Bitcoin (BTC) is presently buying and selling under key demand ranges after shedding the $90K mark earlier this week. The value has tagged recent lows, and bulls have misplaced management because the market faces intense promoting strain. BTC has dropped 14% in lower than three days, getting into a panic promoting part as traders react to market uncertainty.

The sudden drop has sparked worry and hypothesis, with some analysts calling for a bear market whereas others stay optimistic about BTC’s long-term outlook. Regardless of this sharp correction, some crypto specialists argue that panic promoting at this stage is a rookie mistake.

CryptoQuant CEO Ki Younger Ju shared key metrics on X displaying BTC’s value drawdown after value discovery, stating that these kind of corrections are traditionally regular in bull markets. In keeping with Ju, in the event you’re panic promoting now, you’re in all probability a noob—implying that this can be a typical shakeout designed to flush out weak palms earlier than the subsequent rally.

With Bitcoin’s value struggling under $90K, the subsequent few days will probably be essential to find out whether or not BTC stabilizes and recovers or continues to interrupt decrease towards deeper demand ranges.

Bitcoin Faces A Correction Section

Bitcoin has confronted its largest correction of the 12 months, with the worth struggling under the $90K stage as investor worry and uncertainty dominate the market. The sudden drop has shaken confidence, and hypothesis a couple of potential bear market is rising as BTC units new lows.

Regardless of the sharp decline, prime analysts are nonetheless expecting key affirmation ranges. The market is at a vital level, the place BTC might both consolidate under $90K for an prolonged interval or see a powerful push above $95K to verify a restoration rally. The following few days will probably be essential in figuring out whether or not Bitcoin stabilizes or faces additional draw back strain.

Ki Young Ju’s key insights concerning the correction clarify {that a} 30% pullback in a Bitcoin bull cycle is frequent. He reminds traders that in 2021, BTC dropped 53% throughout its bull market but nonetheless recovered to achieve a brand new all-time excessive. Ju warns towards emotional buying and selling, stating that purchasing when costs rise and promoting after they fall is the worst funding technique.

Ju emphasizes that traders ought to have a transparent plan fairly than reacting impulsively. Whereas the current value motion appears to be like scary, historic tendencies counsel that this sort of correction is regular in a long-term Bitcoin bull run.

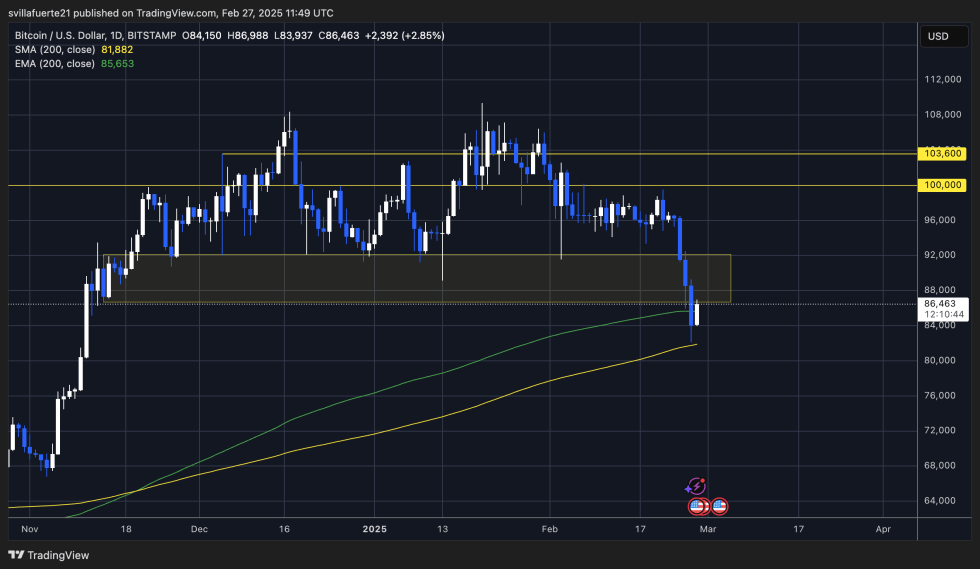

BTC Testing Recent Demand Stage

Bitcoin is presently buying and selling at $86,400, hovering simply above the 200-day Exponential Transferring Common (EMA) and 5% away from the 200-day Transferring Common (MA). These key indicators function long-term help ranges, and holding above them is essential for bulls to forestall additional draw back.

If BTC stabilizes at these ranges, the subsequent main step in reclaiming bullish momentum can be pushing above the $90K stage. Nevertheless, the market stays extremely risky, and this course of might take time earlier than the subsequent main rally takes off. Buyers are intently monitoring value motion to see if Bitcoin can maintain a restoration part or if one other wave of promoting strain will push it into decrease demand zones.

Traditionally, when Bitcoin exams the 200-day MA, it typically results in a interval of consolidation earlier than a major transfer. If bulls handle to reclaim the $90K mark and maintain it as help, this may sign a possible uptrend resumption. Nevertheless, failure to carry present ranges might end in additional declines, with $82K–$84K as the subsequent key demand zone.

For now, merchants are ready to see whether or not Bitcoin can defend its present ranges or if an extended consolidation part is required earlier than a breakout happens.

Featured picture from Dall-E, chart from TradingView