Solana has been underneath intense promoting strain since reaching its all-time excessive in late January. The worth has struggled to regain momentum, dealing with unfavorable sentiment because the meme coin market continues to say no, considerably impacting Solana’s ecosystem. Analysts recommend that speculative meme coin buying and selling is without doubt one of the major causes altcoins, together with SOL, have underperformed in comparison with Bitcoin.

Crypto analyst Jelle shared a technical evaluation on X, highlighting that the SOL/BTC pair is breaking down from a key help degree. Nevertheless, Jelle additionally famous that there are nonetheless 2 days and 15 hours left earlier than the candle closes, which means the ultimate consequence stays unsure. If the breakdown is confirmed, SOL may see additional declines towards BTC, signaling continued weak spot within the altcoin market.

Solana’s efficiency has been carefully tied to meme coin hypothesis, which initially fueled its surge however is now resulting in draw back strain. The following few days shall be essential in figuring out whether or not SOL can reclaim key help ranges or if additional draw back awaits. Traders are carefully watching BTC’s dominance and Solana’s capacity to carry its floor because the broader market seeks readability on altcoins’ function on this cycle.

Solana Faces A Huge Check

Solana is now buying and selling at its lowest ranges since November 2024, successfully erasing all of the features from the post-election rally. As soon as a number one altcoin that outperformed many available in the market, Solana is now struggling to regain momentum amid a broader sell-off. Meme coin hypothesis, which was as soon as a catalyst for its meteoric rise, has now turn out to be a significant danger issue, contributing to sustained promoting strain and growing considerations in regards to the community’s long-term sustainability.

This shift in market sentiment was inevitable, as speculative frenzies usually lead to main corrections. Meme cash, which had pushed record-breaking transaction volumes and excessive community exercise, are actually seen as a legal responsibility fairly than an asset. Many buyers who flocked to high-risk meme coin buying and selling have both exited the market or are dealing with important losses, which has led to decreased liquidity and additional value declines.

Jelle shared an analysis on X, revealing that SOL/BTC is breaking down from a key help degree. Nevertheless, he cautioned that the 3-day candle nonetheless has 2 days and 15 hours earlier than closing, which means {that a} decisive breakdown just isn’t but confirmed. He additionally famous that whereas value motion seems weak, a locked-in bullish divergence at help may nonetheless happen if patrons step in aggressively earlier than the shut.

For now, Solana stays at a crucial juncture, with the subsequent few days anticipated to be pivotal in figuring out its short-term pattern. If bulls handle to defend key help ranges, a restoration rally may observe. Nevertheless, if the promote strain persists and confidence stays low, SOL may expertise additional draw back, extending its correction section.

SOL Testing Contemporary Demand Ranges

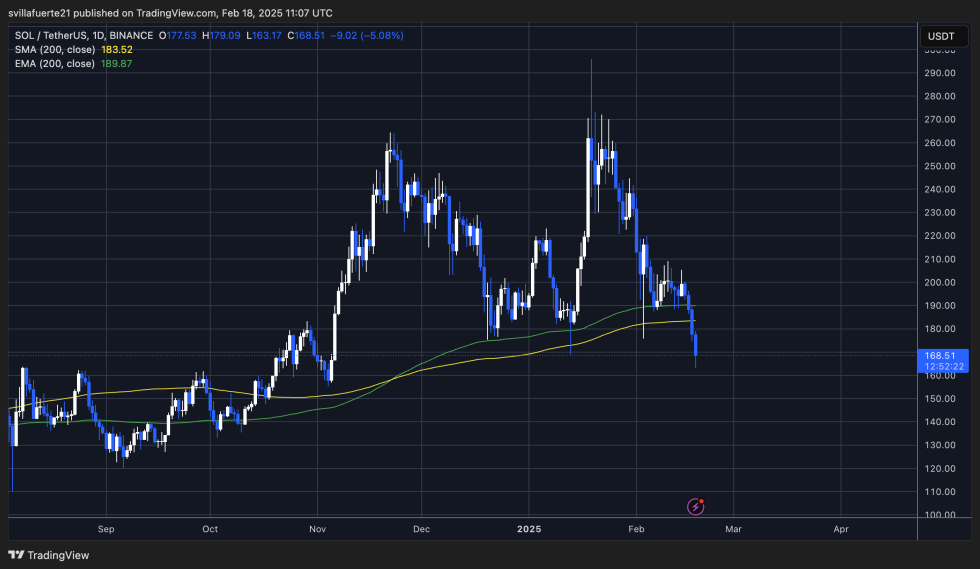

Solana is at present buying and selling at $168 after setting a brand new decrease low round $163, signaling that bears nonetheless have the higher hand within the quick time period. Bulls are actually testing contemporary demand at this degree, and so they should push the value above $170 as quickly as doable to take care of the bullish construction. This degree will function a key short-term resistance, and reclaiming it might be step one towards a restoration rally.

If SOL fails to carry above $170, the chance of a large correction will increase, with the subsequent key help zone round $150. A continued downtrend may expose SOL to deeper losses, particularly if broader market sentiment stays bearish.

Nevertheless, a profitable reclaim of the $170 mark adopted by a breakout above $190 within the coming days could be a powerful sign of energy. A transfer above $190 would recommend that bulls are regaining management, setting the stage for a possible push again towards $200 and better provide zones.

Featured picture from Dall-E, chart from TradingView