American knowledge cloud storage firm Snowflake (NYSE: SNOW) is signaling a possible bullish shift after the inventory struggled in current months.

SNOW’s momentum is basically tied to the corporate’s inroads within the synthetic intelligence (AI) sector, the place it has not less than 1,000 deployed use instances and greater than 3,200 accounts using its AI options.

Snowflake’s rising prowess in AI might be attributed to its product being deemed to assist interoperability and knowledge transformation capabilities. On the identical time, the agency’s potential is reaffirmed by its current key partnerships with entities equivalent to Microsoft (NASDAQ: MSFT).

Relating to inventory worth motion, SNOW has gained 21% 12 months to this point, ending the final buying and selling session at $187.60. These short-term beneficial properties are essential because the fairness makes an attempt to erase the 18% losses incurred over the previous 12 months.

SNOW is ‘beginning to flip heads’

Now, evaluation from charting platform TrendSpider in an X post on February 14 highlighted that Snowflake is ‘beginning to flip heads’ because of its worth motion and a number of other elementary developments.

For example, after combating a chronic downtrend, SNOW is breaking out of a serious month-to-month base. The inventory has not too long ago pushed above a long-term descending trendline under $150, which has acted as resistance since early 2022. This breakout, robust insider shopping for, and enhancing fundamentals recommend that SNOW could possibly be organising for a considerably larger transfer.

On June 7, 2024, Michael Speiser, a director on the agency, acquired $10 million value of shares, whereas CEO Sridhar Ramaswamy made a $5 million buy on March 25.

Traditionally, such substantial insider exercise—particularly close to the inventory’s lows—suggests rising confidence in Snowflake’s prospects.

Including to its enchantment, Snowflake has demonstrated robust and constant income development in current quarters, highlighting its potential for additional enlargement in a high-demand sector.

In the latest quarter, ending October 31, 2024, Snowflake exceeded analyst expectations. The corporate reported adjusted earnings of $0.20 per share, surpassing the $0.15 anticipated by analysts.

Income got here in at $942 million, beating estimates of $897 million. Product income accounted for 96% of complete gross sales, with the corporate now forecasting $3.43 billion in fiscal 2025 product income, implying 29% development.

Regardless of the 28% year-over-year income development, Snowflake’s internet loss widened to $324.3 million in comparison with $214.3 million in the identical interval final 12 months.

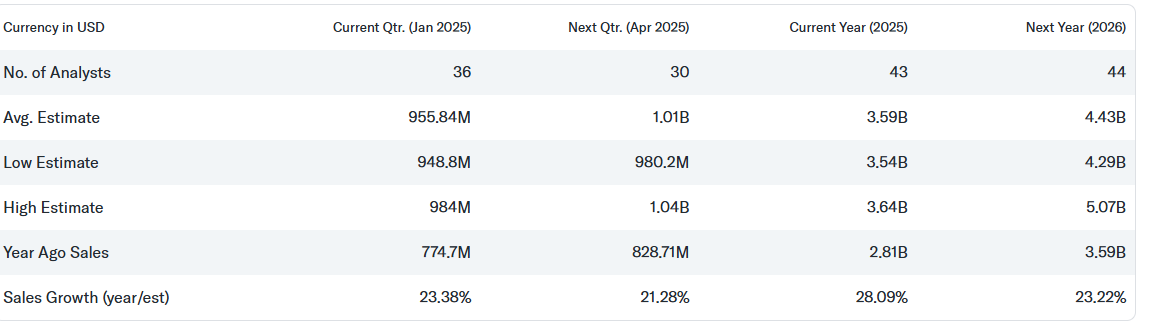

Trying forward, Snowflake is predicted to report $955.84 million in income for the January 2025 quarter, a 23.38% enhance 12 months over 12 months. Analysts mission $3.59 billion in income for fiscal 2025, up 28.09%, with 2026 estimates reaching $4.43 billion, reflecting 23.22% development.

Snowflake AI potential

Relating to Snowflake’s future development, the inventory has the potential for additional momentum, primarily as a result of firm’s funding in AI know-how. Snowflake’s AI-powered options allow prospects to work together with knowledge utilizing pure language processing, retrieve insights shortly, and customise fashions with out coding experience.

Certainly, this user-friendly method positions Snowflake for vital curiosity, particularly as the corporate expects its complete addressable market to double to $342 billion by 2028.

In abstract, Snowflake’s AI-driven development and insider confidence sign upside potential, however dangers stay. Ongoing internet losses, fierce competitors, and the necessity for sustained development may problem its momentum. Nonetheless, its increasing market and strategic positioning make it a inventory to look at.

Featured picture through Shutterstock