Bitcoin has proven a continuation to its crash over the past 24 hours. Right here’s what on-chain knowledge says relating to whether or not a backside is shut or not.

Bitcoin NVT Golden Cross Is Now In Oversold Territory

As identified by an analyst in a CryptoQuant Quicktake post, the Bitcoin NVT Golden Cross has witnessed a pointy decline not too long ago. The “Community Worth to Transactions (NVT) Ratio” refers to an on-chain indicator that measures the ratio between the market cap of Bitcoin and its transaction quantity.

When the worth of this metric is larger than 1, it means the worth of the asset (that’s, the market cap) is excessive in comparison with its potential to transact cash (the transaction quantity). Such a development can counsel BTC is overvalued.

Then again, the indicator being below the zero mark can indicate the cryptocurrency could also be due for a rebound to the upside as its quantity is excessive relative to its market cap.

Within the context of the present dialogue, the NVT Ratio itself isn’t of curiosity, however somewhat a modified type of it referred to as the NVT Golden Cross. This indicator mainly compares the short-term development of the NVT Ratio towards its long-term one to seek out whether or not it’s near a high or backside.

For monitoring these tendencies, the metric makes use of the 10-day and 30-day shifting averages (MAs) of the NVT Ratio, respectively. Now, right here is the chart shared by the quant that reveals the development within the Bitcoin NVT Golden Cross over the past couple of years:

The worth of the indicator appears to have plunged in current days | Supply: CryptoQuant

Traditionally, there have been two zones which have held significance for the Bitcoin NVT Golden Cross. The primary of those is located above 2.2 (highlighted in crimson) and is the place the tops within the metric have usually occurred. These peaks are typically indicators of overvaluation for the cryptocurrency, so bearish motion can most likely observe them.

Equally, the second zone, which takes place beneath -1.6 (inexperienced), is the place bottoms happen within the NVT Golden Cross. The indicator dipping into this zone has typically confirmed to be a bullish signal for the asset.

From the chart, it’s seen that the Bitcoin NVT Golden Cross has not too long ago seen a pointy decline on account of the crash that BTC’s value has witnessed. The metric is now contained in the bottoming zone, which suggests the coin could also be beginning to develop into oversold.

To this point, the indicator’s worth has dropped to -2.4, which continues to be increased than the opposite adverse spikes that the analyst has marked within the graph. Thus, whereas BTC could also be nearing a backside, it may nonetheless take an extra drop earlier than it’s really in.

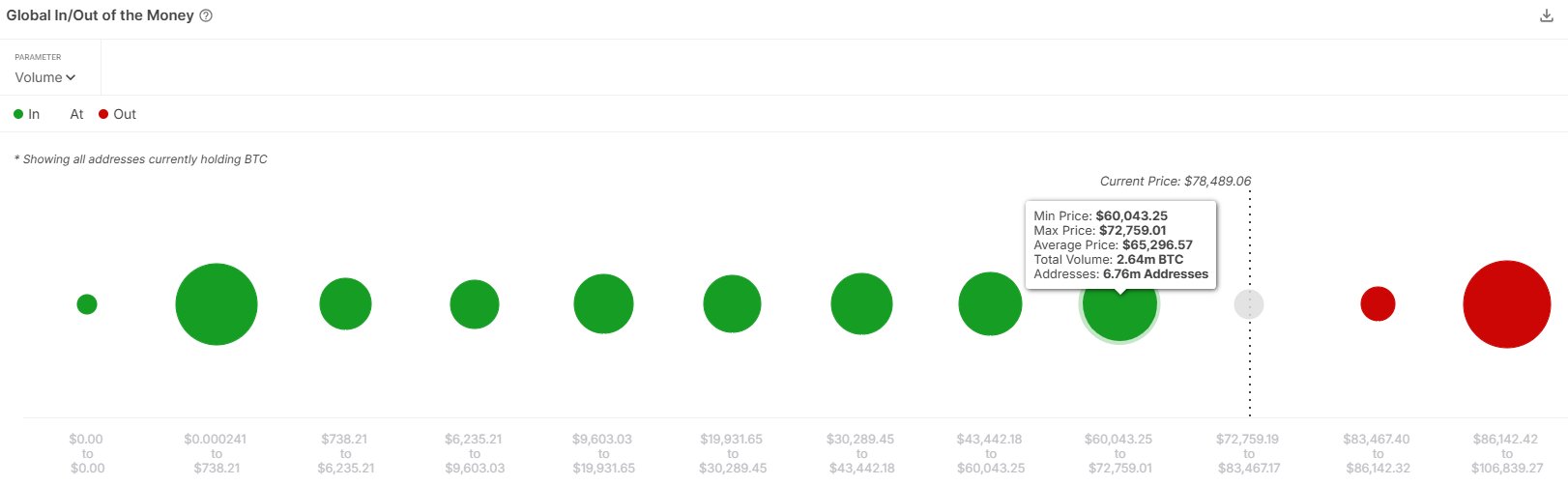

When it comes to on-chain assist, the market intelligence platform IntoTheBlock has defined that the following related one is current below $72,000. As such, if BTC’s decline continues, it’s potential that the asset might discover a minimum of short-term aid round this mark.

The price foundation distribution of the BTC addresses throughout the assorted value ranges | Supply: IntoTheBlock on X

BTC Value

Following the most recent leg of the decline in the course of the previous day, Bitcoin has seen its value drop to the $81,600 mark.

Appears to be like like the value of the coin has been sliding down not too long ago | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com