The market sentiment has dropped to twenty for the primary time in current reminiscence, indicating concern. In addition to, the ETFs witnessed a serious outflow of over $1 billion, with Blackrock recording over $418 million or 4,200 BTC—the single-largest outflow. This dragged the Bitcoin worth near $82,000, which attracted large shopping for curiosity. Presently, the bulls have triggered a powerful rebound and elevated the degrees above $86,000. Nonetheless, the query arises whether or not the present flip may stay for lengthy or a bull entice is within the making.

The BTC worth skilled one of many steepest three-day drops since November 2022, wiping out greater than $300 billion from the market. Regardless of this, a number of the proponents stay bullish on Bitcoin, as they declare the revival of the bull run may very well be triggered as soon as the worth enters the demand zone. Nonetheless, from a broader perspective, the token stays below the bearish affect, and thus the present rebound may be considered as a short-term reduction.

Weekly RSI Raises Concern

The RSI is taken into account one of many vital indicators, which helps to find out the following plan of action of the rally. It’s used to establish the purchase and promote factors and in addition a horizontal consolidation. Within the longer perspective, the indicator has remained bearish whereas the worth continued to vary excessive. Beforehand, when the RSI and the worth displayed an inverse co-relation, it led to the start of a bear market.

As seen within the above chart, the weekly RSI has been forming decrease highs and lows within the instances when the worth fashioned larger highs and lows. Again in 2021, an identical sample occurred, which precipitated the BTC worth to plunge from highs near $69,000 to the underside under $16,000. Though the bulls tried onerous to validate a rebound, the bears had held a powerful grip on the rally that stored on pushing the worth decrease. Due to this fact, if the BTC worth fails to rise and safe ranges above $100K, an identical sample may observe, dragging the degrees by 50%.

