On-chain evaluation exhibits that long-term Bitcoin holders have reawakened and are shifting giant quantities of the asset following its rebound from below $90,000.

Bitcoin has rebounded properly from a short-term value bearish pattern. The pioneering cryptocurrency rebounded over 20% from its lows of $78,179 final week to shut above $94,000 on Sunday.

Whereas the rebound has pulled the bull cycle again on observe, knowledge exhibits long-term holders is perhaps rising impatient with Bitcoin. A current analytical exposition exhibits that funds transfers amongst holders who purchased not less than earlier than the final two Bitcoin halvings have surged extensively.

Giant Holders Shifting BTC

Maarten Regterschot, a market watcher and CryptoQaunt’s neighborhood supervisor, not too long ago shared intriguing Bitcoin exercise amongst long-term holders. In a tweet at present, he famous that there was appreciable motion amongst outdated Bitcoin wallets for the reason that asset rebounded from the most recent dip.

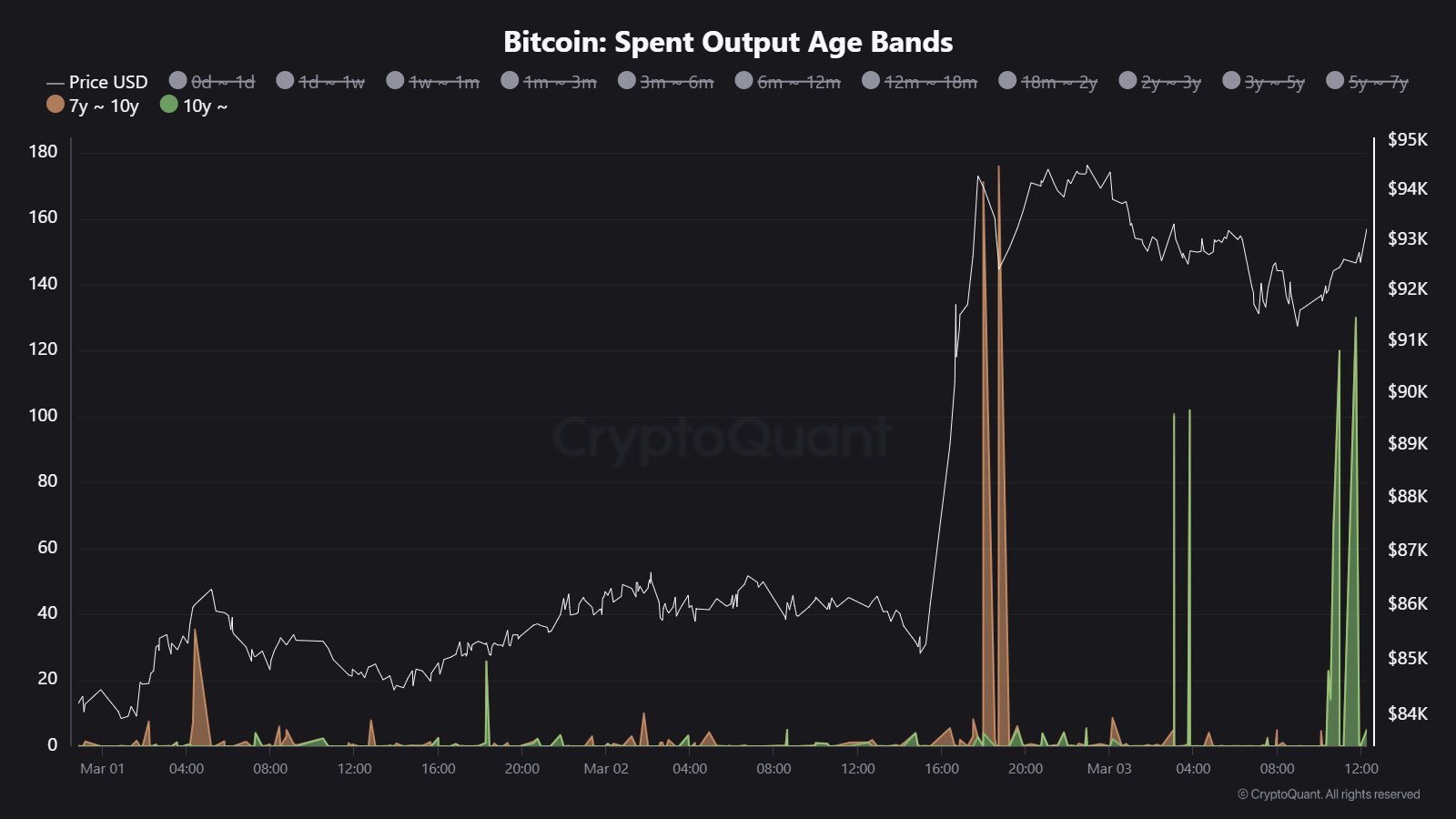

First, an accompanying chart exhibits a spike in Bitcoin’s spent output age bands amongst wallets holding Bitcoin for not less than seven years since yesterday. For perspective, the indicator shows the spent output amongst customers inside a particular age band, giving perception into the market sentiments of an underlying asset’s quick and long-term holders.

The evaluation exhibits that whale wallets between 7 and 10 years outdated moved almost 180 BTC instantly after the market rebounded to a excessive of $96,484 on Sunday. Related on-chain actions have been seen amongst wallets not less than 10 years outdated, which moved over 120 BTC earlier at present.

