U.S. family debt simply hit $18T, mortgage charges are brutal, and Bitcoin’s provide crunch is intensifying. Is the previous path to wealth breaking down?

Actual property is slowing — quick

For years, actual property has been some of the reliable methods to construct wealth. House values usually rise over time, and property possession has lengthy been thought-about a secure funding.

However proper now, the housing market is displaying indicators of a slowdown in contrast to something seen in years. Properties are sitting in the marketplace longer. Sellers are chopping costs. Consumers are combating excessive mortgage charges.

In response to latest information, the common house is now promoting for 1.8% under asking worth — the largest low cost in almost two years. In the meantime, the time it takes to promote a typical residence has stretched to 56 days, marking the longest wait in 5 years.

In Florida, the slowdown is much more pronounced. In cities like Miami and Fort Lauderdale, over 60% of listings have remained unsold for greater than two months. Some properties within the state are promoting for as a lot as 5% under their listed worth — the steepest low cost within the nation.

On the similar time, Bitcoin (BTC) is turning into an more and more engaging various for traders looking for a scarce, useful asset.

BTC just lately hit an all-time excessive of $109,114 earlier than pulling again to $95,850 as of Feb. 19. Even with the dip, BTC remains to be up over 83% up to now yr, pushed by surging institutional demand.

So, as actual property turns into tougher to promote and dearer to personal, might Bitcoin emerge as the final word retailer of worth? Let’s discover out.

From shortage hedge to liquidity entice

The housing market is experiencing a pointy slowdown, weighed down by excessive mortgage charges, inflated residence costs, and declining liquidity.

