The speed at which company and personal establishments undertake the Bitcoin normal has surged extensively up to now yr because the asset continues to go mainstream.

Confidence in Bitcoin has grown quicker than that of some other asset class in historical past. The pioneering cryptocurrency has seen staggering mainstream adoption just lately, mirroring that seen within the web’s early days.

A latest report particulars this rising embrace of the asset, as soon as seen as a bubble. In response to the piece printed by Bitcoin-only monetary establishment Rivers Monetary, the adoption charge has elevated extensively up to now two years.

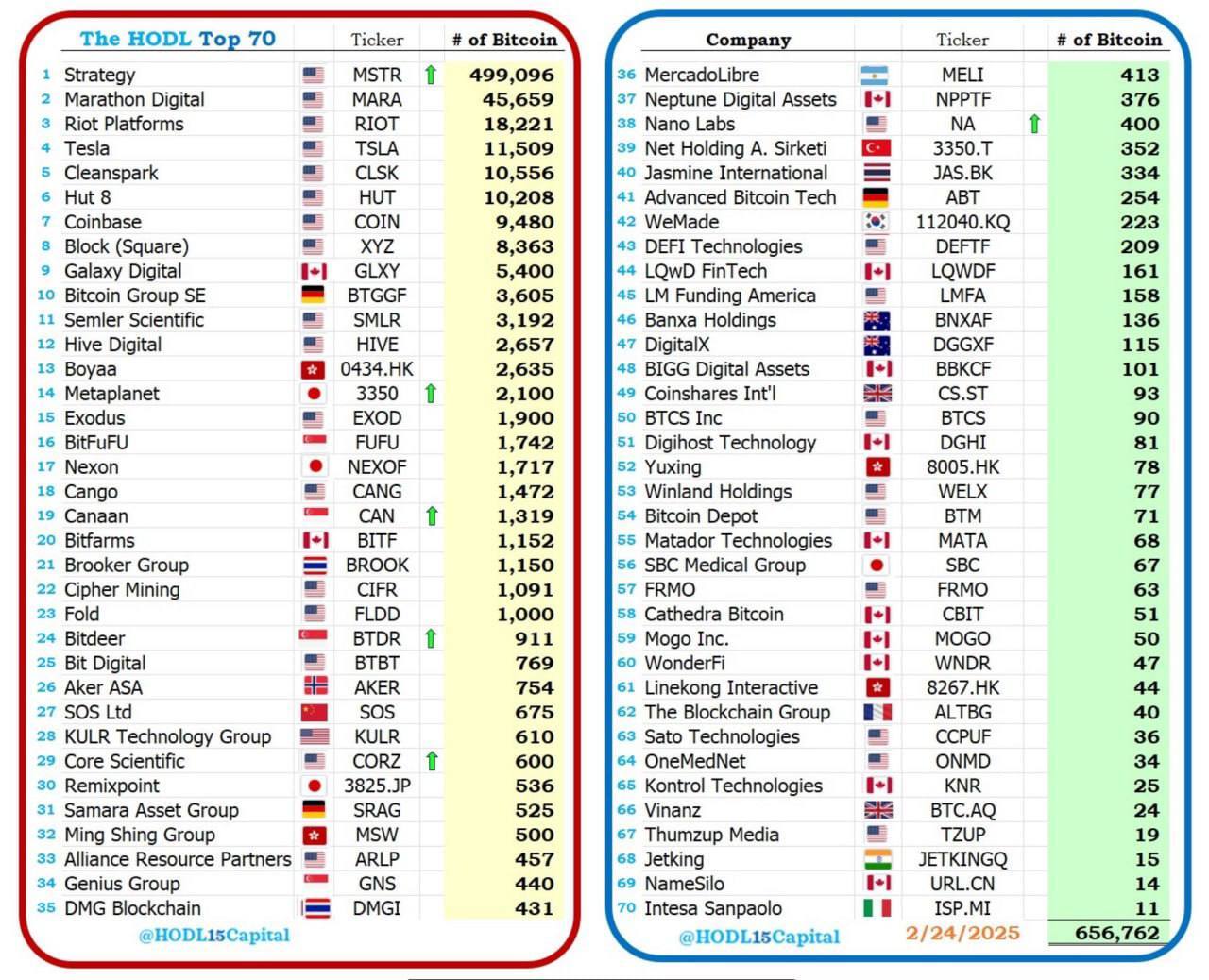

Public Firms Massively Stacking Bitcoin

The Tuesday report discloses that the adoption charge amongst public firms has elevated by a powerful 80% since January 2024, with 81 companies now holding Bitcoin on their steadiness sheets. Reminiscing additional backward, the numbers have grown by 139% since 2023, with three Nasdaq 100 and two S&P 500 firms now adopting the Bitcoin normal.

