A number of key Bitcoin metrics are within the dumps, however there could also be a silver lining.

Amid Bitcoin‘s value struggles, which have seen it swing wildly between mid-$80,000 and the $100,000 degree over the previous few weeks, market sentiment has been in decline.

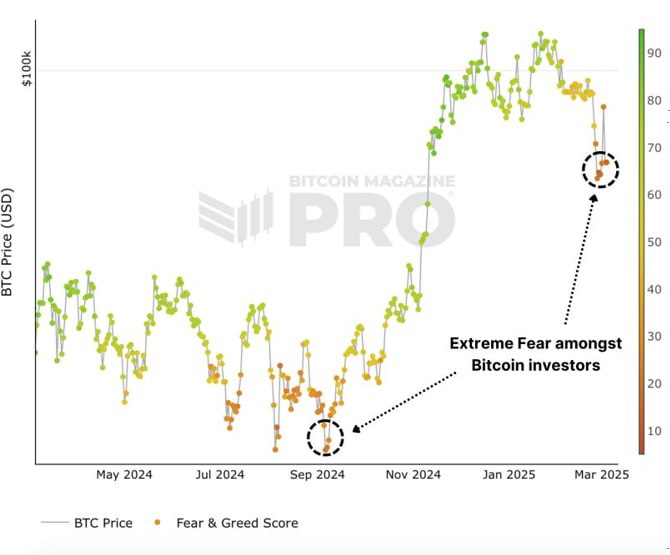

In line with the Worry and Greed Index, this culminated in an prolonged Excessive Worry studying over the weekend as commerce battle fears and panic promoting hit a fever pitch.

The Worry and Greed Index gauges market sentiment utilizing volatility, market quantity, social media mentions, Bitcoin dominance, and Google Developments.

