After almost 5 months of uninterrupted inflows, Bitcoin and different crypto asset funding merchandise recorded their first important outflow, totaling $415 million.

CoinShares highlighted this knowledge in its newest weekly report on crypto investments, notably the ETF market. The most recent determine marks the tip of an unprecedented streak of inflows that noticed $29.4 billion poured into the sector following the U.S. election.

Notably, the 19-week report of $29.4 billion post-November election surpassed the $16 billion recorded within the first 19 weeks following the launch of U.S. spot ETFs in January 2024. Nevertheless, the influx streak finally got here to an finish final week.

In keeping with CoinShares, the sudden reversal adopted Federal Reserve Chair Jerome Powell’s hawkish tone throughout a Congressional assembly and higher-than-expected U.S. inflation knowledge. Notably, these occasions spooked buyers.

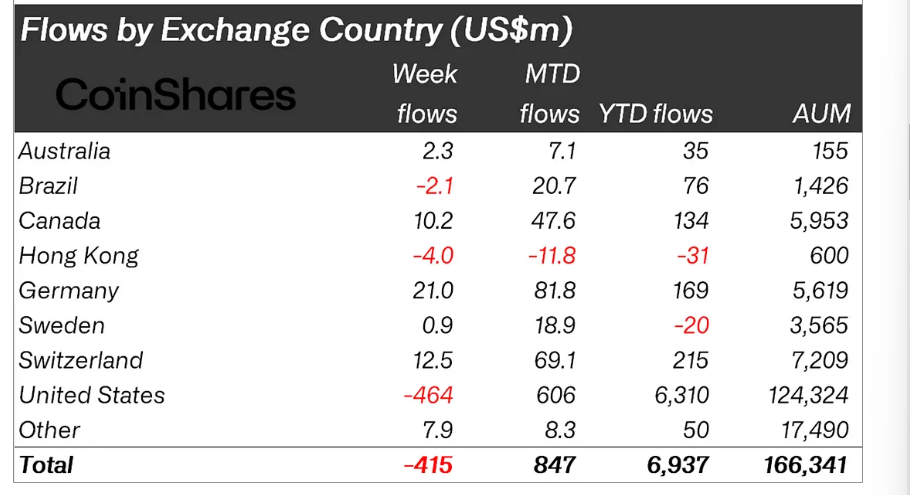

The U.S. market bore the brunt of the withdrawals, with $464 million in outflows. In the meantime, different areas remained resilient with optimistic flows. Particularly, Germany’s crypto ETP market recorded inflows of $21 million, Switzerland noticed $12.5 million, and Canada registered $10.2 million in inflows.

Bitcoin Leads Losses Whereas Solana and XRP Achieve Floor

As rate of interest expectations shifted, Bitcoin noticed the most important weekly outflow at $430 million. Curiously, the BTC market witnessed no corresponding enhance in short-Bitcoin positions, which even noticed $9.6 million in withdrawals. This implies buyers are pulling capital slightly than hedging towards additional draw back.

Regardless of the broad retreat, altcoins noticed continued investor curiosity. Solana recorded $8.9 million in inflows, main the altcoin class. The following in keeping with the most important weekly influx was XRP-based merchandise, with $8.5 million. Sui funding merchandise additionally registered a $6 million influx.

Blockchain Equities Keep Momentum

Whereas digital asset merchandise confronted sell-offs, blockchain equities continued to draw buyers. They noticed $20.8 million in inflows, bringing year-to-date web inflows to $220 million.

This means that some buyers stay optimistic concerning the broader blockchain trade, whilst crypto markets regulate to macroeconomic shifts.

With Bitcoin struggling towards macroeconomic pressures, the highlight is now shifting to altcoins and blockchain shares, that are holding investor curiosity within the risky market.

DisClamier: This content material is informational and shouldn’t be thought-about monetary recommendation. The views expressed on this article might embody the writer’s private opinions and don’t replicate The Crypto Primary opinion. Readers are inspired to do thorough analysis earlier than making any funding choices. The Crypto Primary will not be answerable for any monetary losses.