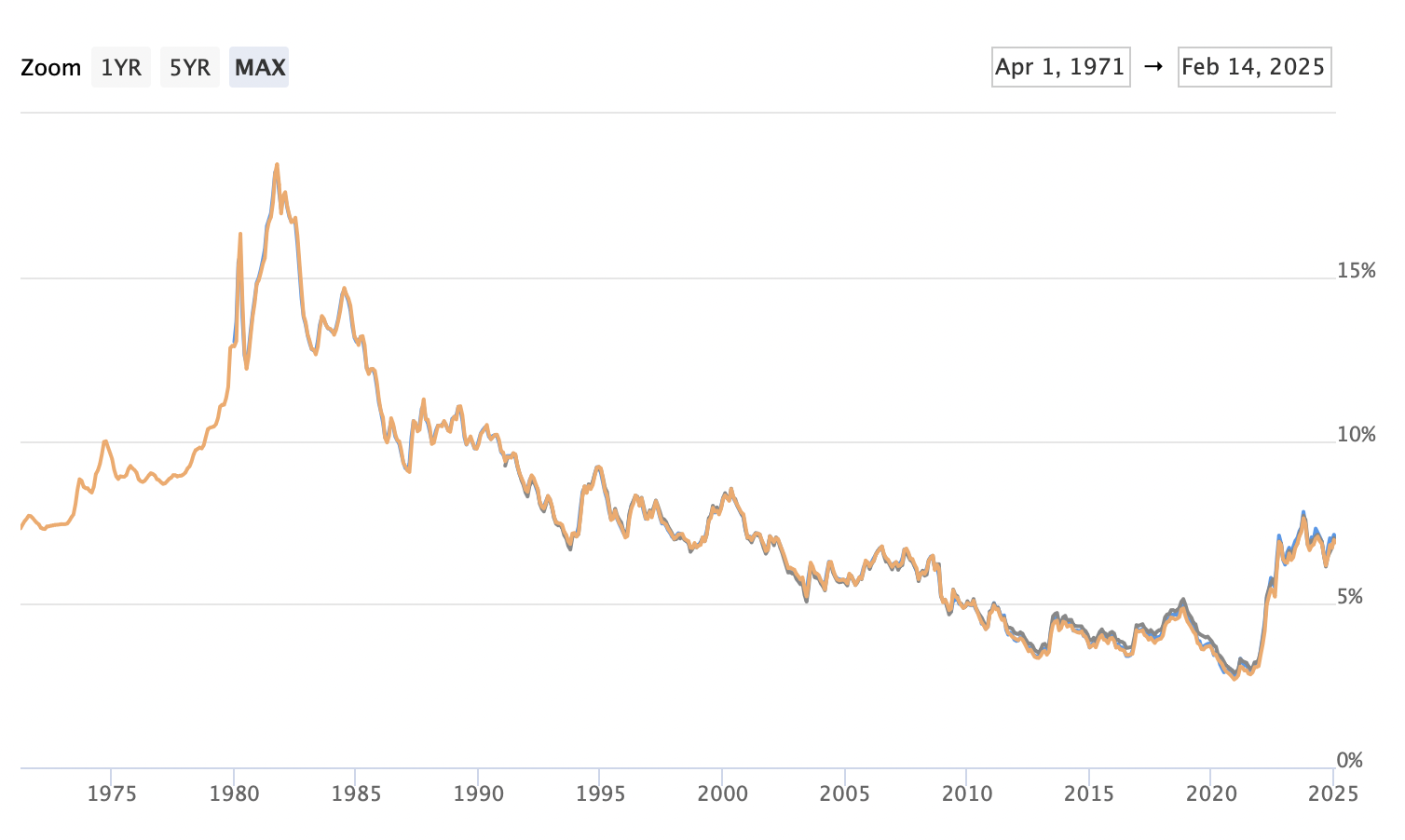

The typical 30-year mortgage fee remains excessive at 6.96%, a stark distinction to the three%–5% charges widespread earlier than the pandemic.

In the meantime, the median U.S. home-sale worth has risen 4% year-over-year, however this improve hasn’t translated right into a stronger market—affordability pressures have stored demand subdued.

A number of key developments spotlight this shift:

- The median time for a house to go beneath contract has jumped to 34 days, a pointy improve from earlier years, signaling a cooling market.

- A full 54.6% of properties are actually promoting under their record worth, a stage not seen in years, whereas simply 26.5% are promoting above. Sellers are more and more pressured to regulate their expectations as patrons acquire extra leverage.

- The median sale-to-list worth ratio has fallen to 0.990, reflecting stronger purchaser negotiations and a decline in vendor energy.

Not all properties, nonetheless, are affected equally. Properties in prime places and move-in-ready situation proceed to draw patrons, whereas these in much less fascinating areas or requiring renovations are going through steep reductions.

However with borrowing prices surging, the housing market has develop into far much less liquid. Many potential sellers are unwilling to half with their low fixed-rate mortgages, whereas patrons battle with larger month-to-month funds.

This lack of liquidity is a elementary weak point. In contrast to Bitcoin, which may be traded 24/7 with near-instant execution, actual property transactions are sluggish, costly, and infrequently take months to finalize.

As financial uncertainty lingers and capital seeks extra environment friendly shops of worth, the obstacles to entry and sluggish liquidity of actual property have gotten main disadvantages.

Too many properties, too few cash

Whereas the housing market struggles with rising stock and weakening liquidity, Bitcoin is experiencing the alternative — a provide squeeze that’s fueling institutional demand.

In contrast to actual property, which is influenced by debt cycles, market situations, and ongoing improvement that expands provide, Bitcoin’s whole provide is completely capped at 21 million.

Bitcoin’s absolute shortage is now colliding with surging demand, notably from institutional traders, strengthening Bitcoin’s function as a long-term retailer of worth.

The approval of spot Bitcoin ETFs in early 2024 triggered a large wave of institutional inflows, dramatically shifting the supply-demand steadiness.

Since their launch, these ETFs have attracted over $40 billion in internet inflows, with monetary giants like BlackRock, Grayscale, and Constancy controlling the vast majority of holdings.

