Bitcoin is making an attempt to determine a short-term course after efficiently holding the $90K degree however struggling to reclaim the $100K mark. The worth continues to commerce inside a decent vary, fluctuating between $94K and $100K, creating uncertainty amongst buyers. Whereas Bitcoin’s long-term outlook stays bullish because it holds above vital demand ranges, short-term value motion has but to supply a transparent development.

Hypothesis is mounting, with analysts suggesting that the present interval of consolidation is the calm earlier than the storm. Many consider {that a} breakout is inevitable, however the query stays whether or not Bitcoin will push into new all-time highs or face a deeper correction earlier than resuming its uptrend.

Key information from CryptoQuant reveals that small addresses have slowed their accumulation, signaling a cautious stance from retail buyers. Usually, retail accumulation will increase throughout bull markets, however this isn’t occurring now, suggesting hesitation amongst smaller buyers. In the meantime, institutional and whale exercise could also be driving the market, indicating that the subsequent transfer could possibly be dictated by bigger gamers.

Bitcoin Consolidates – Is a Large Transfer Coming?

Bitcoin has been in a quiet consolidation part beneath the $100K mark, making a boring but tense market surroundings. The worth motion stays range-bound, fluctuating between $94K and $100K, with no decisive transfer in both course. Analysts and merchants are speculating concerning the subsequent huge transfer, however uncertainty dominates. Most buyers anticipate an aggressive breakout, however opinions are break up on whether or not Bitcoin will push into new all-time highs or face a sell-off into decrease demand ranges earlier than resuming its uptrend.

CryptoQuant analyst Axel Adler shared a key market analysis on X, revealing that the gradual accumulation of small addresses displays a cautious stance from retail buyers. Traditionally, retail buyers have a tendency to extend their accumulation throughout bull markets, anticipating additional value features. Nonetheless, this development is at the moment absent, suggesting that smaller buyers lack confidence in Bitcoin’s short-term value motion.

This shift in sentiment not directly suggests that giant buyers and establishments are the first forces behind Bitcoin’s present market actions. Whales proceed accumulating whereas retail buyers hesitate, making a market imbalance that might result in an explosive value transfer as soon as confidence returns.

BTC Testing Essential Liquidity Ranges

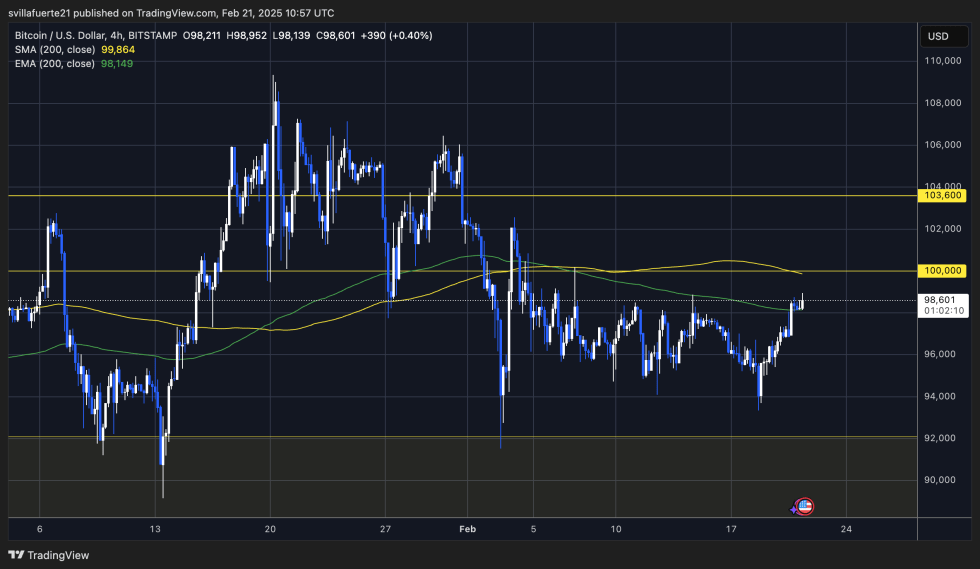

Bitcoin is buying and selling at $98,600 after days of sideways buying and selling, ranging between the $94K help degree and the $100K psychological barrier. This consolidation part has lasted over two weeks, conserving buyers on edge as they look forward to a decisive transfer. Traditionally, such extended durations of tight-range buying and selling are inclined to precede aggressive breakouts, making the subsequent few buying and selling periods essential.

If BTC manages to interrupt above the $100K degree and maintain it as help, the subsequent goal would be the vary highs round $109K. A breakout above this degree might push Bitcoin into value discovery, fueling renewed bullish momentum. Nonetheless, if BTC fails to reclaim the $100K mark and faces rejection, a retest of decrease help ranges is probably going. A drop beneath $94K might set off additional promoting strain, bringing Bitcoin nearer to the $90K demand zone.

Market sentiment stays combined, with retail buyers displaying warning whereas massive buyers accumulate. The continuing consolidation means that Bitcoin is build up for a big transfer, and merchants are intently expecting a confirmed breakout or breakdown. The approaching days will probably be essential in figuring out whether or not BTC resumes its uptrend or faces a deeper correction.

Featured picture from Dall-E, chart from TradingView