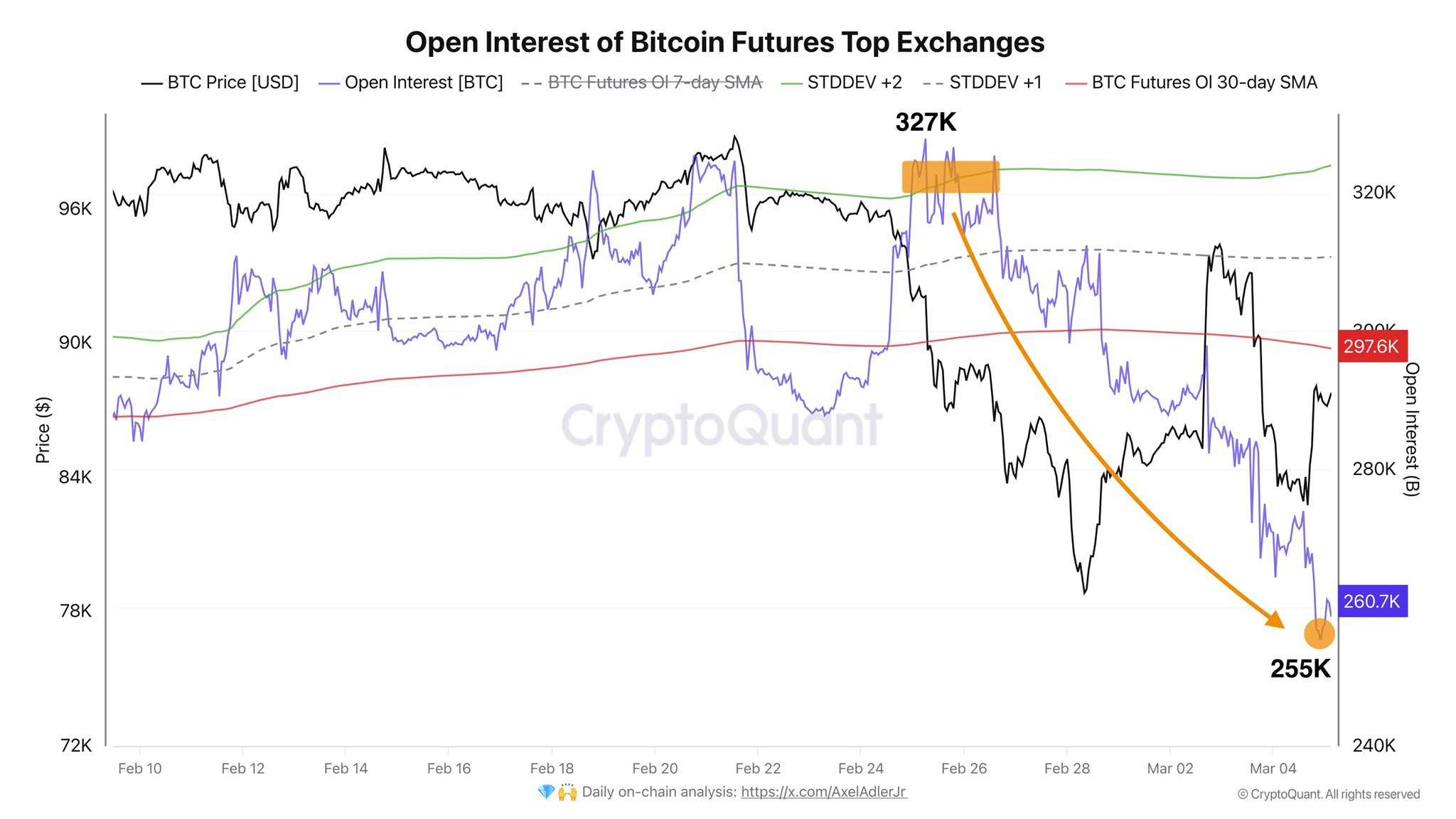

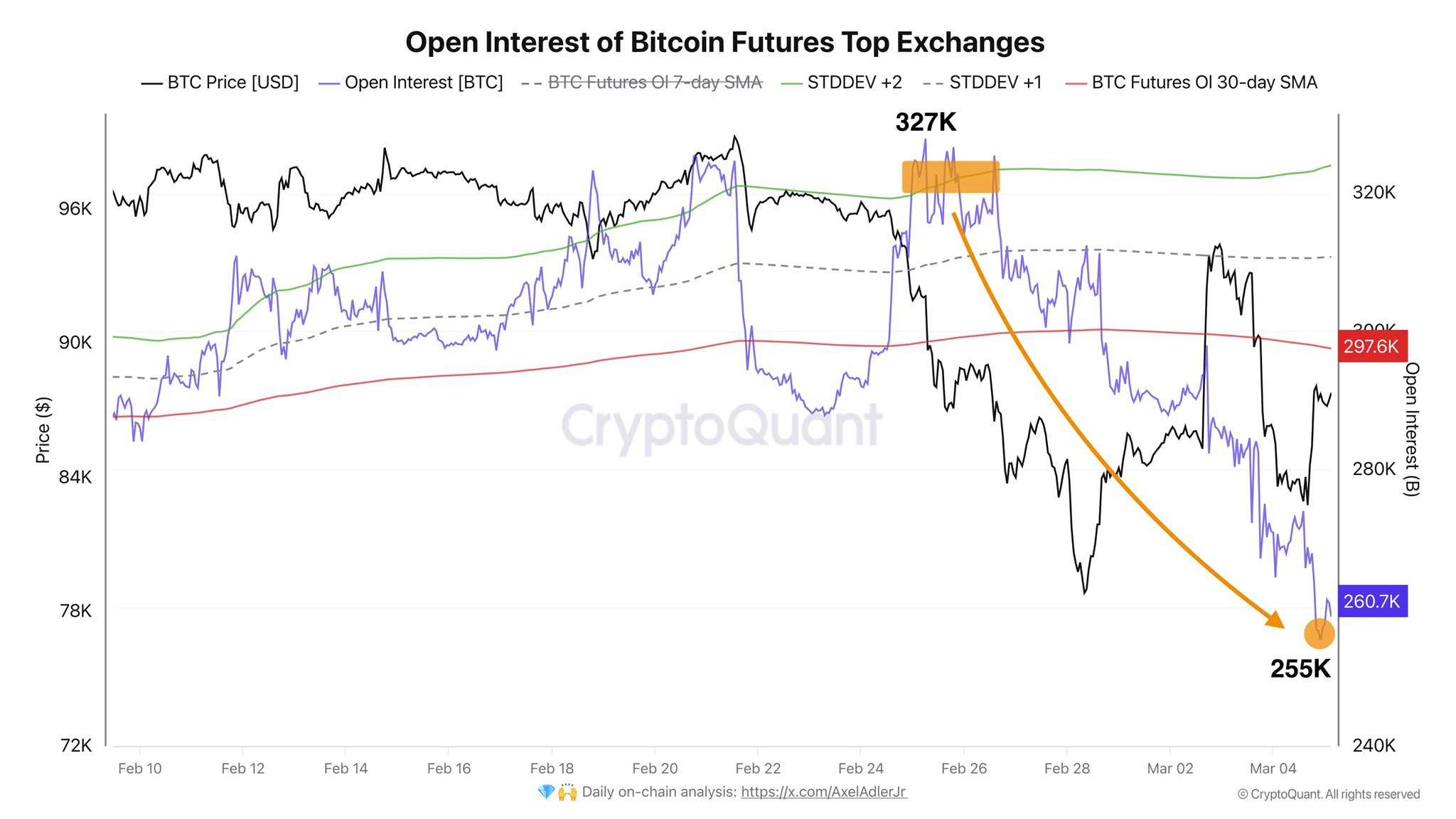

Past market sentiment, open curiosity within the main digital has additionally plummeted lately. Particularly, current CryptoQuant information means that this metric, which might typically be used to gauge speculative curiosity, has dropped 22% up to now ten days alone, from 327,000 BTC to 225,000 BTC.

Regardless of the decline in these metrics, there could also be a catch.

Rebound Incoming?

For one, main crypto analysis agency Kronos Research has noted that the final time Bitcoin recorded prolonged Excessive Worry readings on the Worry and Greed Index like this was in September 2024, when it traded for about $53,000. Because the agency highlighted, the asset’s value doubled to over $106,000 within the months that adopted.

On the similar time, distinguished crypto analyst Axel Adler Jr has contended that the current decline in Bitcoin OI might “point out a clearing of overheated positions, probably setting the stage for a brand new market impulse.”

The crypto market skilled a resurgence on Sunday as President Donald Trump reiterated crypto reserve plans. Bitcoin, specifically, surged over 9% to across the $94,000 value level.

However most of those features got away as markets panicked over commerce battle issues on Monday. All eyes at the moment are on the White Home’s first crypto summit slated for Friday, which is predicted to supply a market catalyst.

In the meantime, Normal Chartered Head of Digital Belongings Analysis Geoffrey Kendrick has warned that danger property like Bitcoin might battle to discover a backside until the market features readability on rising geopolitical issues.

In line with the analyst, an extra drop in Bitcoin’s value to the $69,000 to $76,500 vary will not be out of the query.

DisClamier: This content material is informational and shouldn’t be thought-about monetary recommendation. The views expressed on this article might embrace the creator’s private opinions and don’t replicate The Crypto Primary opinion. Readers are inspired to do thorough analysis earlier than making any funding choices. The Crypto Primary will not be chargeable for any monetary losses.