Bitcoin has confronted important volatility and promoting stress because the begin of February, resulting in bearish worth motion throughout altcoins and meme cash. The heightened uncertainty has triggered concern amongst market members, because the bullish momentum seen earlier within the yr appears to have stalled. Analysts are more and more calling for a correction, citing indicators of exhaustion amongst bulls as the worth struggles to regain essential ranges. The market’s present development suggests additional declines could also be on the horizon, leaving traders anxious about Bitcoin’s subsequent transfer.

Amid this unsure panorama, intriguing on-chain metrics present a glimmer of perception. Quinten Francois, a outstanding crypto skilled, shared knowledge revealing that Bitcoin is vanishing from exchanges sooner than ever earlier than. This unprecedented fee of outflows alerts robust accumulation amongst holders, who’re shifting their property to chilly storage or different non-custodial wallets. Whereas promoting stress continues to weigh on Bitcoin’s worth, the diminishing provide on exchanges signifies rising confidence within the asset’s long-term potential.

This development might have important implications for Bitcoin’s worth trajectory within the coming months. Because the market consolidates, many wonder if lowered provide and rising institutional curiosity will finally propel Bitcoin to new heights. For now, uncertainty stays the dominant theme.

Bitcoin Struggles Beneath $100K As Alternate Outflows Attain Excessive Ranges

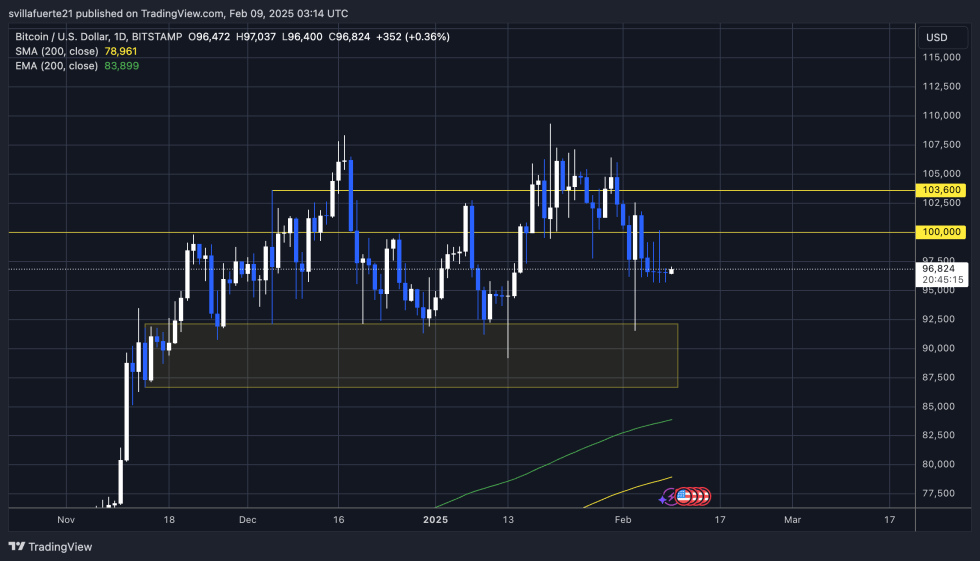

Bitcoin’s worth stays regular across the $96K mark, with bulls struggling to regain management and push BTC above the $100K stage. The shortcoming to reclaim this key psychological barrier as help has raised issues amongst traders, with analysts predicting additional declines if bears proceed to dominate short-term worth motion.

Key insights from prime analyst Quinten Francois, shared on X utilizing CryptoQuant data, reveal a major development: Bitcoin is vanishing from exchanges sooner than ever. Traditionally, such a development is taken into account a bullish sign. When traders transfer Bitcoin from exchanges to personal wallets, it usually displays rising confidence within the asset’s long-term potential and a scarcity of intent to promote. This habits reduces the obtainable provide on exchanges, doubtlessly setting the stage for upward worth momentum as soon as demand will increase.

Regardless of this optimistic on-chain sign, short-term worth motion stays unsure. Bears are exerting stress on BTC, protecting it under key provide ranges and stopping a breakout above $100K. If Bitcoin drops under the $95K stage, it dangers testing decrease demand zones round $90K. Conversely, if bulls handle to push BTC above $100K and maintain it as help, it might pave the way in which for a rally towards new all-time highs.

The approaching days might be essential for Bitcoin’s trajectory as merchants monitor these conflicting alerts. Will alternate outflows result in lowered promoting stress and a bullish reversal, or will bears proceed to suppress the market? For now, Bitcoin stays in a consolidation section, with traders awaiting the following decisive transfer.

Value Consolidates As Bulls Wrestle

Bitcoin is buying and selling at $96,800, closing round this stage for the fourth consecutive day as indecision grips the market. Bulls have misplaced management of worth motion after failing to carry the $100K mark, leaving traders unsure concerning the short-term course. The shortcoming to reclaim key ranges has triggered frustration amongst market members who have been anticipating a February rally.

If Bitcoin manages to reclaim the $98K mark within the coming days, it might sign renewed bullish momentum, seemingly resulting in a surge above the $100K stage. A breakout and affirmation of help above this essential psychological barrier would set the stage for additional upward motion and doubtlessly take a look at increased resistance ranges close to all-time highs.

Nevertheless, the draw back danger stays substantial. If BTC continues to fail to reclaim the $98K stage, promoting stress might intensify, pushing the worth towards decrease demand zones. A drop under the $95K mark would seemingly open the door for a deeper correction, with $90K serving as the following essential help stage.

The approaching days might be essential for Bitcoin’s short-term trajectory as traders search for clear alerts. Till a decisive transfer happens, uncertainty will proceed to dominate the market, leaving each bulls and bears vying for management.

Featured picture from DALL-E, chart from TradingView