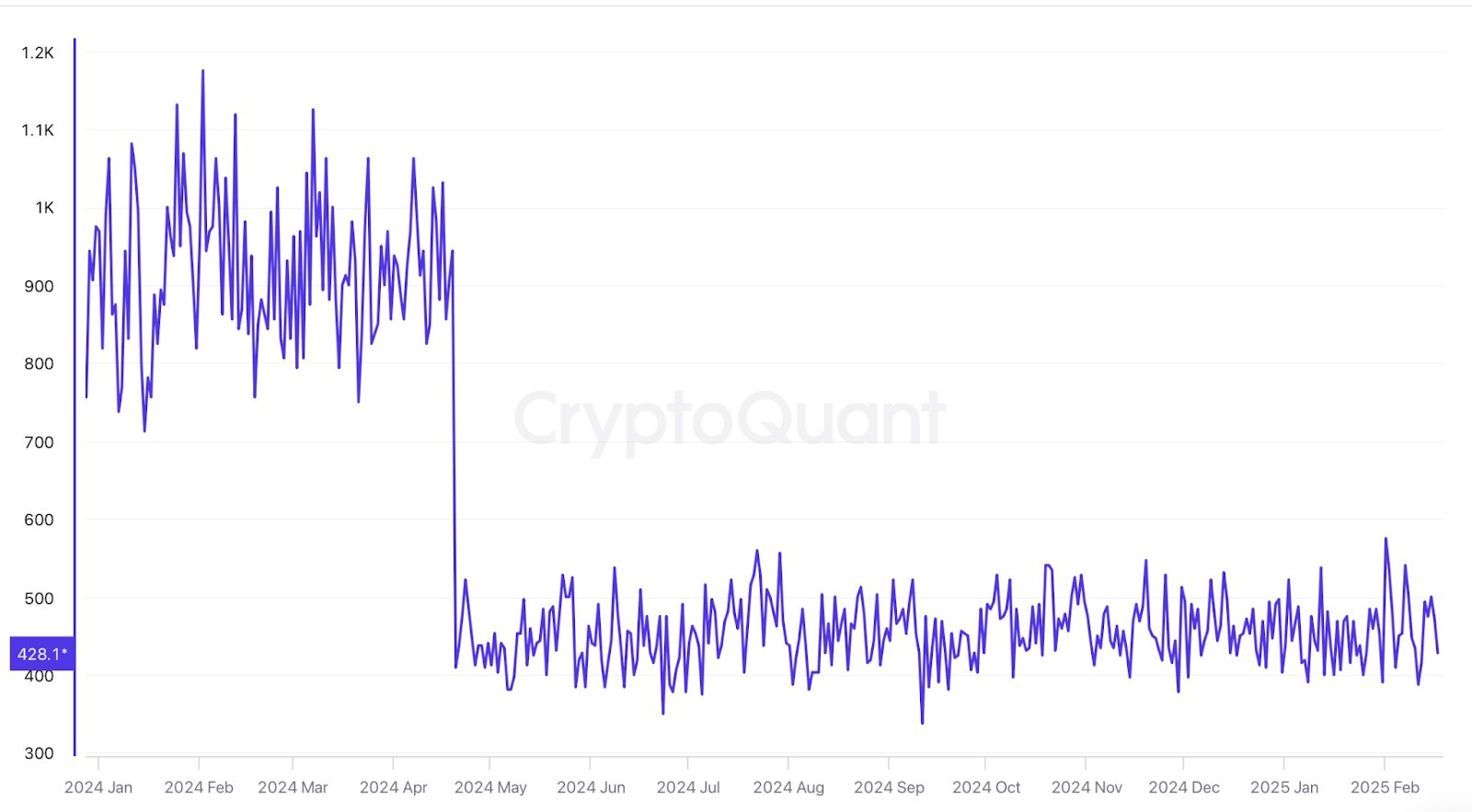

The demand surge has absorbed Bitcoin at an unprecedented fee, with every day ETF purchases starting from 1,000 to three,000 BTC — far exceeding the roughly 500 new cash mined every day. This rising provide deficit is making Bitcoin more and more scarce within the open market.

On the similar time, Bitcoin alternate reserves have dropped to 2.5 million BTC, the bottom stage in three years. Extra traders are withdrawing their holdings from exchanges, signaling sturdy conviction in Bitcoin’s long-term potential relatively than treating it as a short-term commerce.

