Bitcoin has confronted large volatility and promoting strain as wild value swings dominate the market. After reaching a excessive of $96,000 final week, BTC noticed a pointy 18% retrace, plunging to $78,000 final Friday. The sudden drop intensified fears of a deeper correction, with merchants scrambling to evaluate the subsequent transfer.

Nonetheless, in a dramatic reversal, Bitcoin rapidly reclaimed key ranges, surging over 11% in simply hours to achieve $95,000 following President Trump’s announcement of a crypto strategic reserve. The market response was swift, with bullish sentiment briefly overpowering the current promoting strain.

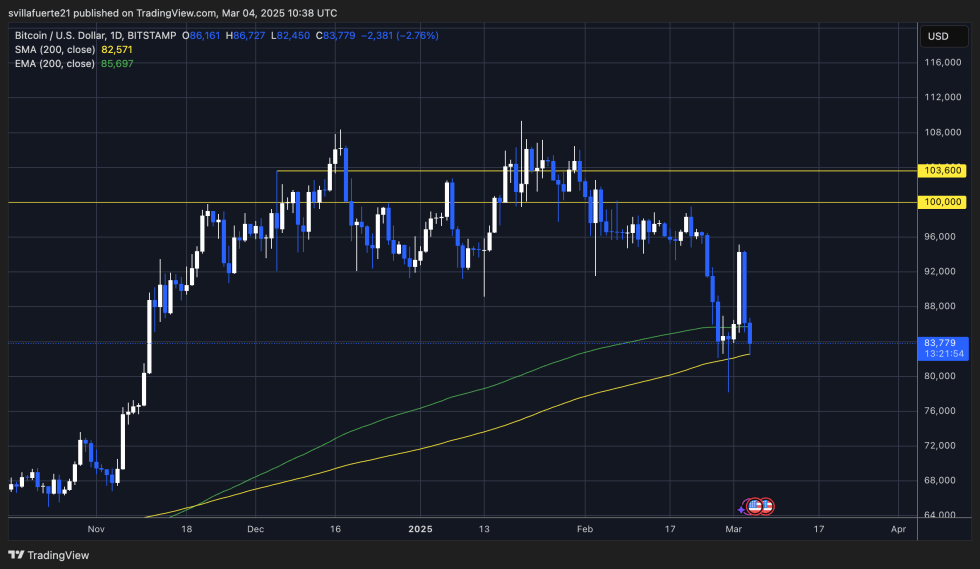

But, Bitcoin’s instability continued, with the value plunging over 12% in lower than a day, as soon as once more falling under $85,000. This rollercoaster value motion has left traders unsure about BTC’s subsequent transfer. In accordance with CryptoQuant information, Bitcoin’s common volatility vary has doubled prior to now 10 days, signaling heightened instability throughout the market.

As BTC stays trapped on this high-volatility cycle, merchants are looking ahead to indicators of a sustained breakout or deeper correction. With key ranges continually being examined, Bitcoin’s subsequent transfer might decide whether or not the market sees one other push towards six figures or faces additional draw back strain.

Bitcoin Volatility Continues

Bitcoin and your entire crypto market are experiencing important ache as BTC struggles under key value ranges, failing to verify a push towards restoration. The market stays unsure, with bulls unable to reclaim misplaced floor after BTC dropped under $90,000—an important stage that beforehand supported its buying and selling vary. This breakdown has shifted momentum, leaving Bitcoin in a precarious place as promoting strain mounts.

After yesterday’s value motion, market sentiment has turned more and more bearish, with some analysts suggesting {that a} bear market might be on the horizon. The failure to ascertain a robust restoration has weakened bullish confidence, elevating considerations that Bitcoin’s current volatility is signaling an extra draw back reasonably than a consolidation part earlier than one other rally.

Prime analyst Axel Adler shared insights on X, revealing that Bitcoin’s common volatility vary has doubled over the previous 10 days. This surge in volatility means that the market is experiencing heightened hypothesis reasonably than forming a decisive development. The speedy value swings point out a battle between bulls and bears, with neither aspect managing to take full management.

The dearth of clear course makes it troublesome to foretell Bitcoin’s subsequent main transfer. Whereas some traders stay looking forward to a restoration, the general market construction leans bearish until BTC can reclaim key resistance ranges. If BTC continues to wrestle under $90,000, the chance of additional draw back will increase, probably confirming the beginning of a deeper correction.

Because the uncertainty grows, merchants are watching carefully for indicators of development affirmation. Till BTC both reclaims misplaced floor or breaks down additional, the market stays in limbo, with hypothesis driving the short-term value motion reasonably than elementary energy.

BTC Struggles Beneath $85K

Bitcoin is at present buying and selling at $83,800 after days of untamed value swings above and under $90,000. The market stays unstable, with bulls struggling to regain momentum after BTC misplaced its grip on key assist ranges.

For Bitcoin to begin a restoration, it should rapidly reclaim the $90,000 stage. A powerful push above this value would sign renewed shopping for curiosity and will set off a aid rally. Nonetheless, the primary stage to carry stays $85,000. This value serves because the final protection earlier than a possible deeper correction.

If BTC stays under $85,000 for the subsequent few days, the chance of a large drop will increase. Prolonged weak spot under this stage might result in accelerated promoting, pushing Bitcoin towards decrease assist zones. Market sentiment is already leaning bearish, and additional declines might verify a shift towards a protracted downtrend.

Merchants are watching carefully to see whether or not BTC can maintain or break via key ranges. The approaching days will decide whether or not Bitcoin can stabilize and get better or if extra draw back is inevitable. With no reclaim of $90,000 quickly, the strain on bulls will proceed to mount, making a deeper retrace extra probably.

Featured picture from Dall-E, chart from TradingView