Notably, this escalating adoption follows the burgeoning feat Technique (previously MicroStrategy) achieved by merely adopting Bitcoin as its major reserve asset. For context, its inventory MTSR has surged a jaw-dropping 1,752% in 5 years, just lately coming into the Nasdaq 100, because of its spectacular efficiency.

Lately, public companies like Matador, Kurl Expertise, Rumble, and Metaplanet, to say however a couple of, adopted the Bitcoin normal. This bias has additional indicated confidence within the largest cryptocurrency by market cap.

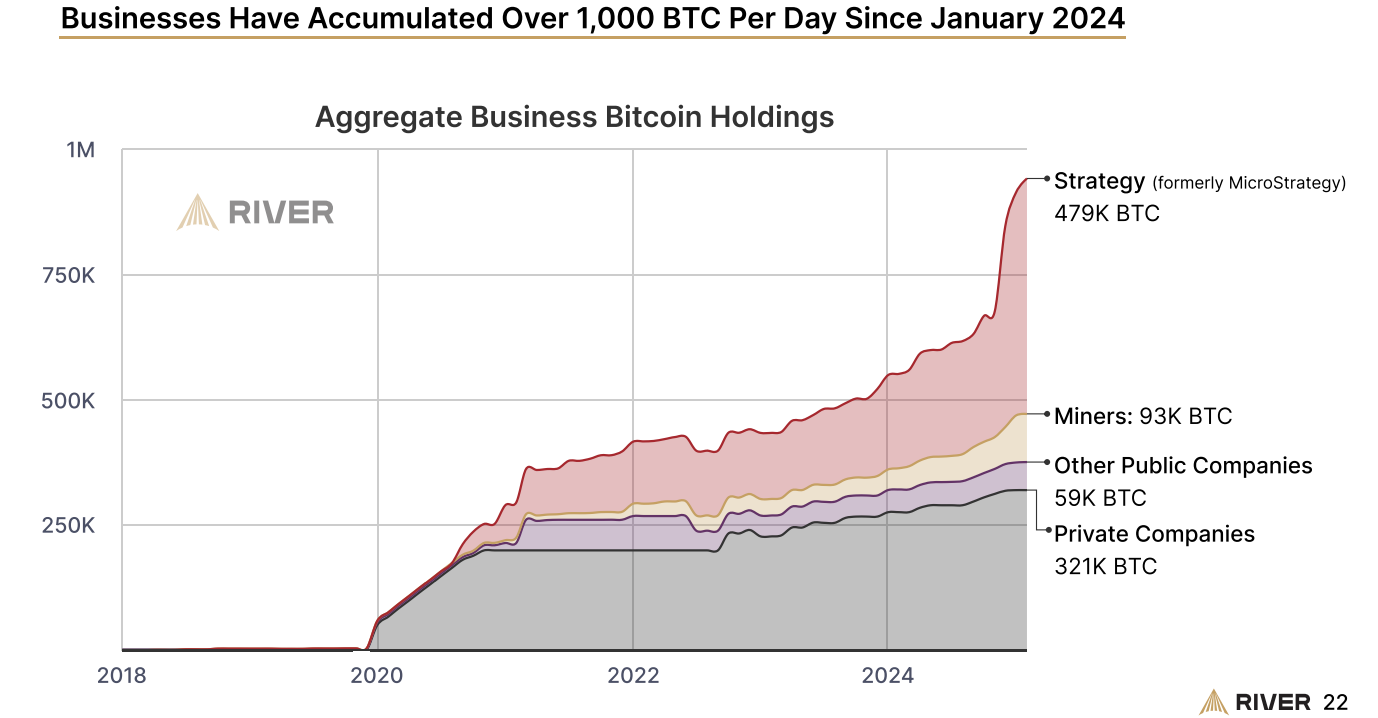

Companies Buying Over 1,000 BTC per Day Since 2024

In the meantime, the River report additional highlighted the rising variety of Bitcoin acquisitions by each previous and new Bitcoin normal adopters. In response to the piece, companies are buying 1,000 bitcoins on daily basis since January 2024.

Technique has led this Bitcoin-hungry pack with its incessant purchases. On Monday, the enterprise intelligence agency acquired 20,356 BTC, bringing its stash to 499,096 BTC ($43 billion).

In complete, public firms maintain over 652,000 BTC, with a piece of them in Technique’s custody.

