Bitcoin stays structurally bullish regardless of failing to verify short-term course, and buyers are actually searching for alerts of the subsequent main transfer. Whereas uncertainty continues to dominate the market, many analysts argue that BTC is making ready for an enormous breakout into all-time highs (ATH).

Key data from IntoTheBlock reveals that Bitcoin’s correlation with the S&P 500 has dropped to zero, signaling that BTC is now decoupled from conventional markets. It is a uncommon occasion, as Bitcoin has usually adopted macroeconomic tendencies and inventory market actions prior to now. Nonetheless, with no clear correlation, BTC seems to be shifting by itself cycle, dictated by inside market forces slightly than exterior monetary occasions.

The final time we noticed such a low correlation was on November fifth, 2024, simply earlier than Bitcoin surged previous $100K. If BTC reclaims the $100K stage within the coming days, analysts count on an enormous rally to observe, doubtlessly resulting in a brand new all-time excessive.

Hypothesis is rising, with analysts suggesting that this latest consolidation is the calm earlier than the storm—and a bullish storm at that. Traditionally, lengthy durations of sideways buying and selling close to cycle highs have led to explosive breakouts, and present market circumstances appear to align with that sample.

Value Consolidation: Technical Ranges

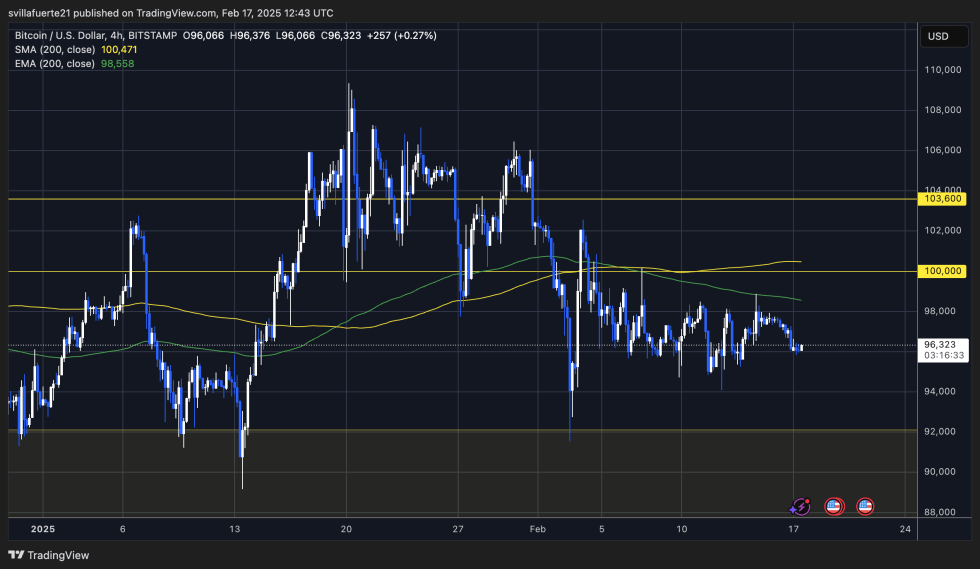

Bitcoin is buying and selling at $96,300 after almost two weeks of sideways buying and selling in a good vary between $94,000 and $100,000. This extended consolidation section alerts market indecision as each bulls and bears wrestle to achieve management.

Regardless of short-term uncertainty, the long-term pattern stays bullish, with Bitcoin holding above key demand zones. Nonetheless, buyers are rising impatient, as the shortage of a transparent breakout has raised doubts about whether or not BTC will push into new all-time highs (ATH) or face a deeper correction.

If Bitcoin reclaims the $100K mark, analysts count on an explosive rally that would drive the value towards unexplored territory. Traditionally, consolidation close to ATH ranges usually precedes main breakouts, and lots of merchants are betting on this situation taking part in out once more.

On the flip facet, a break beneath $94K might spark robust promoting strain, forcing BTC into decrease demand ranges round $89K–$90K. For now, the market stays in limbo, awaiting affirmation in both course. Merchants are carefully watching key ranges, as the subsequent transfer might set the tone for Bitcoin’s trajectory within the coming weeks.

Featured picture from Dall-E, chart from TradingView