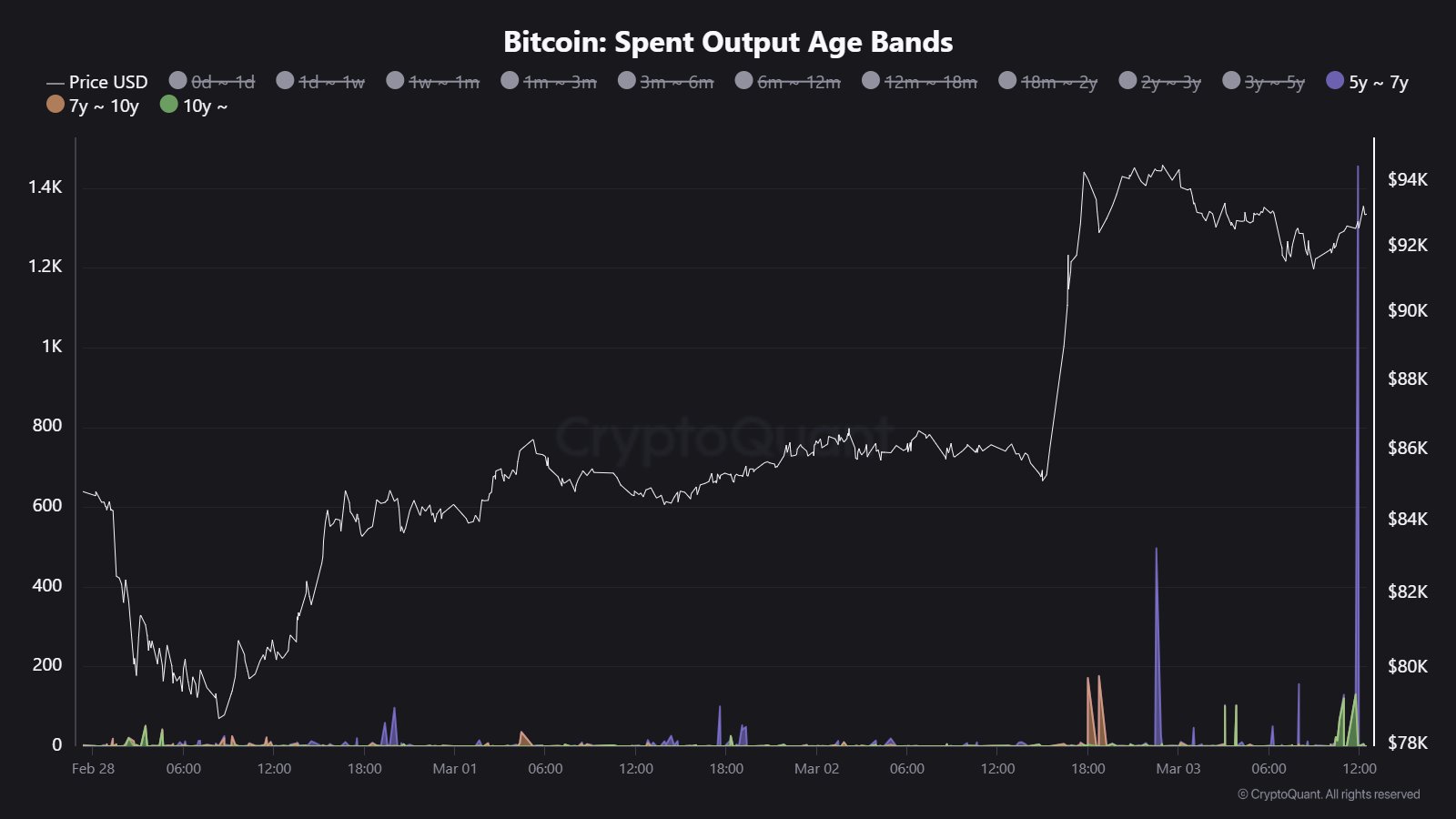

Moreover, Regterschot, popularly identified by his first title, Maarten, disclosed one other hefty Bitcoin shift amongst wallets between 5 and seven years. Whereas Bitcoin continues to pattern round $93,400 at present, addresses within the early-mentioned class have moved 1,453.40 BTC.

These vital shifts trace at doable Bitcoin gross sales amongst outdated wallets. Notably, whales on this class purchased the premier asset for not less than below $25,000, a staggering revenue at its present market value above $90,000.

Bitcoin Nonetheless a Discount at Present Value?