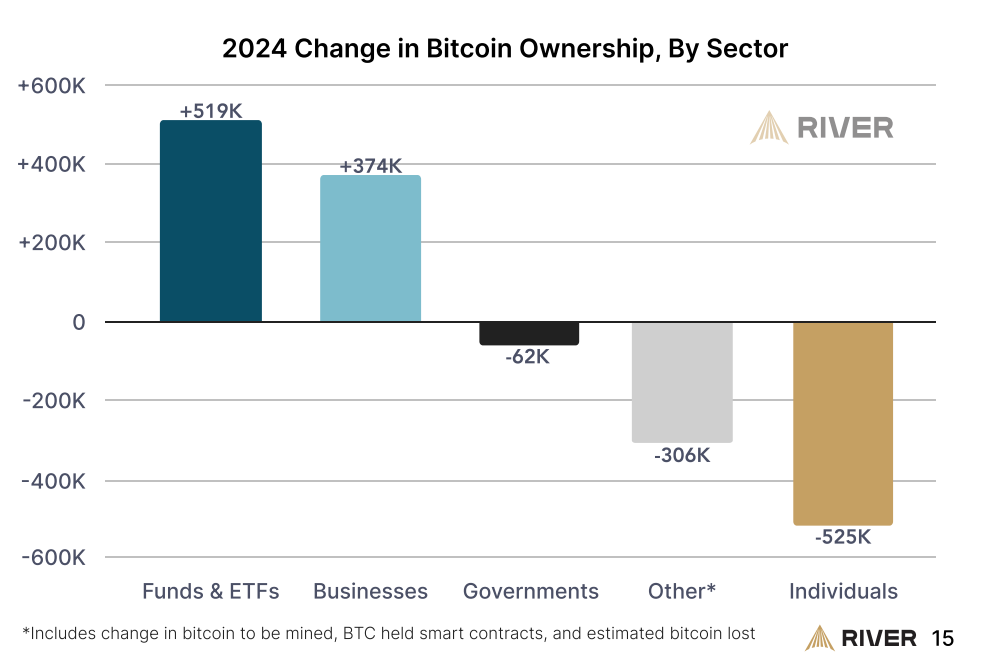

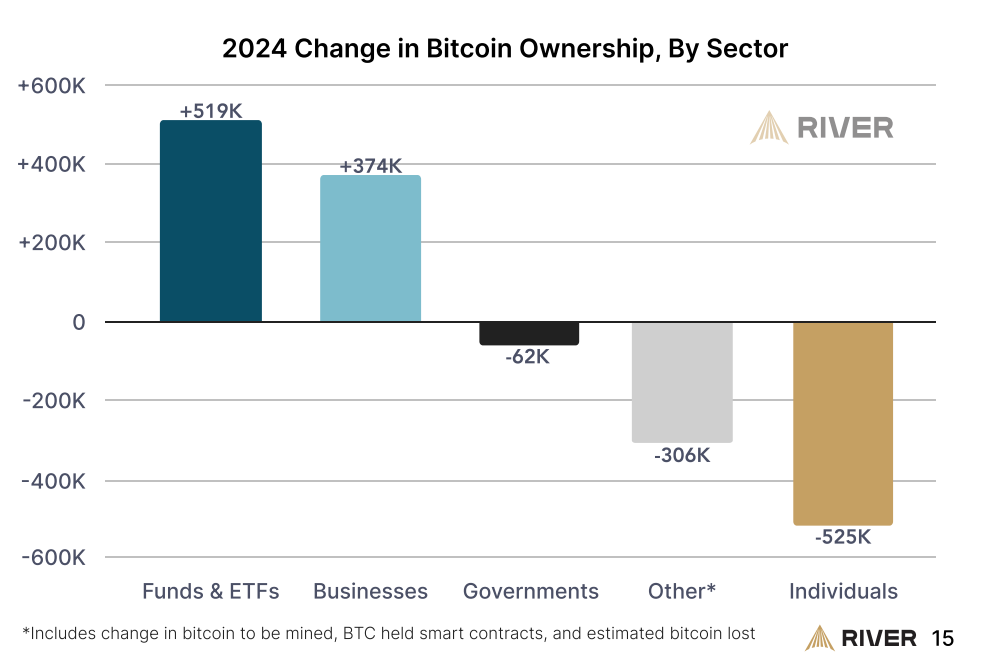

Modifications in Bitcoin Possession

The report additionally highlighted a shift in Bitcoin’s distribution amongst entities. Companies and exchange-traded funds (ETFs) got here to the social gathering final, considerably depreciation holdings amongst different teams holding the asset.

For context, institutional traction in direction of Bitcoin noticed ETFs and different funds amass over 519,000 BTC and companies 374,000 BTC in 2024. This distribution shift price people, governments, and different entities 893,000 BTC final yr.

Nonetheless, knowledge exhibits there’s extra room for growth. Regardless of the rising numbers, below 1% of publicly traded firms have gained publicity to Bitcoin, an indicator the asset has extra steadiness sheets to enter.

DisClamier: This content material is informational and shouldn’t be thought-about monetary recommendation. The views expressed on this article could embody the writer’s private opinions and don’t mirror The Crypto Primary opinion. Readers are inspired to do thorough analysis earlier than making any funding choices. The Crypto Primary will not be answerable for any monetary losses.