BlackRock, the world’s largest asset supervisor by belongings beneath administration, just lately really useful Bitcoin allocation by together with the asset in its mannequin portfolios.

The outstanding asset supervisor has been massive on Bitcoin and its uncommon qualities. Now, it has taken one other step in promulgating the pioneering cryptocurrency by just lately including it to its mannequin portfolio choices.

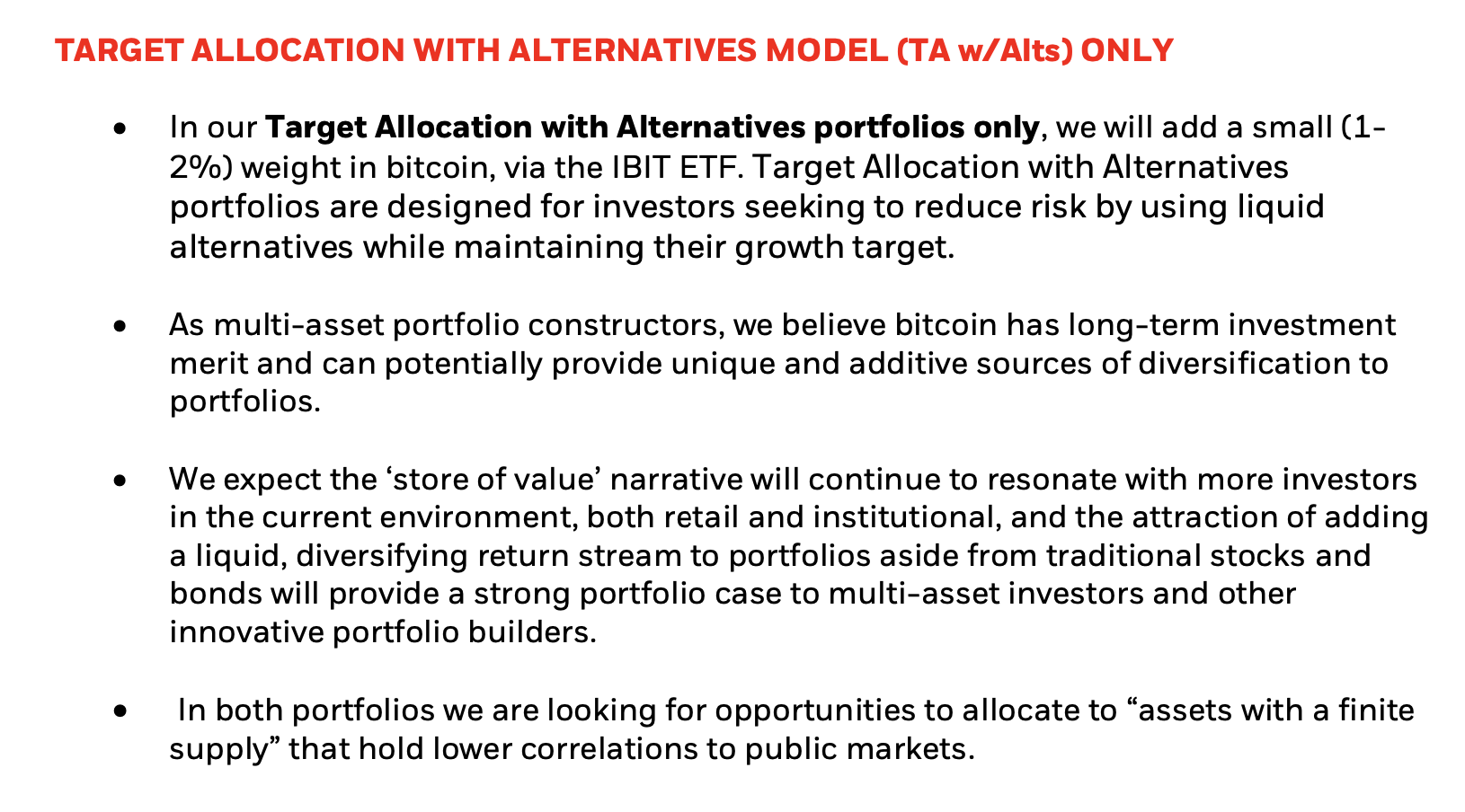

BlackRock confirmed on Friday that it has added the iShares Bitcoin Belief (IBIT)—the fastest-growing fund in ETF historical past, offering different publicity to Bitcoin—to the Goal Allocation with Alternate options fashions.

BlackRock Provides Bitcoin to Establishment-Tailor-made Portfolio Mannequin

For perspective, a mannequin portfolio is a group of predefined asset allocations tailor-made to fulfill shoppers’ dangers and reward aims. Asset managers alter these portfolios over time based on altering market circumstances and shoppers’ tendencies.

On Thursday, BlackRock added IBIT to the Goal Allocation with Alternate options and Goal Allocation with Alternate options Tax-Conscious portfolios. The asset supervisor confirmed including 1% to 2% of the Bitcoin-focused product to the mannequin portfolios.

Michael Gates, the lead portfolio for the BlackRock different mannequin portfolio, famous that a number of theses verify intrinsic worth and long-term funding deserves. Some embrace the asset’s scarce property and observe document of hedge towards inflation.

Because of this, the addition may present its shoppers with the next danger urge for food and portfolio progress goal publicity to Bitcoin. Notably, that is the primary time BlackRock is including IBIT to any of its mannequin portfolios, a shift teased to spur demand for the ETF.

The Addition Is a Massive Deal

In the meantime, the addition adopted BlackRock’s allocation changes of its funds on Thursday. The asset supervisor made a number of adjustments to its mannequin portfolios, affixing IBIT for the primary time.

Evaluation means that though the fashions BlackRock added IBIT to have been a few of its low-end funds in AUM, it’s a massive deal for Bitcoin. Mind Rose, the host of London Actual, stated that the event appears extra important than it appears.

He famous that BlackRock’s mannequin portfolios information “billions” of funds as massive traders copy them for allocation. Moreover, he advised that it may stir different asset managers to pursue an identical ploy, growing inflows into Bitcoin.

Recall that BlackRock’s head of digital asset analysis, Robert Mitchnick, said that the asset supervisor would concentrate on attracting establishments and wealth managers to undertake Bitcoin. The addition displays one means BlackRock appears to make use of to attract demand for the IBIT.

DisClamier: This content material is informational and shouldn’t be thought of monetary recommendation. The views expressed on this article could embrace the creator’s private opinions and don’t replicate The Crypto Primary opinion. Readers are inspired to do thorough analysis earlier than making any funding choices. The Crypto Primary is just not accountable for any monetary losses.