The NFT market continues its downward development at the same time as crypto costs stabilize, with Bitcoin edging as much as $97,000 whereas Ethereum holds regular round $2,688 (see under).

The broader crypto market has seen a modest restoration, with the entire market cap rising to $3.24 trillion from final week’s $3.13 trillion.

New merchants present curiosity regardless of decrease volumes

Based on CryptoSlam information, NFT (non-fungible token) gross sales quantity has fallen to $112.7 million. That’s a 35.15% decline from the earlier week. Nonetheless, the market has seen a notable surge in participation, suggesting rising curiosity from new merchants regardless of decrease total values.

The market information exhibits an attention-grabbing distinction between quantity and participation:

- NFT gross sales quantity dropped to $112.7 million from $119.5 million

- NFT patrons surged 624.41% to 203,994

- NFT sellers elevated 519.61% to 158,805

- NFT transactions declined barely by 1.41% to 1,443,007

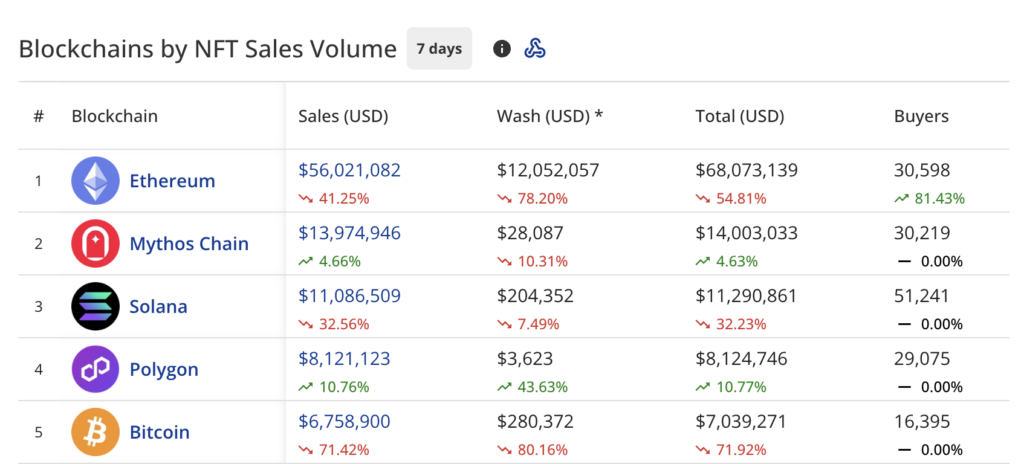

Ethereum NFT gross sales quantity drops 41.25%

- Ethereum (ETH) stays the market chief however noticed gross sales fall 41.25% to $56.0 million. The community’s wash buying and selling dropped 78.20% to $12.0 million, although purchaser numbers rose 81.43% to 30,598.

- Mythos Chain held second place with $13.9 million in gross sales, up 4.66%.

- Solana (SOL) maintained the third place with $11 million regardless of a 32.56% lower.

- Polygon (POL) confirmed energy in fourth place with $8.1 million, rising 10.76%.

- Bitcoin (BTC) dropped to fifth with $6.7 million, falling 71.42%.

DMarket leads the NFT gross sales

DMarket has taken the lead with $8.7 million in gross sales, up 7.98%. The gathering maintained sturdy exercise with 322,241 transactions and 24,413 patrons. Courtyard adopted with $7.3 million, rising 25.78% and seeing purchaser numbers bounce 122.44%.

CryptoPunks held third place with $5.2 million regardless of a 30.01% drop. Pudgy Penguins fell to fourth place with $5.1 million, declining 55.29%. Azuki rounded out the highest 5 with $5 million, down 79.17%.

The week’s high gross sales included:

- Uncategorized Ordinals #8912771: $7,749,449 (80.1296 BTC)

- CryptoPunks #2550: $331,955 (125 ETH)

- CryptoPunks #793: $146,683 (53.5 ETH)

- CryptoPunks #9634: $128,988 (47.5 ETH)

- CryptoPunks #9701: $122,883 (45 ETH)

What occurred?

NFTs had been scorching in 2021, however the market turned more and more saturated. Gross sales plummetted, however confirmed indicators of a comeback in October.

However with 1000’s of initiatives flooding the area, many who lack distinctive worth propositions, patrons have seemingly grown extra cautious about speculative investments.

The preliminary hype-driven growth of NFTs, fueled by high-profile endorsements — together with a collection of photo-shopped photos hyped by Donald Trump whereas he was campaigning — has begun to fade. Many early adopters have grown disillusioned with initiatives that didn’t ship long-term worth, whereas others face the truth of unsustainable valuations.

In consequence, curiosity in NFT buying and selling has slowed, particularly as financial uncertainty—together with rising inflation and recession fears—has prompted shoppers to tug again from speculative belongings.

Regardless of these challenges, the NFT area is evolving. There’s rising curiosity in NFTs with actual utility, notably these tied to the metaverse and gaming ecosystems, suggesting the market is shifting in direction of extra purposeful belongings moderately than speculative collectibles. Whereas the market cools, high quality over amount is changing into the defining issue for future NFT success.

For extra protection on NFTs, take a look at episode six of The crypto.information Present, with particular visitor Anika Meier.