RLUSD, the dollar-pegged Ripple stablecoin has hit a “large milestone.”

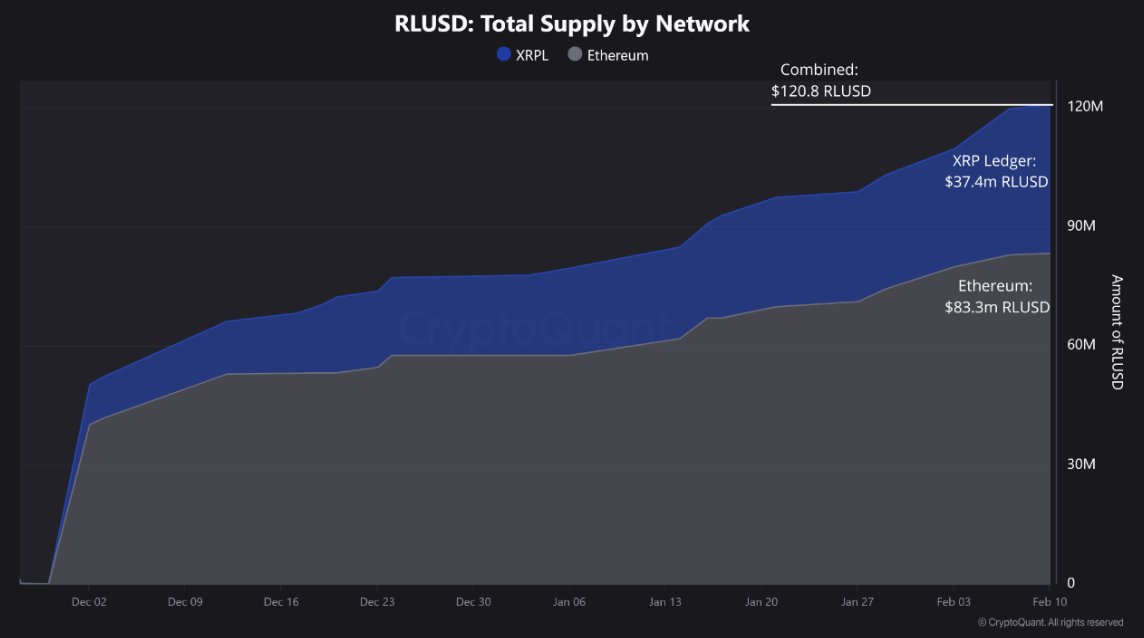

That is in response to a recent report from main crypto analytics platform CryptoQuant. The report by main analyst J.A. Maartunn highlights that RLUSD has hit a complete provide of $120 million inside its first two months of launch amid rising adoption. Particularly, the full stablecoin provide now sits round $120.8 million.

Because the analyst highlighted, the majority of the availability, about $83.3 million RLUSD, sits on Ethereum, whereas solely about $37.4 million RLUSD is on the XRP Ledger.

Nonetheless, he famous that the XRPL has dominated provide progress in current weeks. Alternatively, the stablecoin’s provide on Ethereum has largely remained steady after initially accelerating within the first few weeks, highlighting a shift in demand dynamics.

Maartunn attributed the demand shift to the decrease charges on the XRPL in comparison with Ethereum. One other probably contributing issue is the speedy integration of the asset within the XRPL’s DeFi ecosystem. On the time of writing, xpmarket data exhibits 80 liquidity swimming pools denominated within the stablecoin.

The current provide feat comes on the heels of the stablecoin reaching a milestone of 100,000 transactions earlier within the month. According to the rising demand on the XRPL, 95% of RLUSD transactions on the time had been recorded on the community.

Regardless of these feats, RLUSD continues to be miles away from providing any actual competitors to established gamers like Tether and Circle, whose flagship merchandise, USDT and USDC, boast market capitalizations of $142 billion and $56 billion, respectively.

Nonetheless, many anticipate that this established order might change with higher help for RLUSD from main exchanges like Binance and Coinbase. On the similar time, Ripple has but to combine the asset into its main funds enterprise.

RLUSD has been tipped to bolster XRP liquidity and DeFi exercise by serving as a straightforward on-ramp for market contributors and a steady unit of worth for choices like loans.

DisClamier: This content material is informational and shouldn’t be thought of monetary recommendation. The views expressed on this article might embody the creator’s private opinions and don’t mirror The Crypto Fundamental opinion. Readers are inspired to do thorough analysis earlier than making any funding selections. The Crypto Fundamental isn’t liable for any monetary losses.