As corporations compete for dominance within the booming synthetic intelligence (AI) sector, funding strategist Shay Boloor has highlighted what he believes is an undervalued inventory on this house poised to catch buyers’ consideration.

To this finish, the knowledgeable identified that American cloud-based information storage agency Snowflake (NYSE: SNOW) is the subsequent AI inventory to look at, citing the fairness’s underlying fundamentals, Boloor stated in an X post on February 16.

Boloor sees SNOW because the “engine for AI-driven information liquidity,” a essential part in AI fashions’ seamless coaching and monetization.

“SNOW is the undervalued AI inventory everybody will chase. I consider Snowflake is the subsequent AI title set for a large re-rating because the market acknowledges its function because the engine for AI-driven information liquidity — powering seamless mannequin coaching & monetization,” he stated.

Evaluating SNOW inventory with counterparts

The strategist noticed that whereas its AI counterparts, like Palantir (NASDAQ: PLTR) and Cloudflare (NYSE: NET), have already skilled important inventory development, Snowflake remains to be flying underneath the radar.

He famous that Snowflake is buying and selling at simply 42 occasions free money stream (FCF), which Boloor believes doesn’t absolutely replicate the corporate’s development potential. Palantir, sometimes called the “Working System of AI,” boasts a 32% topline development and 40% FCF margins however is buying and selling at a hefty 181 occasions FCF.

Equally, Cloudflare dubbed the “Controller of the New Web,” is rising at 26% topline with 12% FCF margins, but its inventory instructions a 257 occasions FCF a number of.

Boloor highlighted Snowflake’s 23% topline development and 26% FCF margins, noting that its projected development might attain 30% by year-end, positioning the inventory for a re-rating. He additionally emphasised that increasing margins, anticipated to hit 28%, additional bolster its standing as a ‘Stage 2 AI winner’.

This outlook provides to the current rising bullish sentiment round Snowflake. As an illustration, as reported by Finbold, the inventory’s technical setup, sturdy insider shopping for, spectacular income, and bettering AI choices sign the potential for a big transfer increased.

Though Snowflake faces competitors from entities akin to Palantir, its AI merchandise have been recording notable features in current quarters. The agency has not less than 1,000 deployed use instances and over 3,200 accounts using its AI options, attracting curiosity as a consequence of its interoperability and information transformation capabilities.

General, there’s extra potential for development on this house, as Snowflake initiatives its whole addressable market to double to $342 billion by 2028.

SNOW inventory worth evaluation

By press time, SNOW was buying and selling at $187.60, down over 2%, however stays above the essential $150 help, which served as a resistance zone for a protracted interval. Yr-to-date, Snowflake’s share worth has rallied 21%.

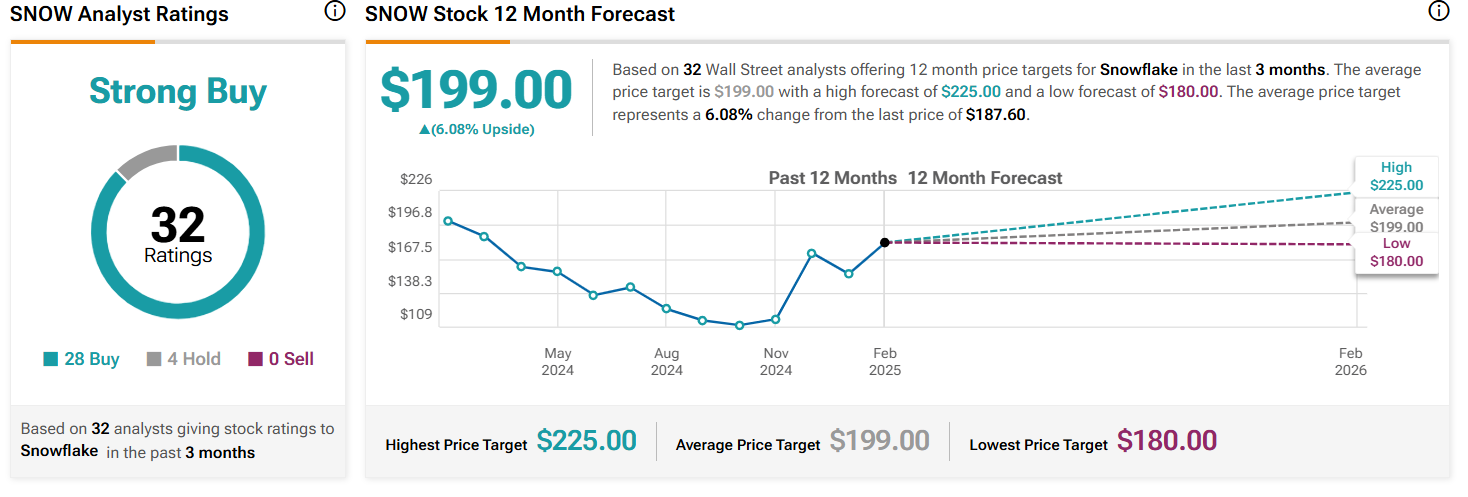

Over at TipRanks, Wall Road analysts even have a constructive outlook on Snowflake. A consensus of 32 consultants has issued rankings for the inventory, with 28 recommending a ‘Purchase,’ 4 suggesting ‘Maintain,’ and none advising a ‘Promote.’ This consensus categorizes Snowflake as a ‘Sturdy Purchase.’

Relating to worth forecasts, the analysts predict a mean goal of $199 for the subsequent 12 months, representing a 6.08% upside. The best goal is $225, whereas the bottom forecast is $180.

Though the projections point out some variance in analysts’ expectations, the final sentiment round SNOW stays bullish in the long run. To comprehend this potential, the corporate might want to maintain AI momentum, drive innovation, and push back competitors.

Featured picture by way of Shutterstock