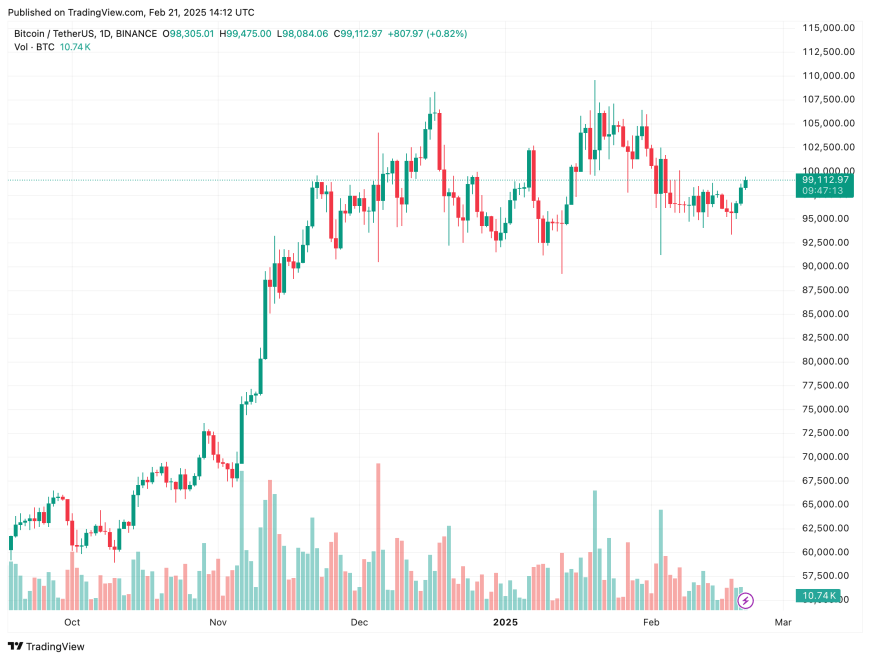

After spending greater than two weeks buying and selling within the mid-$90,000 vary, Bitcoin (BTC) is beginning to climb towards the psychologically important $100,000 mark. The flagship cryptocurrency surged previous $99,000 following dovish remarks from Atlanta Federal Reserve Financial institution (Fed) President Raphael Bostic.

Bostic’s Dovish Remarks Propel Bitcoin Past $99,000

Lately, Federal Reserve Chair Jerome Powell’s hawkish feedback dampened investor sentiment, successfully signaling that rate of interest cuts might not occur for the remainder of the yr as a result of persistent inflation and a resilient job market.

Nevertheless, Bostic’s newest remarks distinction with Powell’s stance. The Atlanta Fed president famous that whereas total employment stays secure, indicators of a slowdown are starting to emerge.

He identified that it has turn into more and more troublesome for unemployed people to search out jobs in contrast to a couple months in the past, with the likelihood of securing employment now decrease than pre-pandemic ranges. Moreover, he highlighted that the common length of unemployment has prolonged by roughly three weeks since August 2024.

Bostic additionally emphasised the decline within the “quits price” – the share of staff who voluntarily go away their jobs every month – which has fallen to ranges final seen in 2015, excluding the pandemic years. Given these indicators, he expressed assist for relieving financial coverage, stating that “the steadiness of dangers to our twin mandate of worth stability and most employment has shifted.”

He additional pointed to rising geopolitical tensions, significantly in mild of US President Donald Trump’s proposed commerce tariffs. Bostic argued that decreasing financial coverage restrictiveness would assist forestall extreme deterioration within the labor market.

Lastly, he projected that the Fed would implement two price cuts in 2025. Following his dovish remarks, the U.S. 10-year Treasury yield and the US Greenback Index (DXY) declined, whereas risk-on property like BTC gained.

BTC Coming Of Age In 2025?

Regardless of the shaky begin to the yr as a result of world macroeconomic uncertainties, BTC has carried out comparatively nicely. The highest cryptocurrency held its personal regardless of the inventory market turmoil as a result of Fed’s cautious stance on price cuts.

As Bitcoin continues to commerce across the pivotal $100,000 mark with a complete market cap of virtually $2 trillion, future worth pullbacks are prone to be shallower in comparison with these witnessed throughout previous market cycles.

Bitcoin’s adoption continues to develop, with an rising variety of US states exploring methods to include it into their treasury reserves. Lately, Kansas, Kentucky, and Utah have taken important steps towards recognizing BTC as a mainstream digital asset.

This development aligns with a current Constancy Digital Property report, which means that the subsequent wave of crypto adoption will probably be pushed by nation-states and authorities treasuries. At press time, BTC is buying and selling at $99,112, up 2% up to now 24 hours.

Featured Picture from Unsplash.com, Charts from TradingView.com