With the continued market decline, XLM, the native token of Stellar, has turned bearish and is poised for a major worth drop. The first purpose for this bearish outlook is the present market sentiment and the value motion XLM has fashioned on the each day timeframe.

Present Worth Momentum

XLM is at present buying and selling close to $0.297 and has skilled a worth drop of over 12% prior to now 24 hours. Nevertheless, throughout the identical interval, its buying and selling quantity jumped by 120%, indicating heightened participation from merchants and buyers in comparison with yesterday.

This soar in buying and selling quantity is probably attributable to the shift in market sentiment and XLM’s bearish outlook.

XLM Technical Evaluation and Upcoming Degree

In accordance with knowledgeable technical evaluation, XLM seems bearish because it has damaged by the essential help stage of $0.311, which the asset examined a number of occasions in latest days. Moreover, it closed a each day candle beneath this stage, partially confirming that the value is poised to proceed its decline.

With this breakdown and candle closing, there’s a robust risk that the asset might drop by 35% to succeed in the $0.189 mark within the coming days. In the meantime, through the worth drop, XLM might discover momentary help on the $0.25 mark earlier than reaching $0.189.

Regardless of the breakdown of the essential help, XLM’s worth stays above the 200 Exponential Shifting Common (EMA) on the each day timeframe, which at present acts as a help stage. If the asset breaches the 200 EMA and falls beneath it, there’s a excessive risk that XLM’s worth will proceed declining easily to that stage within the coming days.

$6.75 Million Price Bets on Brief Facet

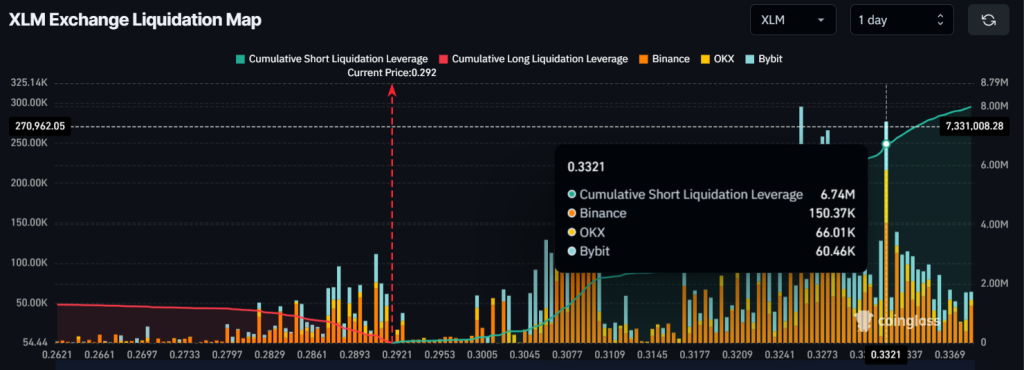

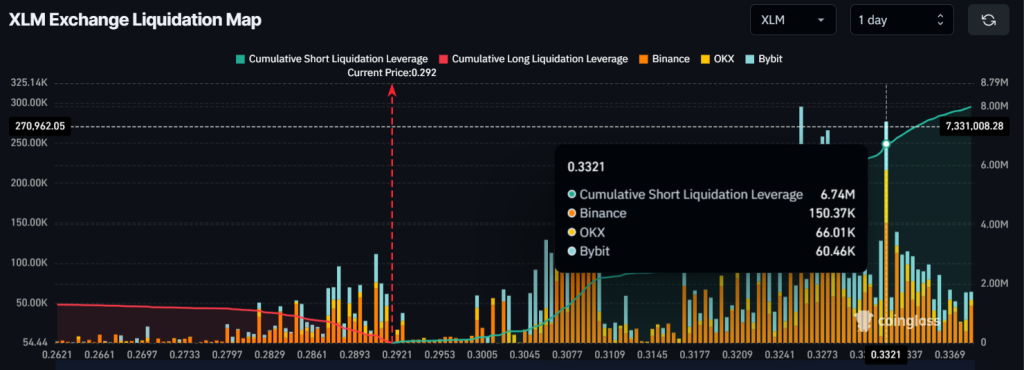

With the notable worth drop and up to date breakdown, sentiment has utterly shifted as intraday merchants look like strongly backing brief positions, in accordance with on-chain analytics agency Coinglass.

Knowledge from the XLM trade liquidation map exhibits that bears, or merchants betting on brief positions, are at present dominating the asset. In the meantime, with the latest worth drop, merchants betting on lengthy positions appear to be exhausted.

Primarily based on latest information, $0.3321 is a stage the place merchants betting on brief positions are over-leveraged, holding $6.75 million price of brief positions. In the meantime, $0.2821 is one other stage the place merchants betting on lengthy positions are over-leveraged, holding $1.10 million price of lengthy positions.

This liquidation information and over-leveraged positions point out that bears are at present dominating the asset and will push XLM’s worth towards the $0.189 stage quickly.