Fold Holdings, a US-based Bitcoin (BTC) monetary companies agency, announced as we speak the addition of 475 BTC to its company treasury. This acquisition positions Fold Holdings among the many prime 10 US public firms with the biggest Bitcoin reserves.

Fold Holdings Unveils Bitcoin Buy

Bitcoin adoption amongst firms continues to snowball, as Nasdaq-listed Fold has acquired one other 475 BTC. This newest buy marks almost a 50% improve within the firm’s whole BTC holdings, which now stand at barely greater than 1,485 BTC.

Notably, the agency financed its BTC acquisition by means of the issuance of a convertible observe at a 100% premium, with a conversion value of $12.50 per share. Commenting on the event, Fold CEO Will Reeves acknowledged:

We consider Bitcoin will play a key function within the basis of a brand new monetary period, and Fold will assist prepared the ground. As the primary publicly traded bitcoin monetary companies firm, we consider sustaining a major bitcoin treasury not solely drives worth for our shareholders, however extra importantly, strengthens our skill to energy the subsequent technology of monetary companies constructed on bitcoin.

Reeves additional emphasised that Fold’s Bitcoin company treasury serves a twin goal. It not solely gives worth to buyers looking for BTC publicity, but in addition capabilities as a strategic reserve to help the agency’s Bitcoin-native monetary merchandise.

Fold’s share value (FLD) surged by greater than 27% yesterday, closing the day at $7.71. Nonetheless, in pre-market buying and selling, the inventory has dipped barely to $7.50 on the time of writing. On a year-to-date foundation, FLD stays down by over 30%.

BTC Adoption More likely to Acquire Additional Traction

Yesterday, US President Donald Trump signed an govt order to create a Strategic Bitcoin Reserve (SBR) and a Digital Asset Stockpile. The institution of an SBR additional legitimizes BTC as a dependable retailer of worth, now acknowledged by the world’s largest financial system.

The formation of a US SBR is anticipated to set off a domino impact, prompting different nations to ascertain their very own BTC reserves in an effort to build up ‘digital gold.’ Nations like El Salvador and Bhutan already maintain vital BTC reserves.

As nation-states more and more embrace BTC as an asset class, firms worldwide are prone to observe swimsuit. Michael Saylor’s Technique presently ranks first amongst public firms by way of BTC holdings, with greater than 440,000 BTC, according to CoinGecko knowledge.

Yesterday, Brazilian fintech and publicly traded firm Meliuz introduced that it had allotted 10% of its whole money reserves to BTC. Equally, Mexican billionaire Ricardo Salinas lately disclosed that 70% of his portfolio is allotted to BTC and associated investments.

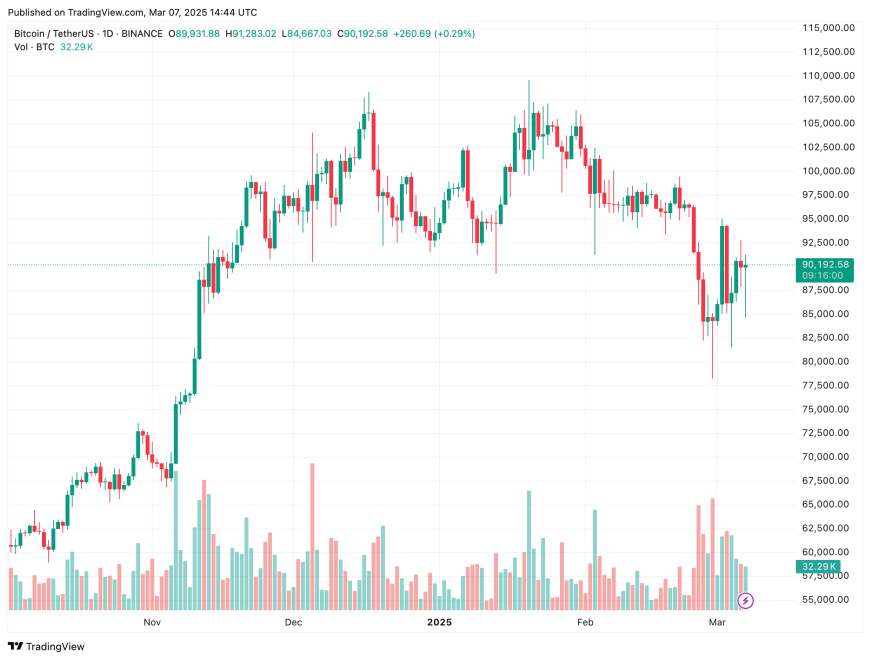

That stated, considerations persist over BTC’s volatility, with some arguing that it behaves extra like a speculative asset than a dependable retailer of worth. At press time, BTC is buying and selling at $90,192, up 0.5% up to now 24 hours.

Featured Picture from Unsplash.com, Charts from Yahoo! Finance and TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.