Extra Bearish Motion Upcoming For BTC Worth

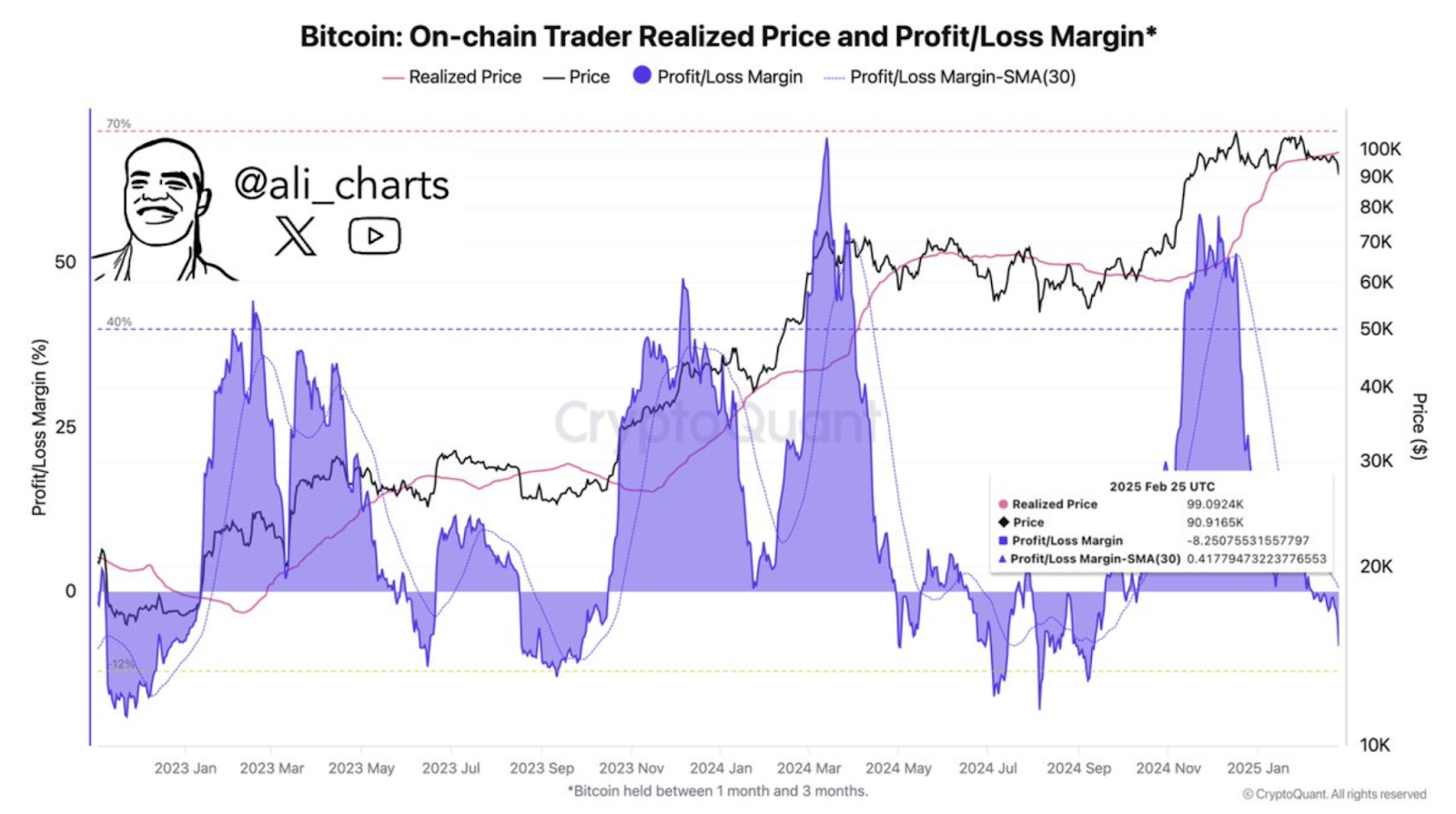

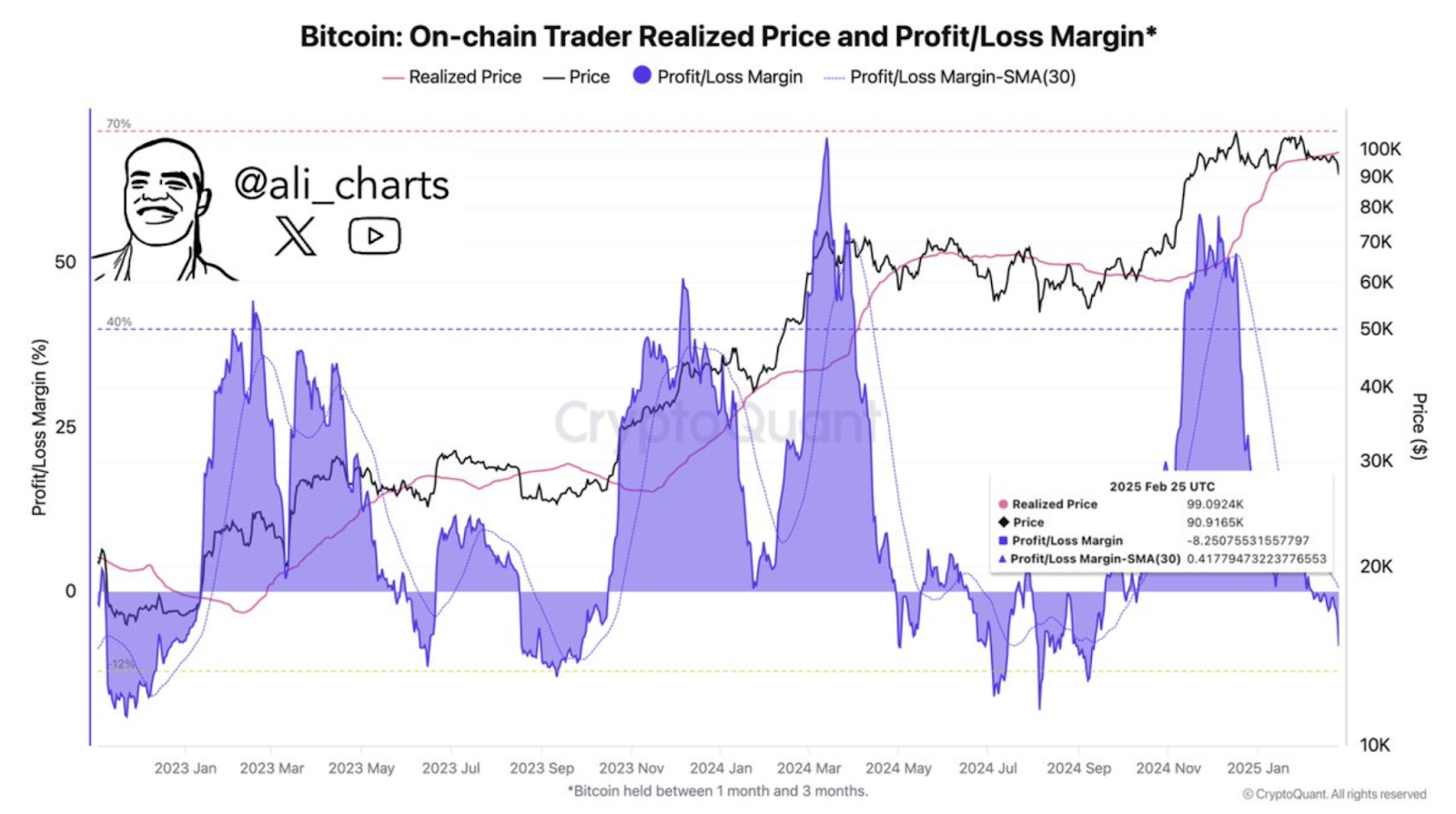

In instances when the Bitcoin worth is experiencing large promoting stress, each rebound is checked out as the beginning of a restoration part. Nonetheless, the previous commerce sample means that the worth is but to enter the demand zone. The realized worth and the revenue/loss margin recommend the token is anticipated to witness extra bearish warmth.

The above chart shared by a preferred analyst, ALI, exhibits that since 2022, shopping for alternatives have all the time occurred when the dealer’s realized loss margin hits -12%. Apparently, the degrees have reached -8.25%, suggesting the rally is inching near the 2022 purchase zone. Whereas some consider the merchants could discover the shopping for alternatives mish earlier than, the correlation between realized worth & P/L margin raises some concern about market psychology & investor habits.

So what’s subsequent?

Whereas some analysts consider the present rebound may very well be the tip of the bearish development, the liquidation ranges recommend a various worth motion. After the newest worth motion, large, over-leveraged clusters have been mounted on each side. This means the Bitcoin worth could witness large volatility within the subsequent few days. Due to this fact, extra downfall may be anticipated on the finish of the month, and if the worth begins the recent month-to-month commerce on a bullish word, then it could stay elevated till the tip of the quarter.