After a number of classes of sustained losses, the inventory worth of American software program large Palantir (NASDAQ: PLTR) is exhibiting indicators of restoration, with a synthetic intelligence (AI) instrument forecasting additional beneficial properties towards the tip of the month.

On the time of reporting, PLTR was buying and selling at $84.90, up 5.5% on the day. Nevertheless, the inventory stays within the crimson for the previous week, having dropped over 4%. The losses are much more pronounced on the month-to-month timeframe, with PLTR down 27%.

Palantir inventory worth prediction

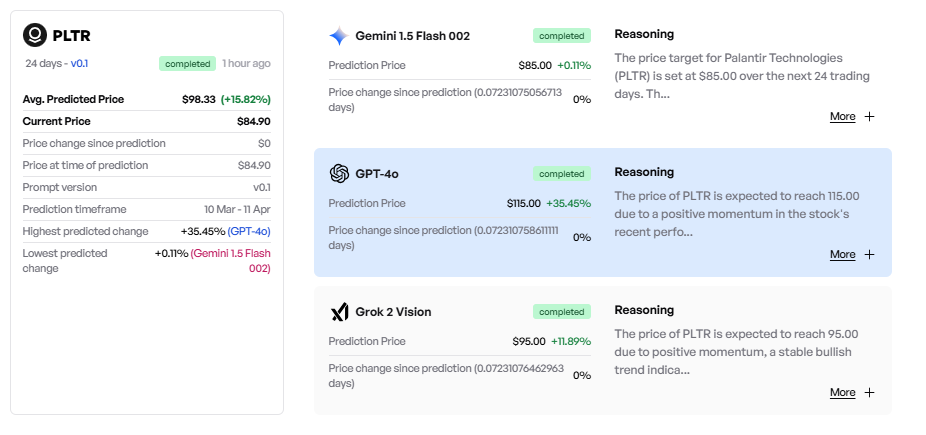

Relating to the inventory’s subsequent worth trajectory, Finbold tapped its personal AI prediction instrument, which sees PLTR nearing the $100 mark within the coming weeks. Using insights from numerous fashions, the instrument set a mean worth of $98.33 by March 31, a 5.82% leap from its present spot.

Among the many forecasts, ChatGPT-4o is probably the most optimistic, predicting that PLTR will climb to $115, a 35.45% surge. It factors to robust momentum and a potential ‘golden cross’ on the charts, hinting at a longer-term uptrend.

Grok 2 Imaginative and prescient shared a extra conservative goal of $95, a stable 11.89% rise. It credit regular momentum, a bullish pattern, and upbeat market sentiment for the potential raise.

On the cautious facet, Gemini 1.5 Flash 002 sees PLTR dipping barely to $85.00, almost flat with a 0.10% drop. It notes that whereas the 50-day and 200-day shifting averages (MA) trace at modest progress, market jitters name for a cautious strategy.

However, inventory buying and selling skilled Market Maestro harassed in an X post on March 8 that the latest correction in Palantir mustn’t trigger an alarm. After the inventory’s rally, the analyst acknowledged {that a} wholesome correction is important earlier than its subsequent upward transfer.

He noticed that the latest drop under $100 fashioned a possible cooling-off interval that might stop extreme volatility. A key degree to observe is $76, which aligns with the 21-week Exponential Transferring Common (EMA), a crucial help degree.

If Palantir breaks under this degree, the skilled famous {that a} deeper pullback towards the Honest Worth Hole (FVG) zone would seemingly provide buyers a pretty re-entry alternative.

He famous that regardless of this short-term correction, the longer-term outlook stays robust. The Fibonacci extension suggests a future worth goal of $101, whereas institutional exercise and momentum indicators stay optimistic.

Palantir inventory fundamentals

It’s price noting that Palantir’s latest drop has been attributable to a number of elements past the broader inventory market correction. The fairness took a significant hit after stories emerged that the Division of Protection (DoD) may be planning price range cuts as a part of a government-wide push beneath the Donald Trump administration. As a significant DoD contractor, Palantir noticed its inventory decline over considerations that the transfer might affect its future income.

Past potential DoD price range cuts, PLTR’s valuation stays a key concern. Some analysts argue that the inventory is overextended and will dip earlier than rebounding.

However, Wall Avenue stays divided on Palantir’s outlook. On March 5, Jefferies analyst Brent Thill reaffirmed an ‘Underperform’ ranking with a $60 goal, citing insider promoting, CEO Alex Karp’s offloading of $45 million in shares (21% of his stake) over six months, and Palantir’s still-high valuation, buying and selling at 39x CY 2026 income.

Conversely, on March 3, Wedbush’s Dan Ives maintained an ‘Outperform’ ranking with a $120 goal, seeing the sell-off as a shopping for alternative. He believes Palantir’s AI progress, particularly by Undertaking Stargate, might safe extra authorities offers and long-term beneficial properties.

On the basics, Palantir lately deployed its first AI-powered Tactical Intelligence Focusing on Entry Node (TITAN) methods to the U.S. Military. The $178 million contract, awarded final March, marks the primary time a software program agency has led a significant {hardware} program. The deal consists of 10 TITAN items, which improve battlefield intelligence with out cloud reliance.

Featured picture through Shutterstock