Robert Kiyosaki, writer of the bestselling private finance e book ‘Wealthy Dad Poor Dad’, is an energetic investor who by no means shies away from making daring predictions relating to the monetary markets.

The monetary educator has an extended historical past of criticizing fiat currencies, which he usually refers to as ‘faux cash’. In distinction (and to little shock), he’s fairly bullish on cryptocurrencies — Bitcoin (BTC) particularly. Besides, Kiyosaki has persistently sung the praises of valuable metals akin to silver and gold, owing to their roles as hedges towards inflation and shops of wealth.

Kiyosaki has attracted important controversy – he’s politically outspoken, closely indebted, and has been accused of undue alarmism. However, it’s inconceivable to disregard the spectacular income that his investments have secured. Over the course of 2024, the writer’s portfolio netted a 76.03% return — by early February of 2025, his investments had gotten off to an auspicious begin.

Now, the monetary guru is ringing the alarm bells as soon as once more — because the famed investor took to social media platform X to share one more portent of imminent doom.

Robert Kiyosaki doubles down on Bitcoin amid dire warning

Readers have more than likely come throughout the time period ‘bubble’ earlier than. ‘An every little thing bubble’ is a phenomenon the place all asset lessons — shares, bonds, actual property, and even cryptocurrencies, are inflated past their basic worth.

That’s the actual state of affairs we’re in presently — not less than per Kiyosaki’s February 20 post. As well as, the writer expressed that the aforementioned bubble is crashing — proper now. To make issues worse, Kiyosaki appropriately highlighted that, in conditions like these, all asset lessons — even cryptocurrencies like BTC, crash.

Nevertheless, this hasn’t deterred the writer — who emphatically said that he wouldn’t promote his Bitcoin, even when it crashes. Au contraire, Robert Kiyosaki intends to purchase much more BTC ought to costs crash.

“When the Every little thing Bubble crashes….which is occurring now…Bitcoin would be the quickest to get well and climb to increased highs.”

His reasoning is easy — in Kiyosaki’s view, Bitcoin would be the asset that can see the quickest restoration, adopted by a climb to increased highs, following the crash.

The boy who cried crash

Readers ought to be aware, nevertheless, that Kiyosaki habitually predicts crashes that subsequently fail to materialize.

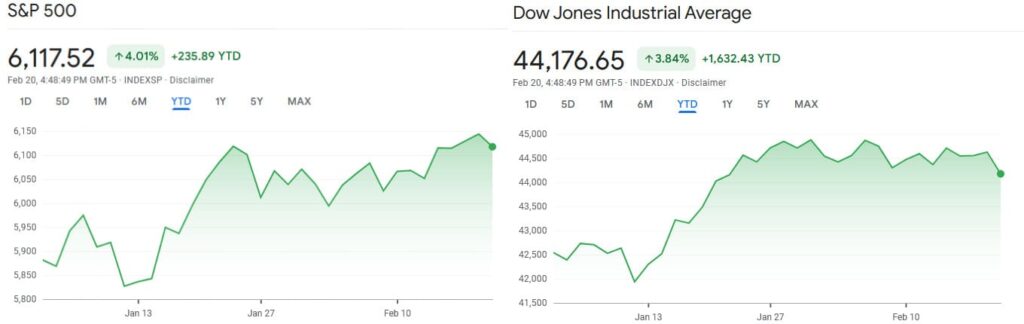

Moreover, whereas asset costs might presently be inflated (even considerably so), no proof means that the ‘every little thing bubble’ has popped. On the time of writing, there was no signal of irregular exercise within the main indices.

The S&P 500 and Dow Jones Industrial Common have rallied by 4.24% and three.84% because the begin of the 12 months, respectively. Whereas the DJIA has marked a small 0.56% pullback on the weekly chart, the S&P has marked a 0.94% achieve in the identical timeframe.

As legitimate as Robert Kiyosaki’s thesis on Bitcoin restoration may very properly be, the remainder of his prediction seems to be little greater than a bid for engagement.

Featured picture by way of Ben Shapiro’s YouTube