An early Ethereum whale reportedly sells 14,000 ETH by way of the main crypto buying and selling algorithm platform, Wintermute OTC.

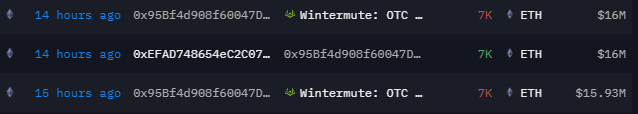

The transaction, valued at roughly $31.92 million, occurred yesterday, February 27, at 22:58 (UTC). Data from blockchain analytics platform Arkham Intelligence exhibits that the consumer behind the pockets, 0x95B…A90e7, transferred 14,000 ETH to Wintermute OTC in two separate transactions containing 7,000 ETH.

Supply of Funds

It bears mentioning that the 14,000 ETH originated from an historical Ethereum handle, 0x035…8dFC7, which scooped 35,932 ETH previously.

Particularly, this early Ethereum handle acquired the property at a median worth of $203.22 per coin between September 2016 and December 2018, totaling $7.3 million.

Since accumulating Ethereum, the supply handle has been transferring the funds to totally different blockchain wallets. A few of these addresses have additionally interacted with Wintermute OTC through the years.

Whale Nets Over $29M in Revenue

Notably, crypto property transferred to Wintermute OTC are normally offered for stablecoins. This implies the whale might have profited $29.07 million by promoting the 14,000 ETH.

Following the transaction, the pockets at present has a stability of 0.515 ETH, value $1,093. Then again, the supply handle nonetheless holds 49.562 ETH ($105,140).

Ethereum Sees Huge Selloffs

The transaction comes because the broader crypto market continues to expertise vital downturns, spreading panic amongst buyers. Yesterday, the Concern and Greed Index dropped to a multi-year low of 10, suggesting that the market was in excessive concern.

This was pushed by the large selloffs throughout the market, with whales and establishments promoting 8,074 ETH inside 13 hours at a median worth of $2,431.

Whereas buyers had been nonetheless recuperating from the dump, outstanding asset supervisor BlackRock transferred 30,280 ETH ($71.85 million) to Coinbase, hinting at potential gross sales. The transaction aligns with BlackRock’s iShares Ethereum Belief (ETHE) registering an outflow of $70 million.

Different Ethereum spot ETF issuers noticed vital outflows this week moreover BlackRock. As an example, Grayscale Investments and Constancy offered a mixed $24.5 million value of ETH tokens.

In the meantime, the Concern and Greed Index at present stands at 21 because the market progressively recovers from yesterday’s selloff. ETH is at present buying and selling at $2,179, marking a decline of 5.91% previously 24 hours and 22.33% previously week.

DisClamier: This content material is informational and shouldn’t be thought of monetary recommendation. The views expressed on this article might embody the writer’s private opinions and don’t replicate The Crypto Fundamental opinion. Readers are inspired to do thorough analysis earlier than making any funding selections. The Crypto Fundamental will not be liable for any monetary losses.