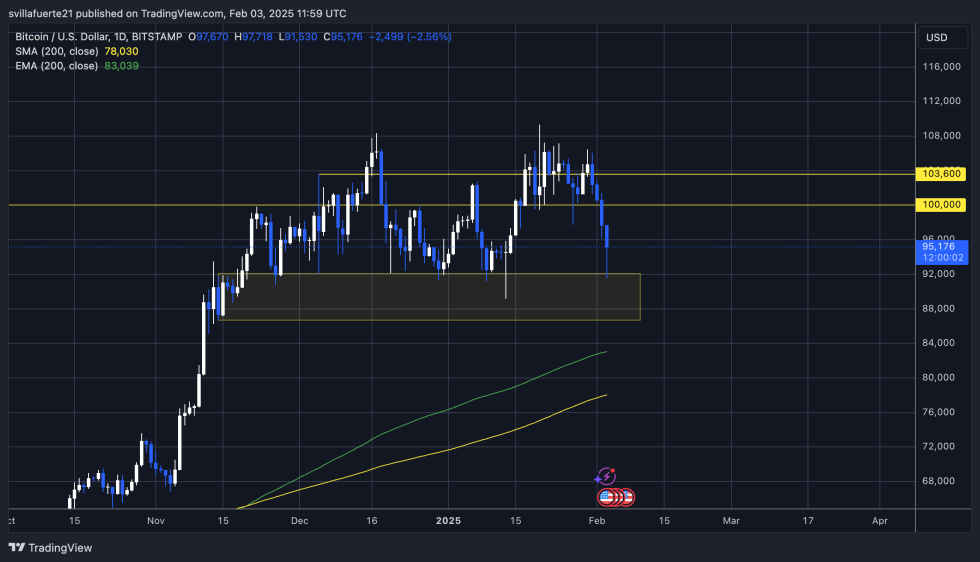

Bitcoin is buying and selling at key demand ranges across the $95K mark after dropping the essential $100K stage. Yesterday’s market-wide selloff triggered by U.S. commerce battle fears triggered a pointy 10% drop in lower than 24 hours, shaking investor confidence. The market stays extremely unsure, and this week might see additional declines as promoting stress continues.

Key metrics shared by Axel Adler on X reveal that Bitcoin is reacting strongly to escalating world commerce battle tensions. In response to his evaluation, Bitcoin’s max drawdown final quarter was -17%, whereas the present drawdown sits at -16%, reflecting the acute volatility dominating the market. These ranges point out that BTC is now approaching an important section, the place an additional dip might check decrease help zones.

Regardless of the short-term volatility, long-term fundamentals stay sturdy. Bitcoin continues to carry above vital structural ranges, and accumulation developments recommend that enormous traders are making the most of these dips. Traditionally, such high-volatility intervals have preceded main rallies, making this a key second for merchants and traders.

If BTC can reclaim the $100K mark quickly, bullish momentum will possible return, setting the stage for a transfer towards new all-time highs. Nevertheless, failing to carry above $95K might open the door for a deeper correction earlier than BTC stabilizes.

BTC Worth Motion Particulars

Bitcoin is buying and selling at $95,100 after a pointy decline to $91,530 throughout yesterday’s market-wide selloff. Bulls are struggling as they face ongoing promoting stress, however value motion stays structurally bullish so long as BTC holds above the vital $90K stage. This help zone is essential in figuring out whether or not the market stabilizes or continues to slip additional within the coming days.

This week, Bitcoin stays weak to additional declines because the U.S. market navigates growing fears of a world commerce battle. Investor sentiment is blended, with some anticipating a deeper correction whereas others see this dip as a first-rate accumulation alternative. If BTC stays above key demand across the $90K-$92K vary, a robust restoration might comply with.

For bulls to regain management, Bitcoin should push again above the $100K stage as quickly as potential. Reclaiming this psychological threshold would assist restore market confidence and set the stage for an additional rally towards all-time highs. Nevertheless, continued uncertainty and financial considerations might delay any significant upside motion. A decisive transfer in both course will form BTC’s short-term pattern, making this a vital second for merchants and traders.

Featured picture from Dall-E, chart from TradingView