The general cryptocurrency market seems bearish. Amid this, some buyers noticed a possibility and amassed tokens, whereas others panicked and bought their holdings.

610,000 LINK Despatched to Exchanges

Lately, a distinguished crypto skilled shared a publish on X (previously Twitter), revealing that crypto whales have moved almost 610,000 Chainlink (LINK) tokens to exchanges prior to now 24 hours, signaling elevated promoting strain.

https://twitter.com/ali_charts/standing/1894448777664369086

Present Worth Momentum

This substantial switch of LINK tokens led to a notable value drop. At press time, LINK is buying and selling close to $15, having declined by over 7.50% prior to now 24 hours. Nonetheless, throughout the identical interval, its buying and selling quantity surged by 160%, indicating elevated participation from merchants and buyers in comparison with yesterday.

The surge in buying and selling quantity is probably going as a result of breakdown of a protracted consolidation zone and a shift in value motion.

Chainlink (LINK) Technical Evaluation and Upcoming Ranges

Based on skilled technical evaluation, LINK seems bearish and is poised for additional decline. On the day by day timeframe, LINK had been consolidating inside a decent vary for an prolonged interval. Nonetheless, as market sentiment shifted, the asset failed to carry this zone, breaking beneath the consolidation and experiencing a major drop.

Trying on the value motion and historic momentum, LINK seems to have discovered some assist close to $15. If this sentiment stays unchanged and LINK closes a day by day candle beneath the $15 stage, there’s a sturdy chance it may decline one other 15%, reaching the subsequent assist at $12.60.

This consolidation breakdown has pushed LINK right into a downtrend. In the course of the consolidation section, the asset was not solely buying and selling inside a decent vary but additionally transferring above the 200 Exponential Shifting Common (EMA) on the day by day timeframe. This breakdown beneath the 200 EMA could additional clarify the asset’s bearish development.

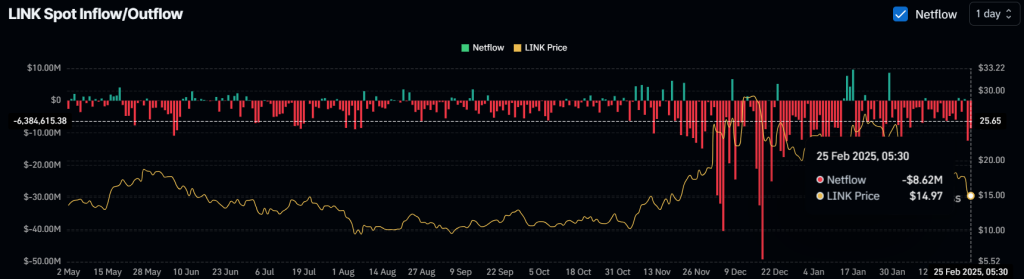

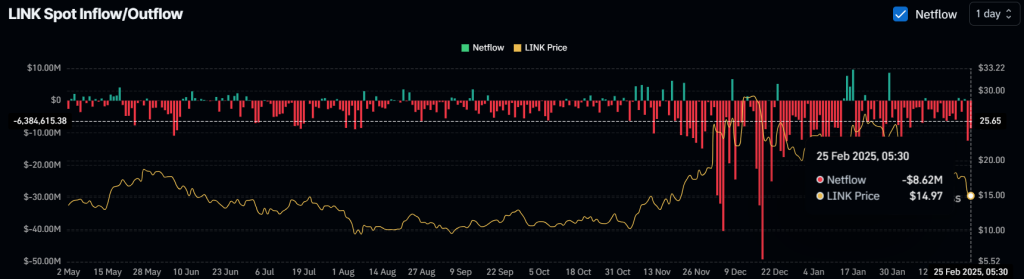

$8.65 Million Price of LINK Outflow

This bearish outlook is likely to be the rationale why whales have moved their LINK holdings onto exchanges. Nonetheless, some buyers and long-term holders have been accumulating the tokens, as reported by the on-chain analytics agency Coinglass.

Knowledge from spot influx/outflow reveals that exchanges have witnessed an outflow of over $8.65 million value of LINK tokens prior to now 24 hours, indicating potential accumulation.

The numerous dumping and accumulation of LINK by buyers, long-term holders, and whales replicate particular person sentiments amid market uncertainty.