Distinguished funding firm Avenir has considerably elevated its Bitcoin-related holdings, in line with its newest 13F submitting.

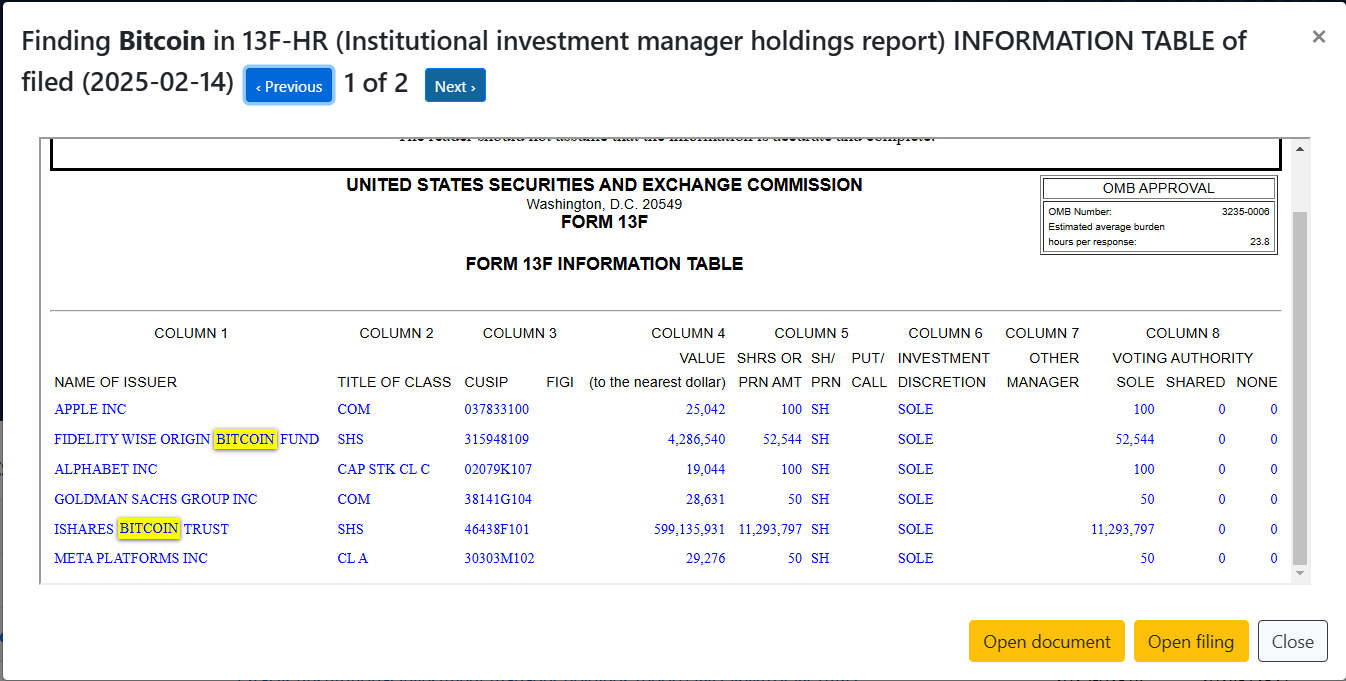

The agency reported proudly owning $599 million price of shares in BlackRock’s iShares Bitcoin Belief (IBIT) as of December 31. This displays a considerable enhance from the 614,195 shares it held in September, which had been then valued at $22 million.

Moreover, Avenir disclosed a $4.2 million place within the Constancy Sensible Origin Bitcoin Fund (FBTC), holding 52,544 shares.

The 13F submitting particulars institutional funding holdings, outlining asset positions, their CUSIP numbers, and market valuations. Avenir’s reported enhance in Bitcoin ETF publicity aligns with IBIT’s speedy development, which has outpaced different exchange-traded funds in historic efficiency.

BlackRock Bitcoin ETF’s Document Progress

BlackRock’s Bitcoin ETF has set a brand new document within the exchange-traded fund business. Information point out that IBIT has reached $56 billion in internet belongings below administration.

Notably, the fund attained the $50 billion milestone in simply 228 days, surpassing the earlier quickest document of 1,329 days by a big margin. Analysts spotlight IBIT’s speedy ascent as a notable growth within the crypto funding panorama, reflecting heightened institutional curiosity in Bitcoin publicity.

The robust efficiency of BlackRock’s Bitcoin spot product follows a broader development of rising investor curiosity in regulated cryptocurrency funding autos. Avenir’s elevated holdings underscore the agency’s strategic positioning inside this market as Bitcoin ETFs proceed gaining traction amongst institutional buyers.

Avenir Group’s Progress Initiatives

The rise in Avenir’s Bitcoin ETF investments coincides with key business developments led by Avenir CRYPTO, the agency’s digital asset division. The corporate recently organized its flagship Future Boundless occasion in Singapore, bringing collectively prime business leaders.

Co-hosted with Deribit, Paradigm, and LTP, the occasion addressed market challenges similar to buying and selling inefficiencies and liquidity fragmentation within the crypto sector.

This gathering follows the launch of Avenir CRYPTO’s $500 million Crypto Partnership Program, introduced in September. The initiative goals to assist quantitative buying and selling groups and improve monetary innovation.

Notably, this system allocates 200 million USDT, 3,000 Bitcoin, and 50,000 Ethereum to strengthen partnerships with top-performing corporations worldwide.

DisClamier: This content material is informational and shouldn’t be thought-about monetary recommendation. The views expressed on this article could embody the creator’s private opinions and don’t replicate The Crypto Primary opinion. Readers are inspired to do thorough analysis earlier than making any funding selections. The Crypto Primary isn’t liable for any monetary losses.