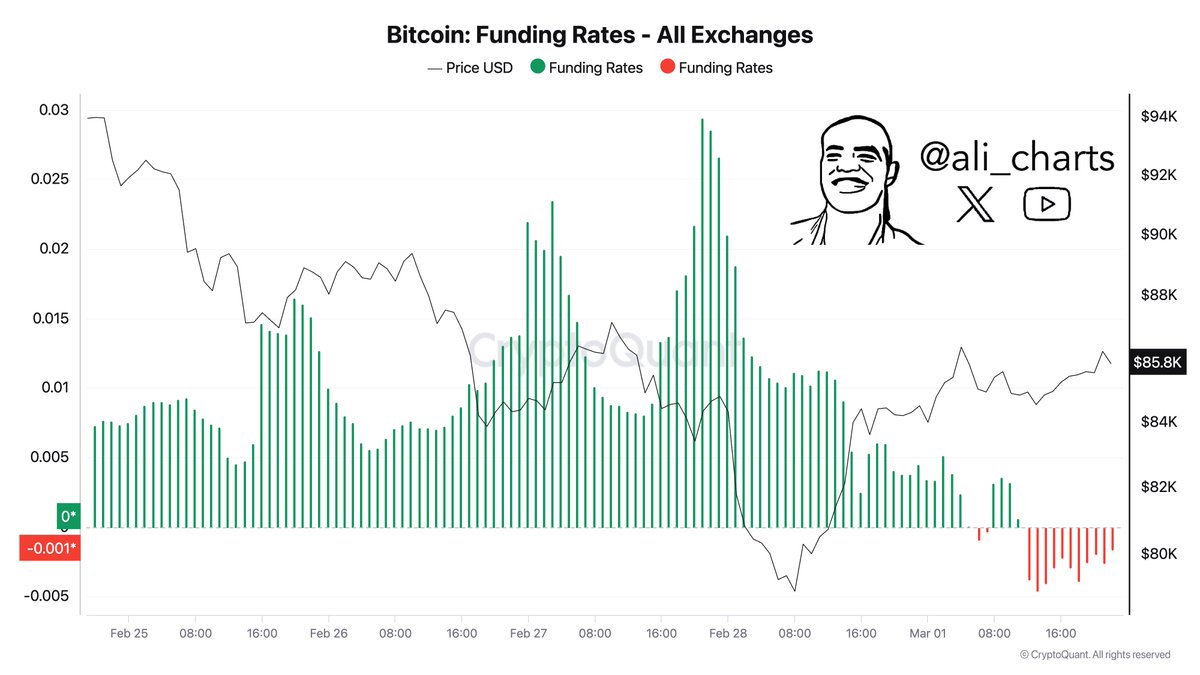

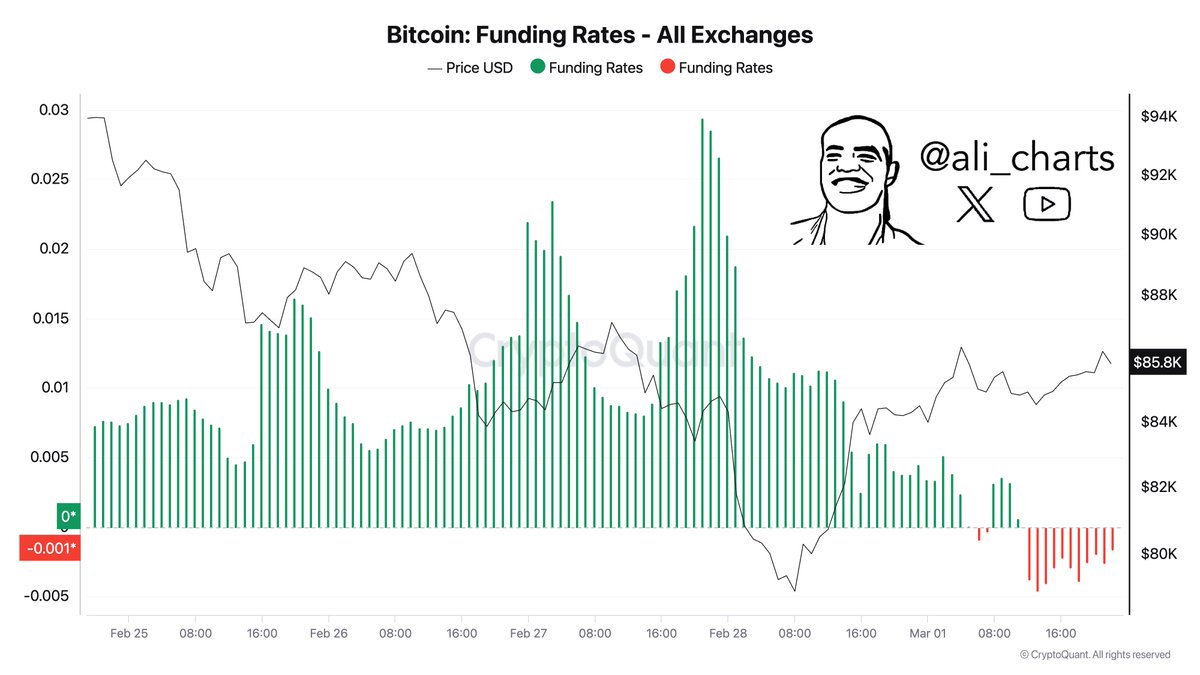

Whereas outdated Bitcoin wallets have resorted to doable gross sales, analyst Ali Martinez has urged that the present value should still be a cut price. In a tweet at present, he indicated that now could be the most effective time to purchase Bitcoin for optimum positive aspects.

Martinez cited the destructive Bitcoin funding fee as a historic indicator of a buy-in. The metric, which tracks the price of holding a purchase or promote perpetual futures contract of Bitcoin in an alternate, is presently below 0, particularly at -0.001.

Consequently, the distinguished market analyst said this may very well be a great alternative to stack the pioneering cryptocurrency. Within the meantime, Bitcoin trades at $91,897, down 2.64% previously day.

DisClamier: This content material is informational and shouldn’t be thought of monetary recommendation. The views expressed on this article could embody the writer’s private opinions and don’t replicate The Crypto Primary opinion. Readers are inspired to do thorough analysis earlier than making any funding selections. The Crypto Primary shouldn’t be accountable for any monetary losses.