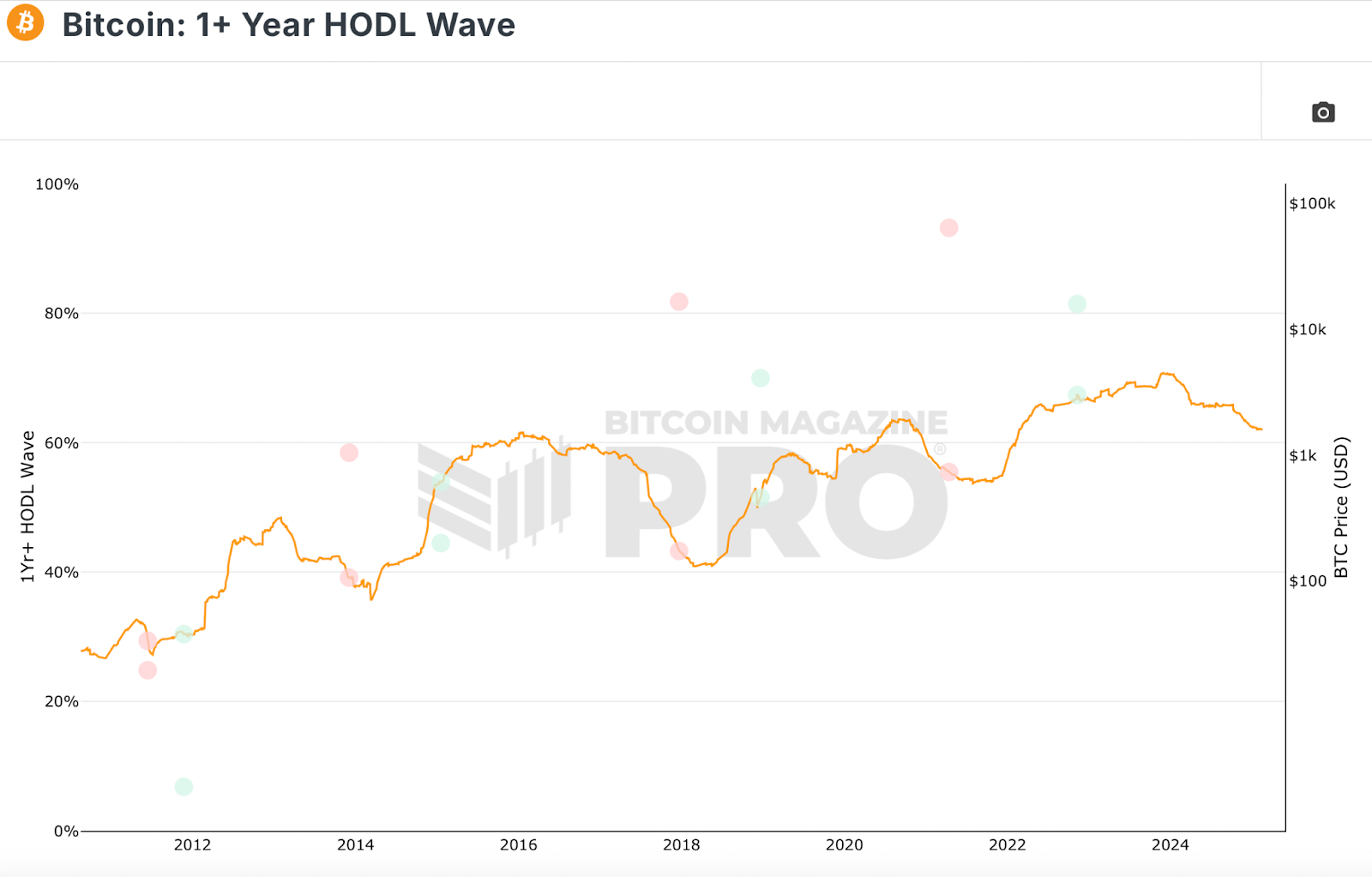

Additional reinforcing this pattern, long-term holders proceed to dominate provide. As of December 2023, 71% of all Bitcoin had remained untouched for over a yr, highlighting deep investor dedication.

Whereas this determine has barely declined to 62% as of Feb. 18, the broader pattern factors to Bitcoin turning into an more and more tightly held asset over time.

The flippening isn’t coming — it’s right here

As of January 2025, the median U.S. home-sale worth stands at $350,667, with mortgage charges hovering close to 7%. This mix has pushed month-to-month mortgage funds to report highs, making homeownership more and more unattainable for youthful generations.

To place this into perspective:

- A 20% down fee on a median-priced residence now exceeds $70,000—a determine that, in lots of cities, surpasses the whole residence worth of earlier a long time.

- First-time homebuyers now symbolize simply 24% of whole patrons, a historic low in comparison with the long-term common of 40%–50%.

- Complete U.S. family debt has surged to $18.04 trillion, with mortgage balances accounting for 70% of the whole—reflecting the rising monetary burden of homeownership.

In the meantime, Bitcoin has outperformed actual property over the previous decade, boasting a compound annual progress fee (CAGR) of 102.36% since 2011—in comparison with housing’s 5.5% CAGR over the identical interval.

However past returns, a deeper generational shift is unfolding. Millennials and Gen Z, raised in a digital-first world, see conventional monetary techniques as sluggish, inflexible, and outdated.

The concept of proudly owning a decentralized, borderless asset like Bitcoin is way extra interesting than being tied to a 30-year mortgage with unpredictable property taxes, insurance coverage prices, and upkeep bills.

Surveys counsel that youthful traders more and more prioritize monetary flexibility and mobility over homeownership. Many favor renting and retaining their belongings liquid relatively than committing to the illiquidity of actual property.

Bitcoin’s portability, round the clock buying and selling, and resistance to censorship align completely with this mindset.

Does this imply actual property is turning into out of date? Not solely. It stays a hedge towards inflation and a useful asset in high-demand areas.

However the inefficiencies of the housing market — mixed with Bitcoin’s rising institutional acceptance — are reshaping funding preferences. For the primary time in historical past, a digital asset is competing immediately with bodily actual property as a long-term retailer of worth.

The query is not whether or not Bitcoin is an alternative choice to actual property — it’s how shortly traders will modify to this new actuality.