Public state funds within the U.S. are shopping for shares of Technique, previously MicroStrategy, en masse in potential proof of a need for Bitcoin publicity.

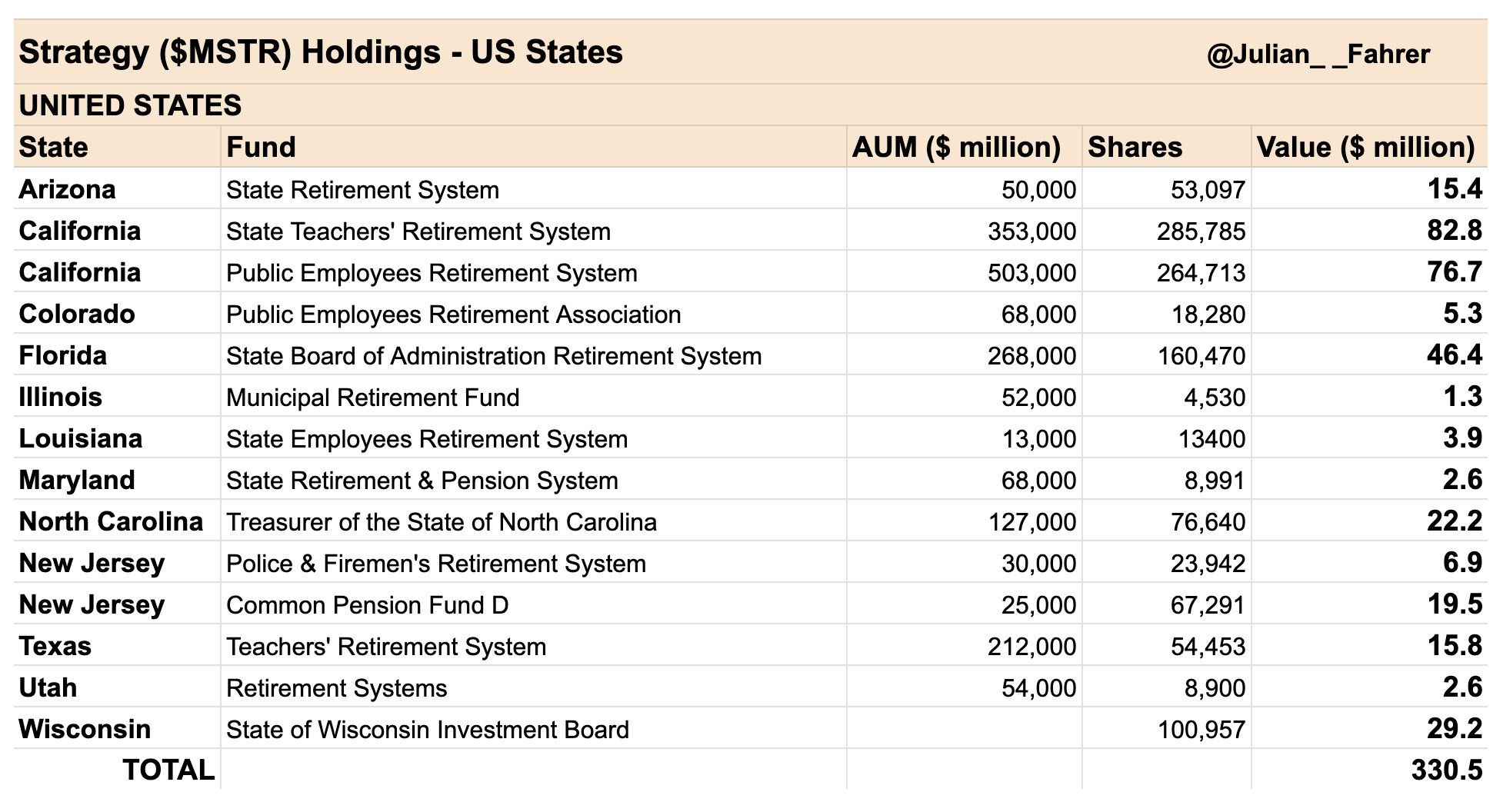

A minimum of 12 U.S. public state funds, together with pension funds and treasury, have reported possession of Technique shares per data compiled by Bitcoin-focused builder Julian Fahrer from lately launched This fall 2024 reviews filed with the Securities and Alternate Fee (SEC).

These states embrace Arizona, California, Colorado, Florida, Illinois, Louisiana, Maryland, North Carolina, New Jersey, Texas, Utah, and Wisconsin. In whole, they maintain $330.5 million value of shares within the firm, which has dubbed itself a Bitcoin treasury agency amid its aggressive acquisition of the main digital asset.

California’s State Instructor’s Retirement System and Public Staff Retirement Affiliation boast the biggest Technique shareholdings with $82.8 million and $76.7 million, respectively. Florida’s State Board of Administration Retirement System is available in at a distant third with $46.4 million value of the Bitcoin proxy’s shares.

The reported Technique publicity of those public funds follows the agency’s acceleration of its Bitcoin treasury technique inside the quarter, buying extra of the asset nearly each week inside the interval. This has culminated within the agency holding almost 479,000 BTC value over $46 billion on the time of writing.

The info additionally factors to a rising need for Bitcoin publicity amongst U.S. states, about 18 of that are already pushing to permit for direct investments within the asset with strategic Bitcoin reserve payments. These states embrace Florida, Maryland, Texas, and Utah, to call a couple of.

VanEck lately disclosed that if these payments handed, U.S. states might purchase as much as $23 billion value of the main digital asset.

DisClamier: This content material is informational and shouldn’t be thought of monetary recommendation. The views expressed on this article could embrace the writer’s private opinions and don’t mirror The Crypto Fundamental opinion. Readers are inspired to do thorough analysis earlier than making any funding selections. The Crypto Fundamental is just not answerable for any monetary losses.