Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, is at a vital degree, indicating a make-or-break scenario for the altcoin. This prediction is predicated on ETH’s present worth motion within the four-hour timeframe.

Ethereum (ETH) Technical Evaluation and Upcoming Degree

Based on professional technical evaluation, ETH seems to be forming an ascending triangle sample on the four-hour timeframe however is at the moment going through resistance from the descending trendline and appears to be falling towards the sample’s help degree.

Primarily based on the current worth motion, if ETH fails to carry the $2,680 degree and closes a four-hour candle beneath $2,670, there’s a sturdy chance it might drop by 4.5% to succeed in the $2,560 degree within the coming days.

Together with the bearish outlook, ETH is at the moment buying and selling beneath the 200-day Exponential Transferring Common (EMA) on the every day timeframe, indicating that the asset is in a downtrend and has the potential to proceed this bearish pattern additional.

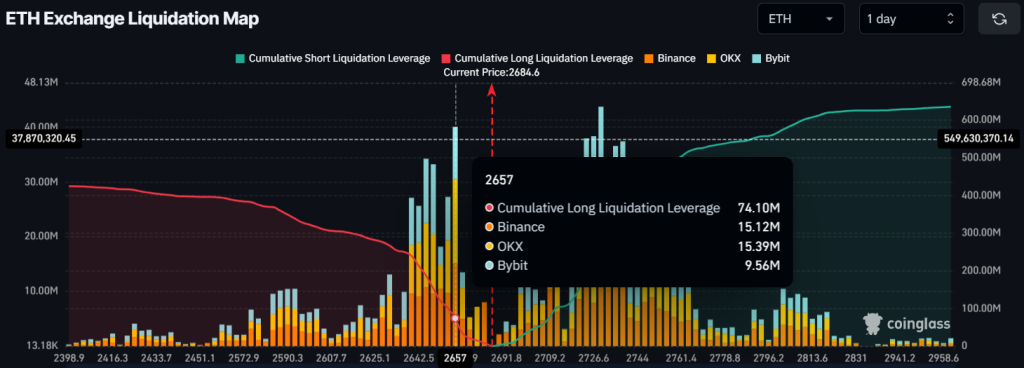

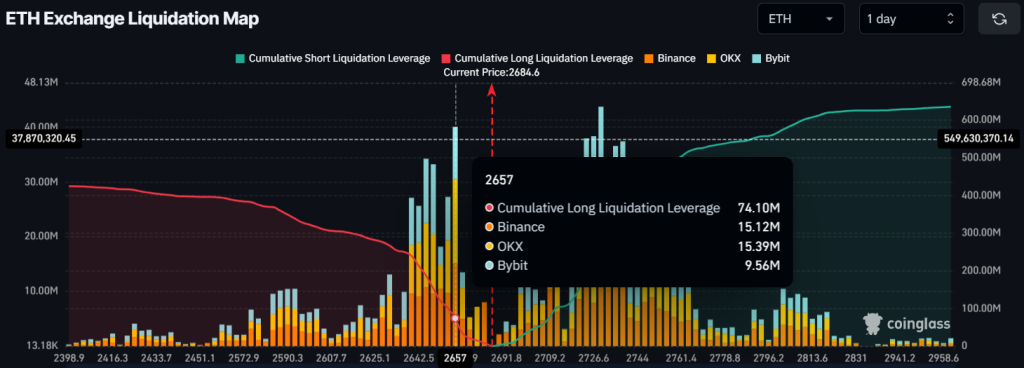

Ether Liquidation Threat

With the bearish outlook, intraday merchants’ $74 million price of lengthy positions are on the verge of liquidation. Data reveals {that a} important $72 million price of lengthy positions was opened when merchants turned over-leveraged on the $2,657 degree. This huge quantity of ETH will probably be liquidated if the value falls beneath this over-leveraged degree.

Conversely, merchants holding lengthy positions are over-leveraged on the $2,730 degree, with $275 million price of lengthy positions vulnerable to liquidation if the value falls additional.

Present Worth Momentum

At the moment, ETH is buying and selling close to the $2,685 degree and has skilled a modest worth drop of 0.55% up to now 24 hours. Nonetheless, throughout the identical interval, its buying and selling quantity dropped by 9%, indicating decrease participation from merchants and buyers.