A fast have a look at the numbers reveals that the memecoin market has continued to expertise a dramatic downturn in latest months, marking a major shift in investor sentiment whereas as soon as once more elevating some critical doubts concerning the long-term viability of those property.

Up to now, between Jan and Feb of this yr, the market cap of those tokens dipped from a large $116 billion to $67 billion, representing a loss of nearly $50 billion (or roughly 30% of the trade’s worth).

This sharp decline adopted what many thought-about the height of meme coin enthusiasm, catalyzed by the meteoric rise of Official Trump (TRUMP) earlier this yr. The Trump-endorsed cryptocurrency surged to a formidable $72 per token virtually in a single day following its debut, capturing widespread consideration and driving speculative curiosity throughout the meme coin sector.

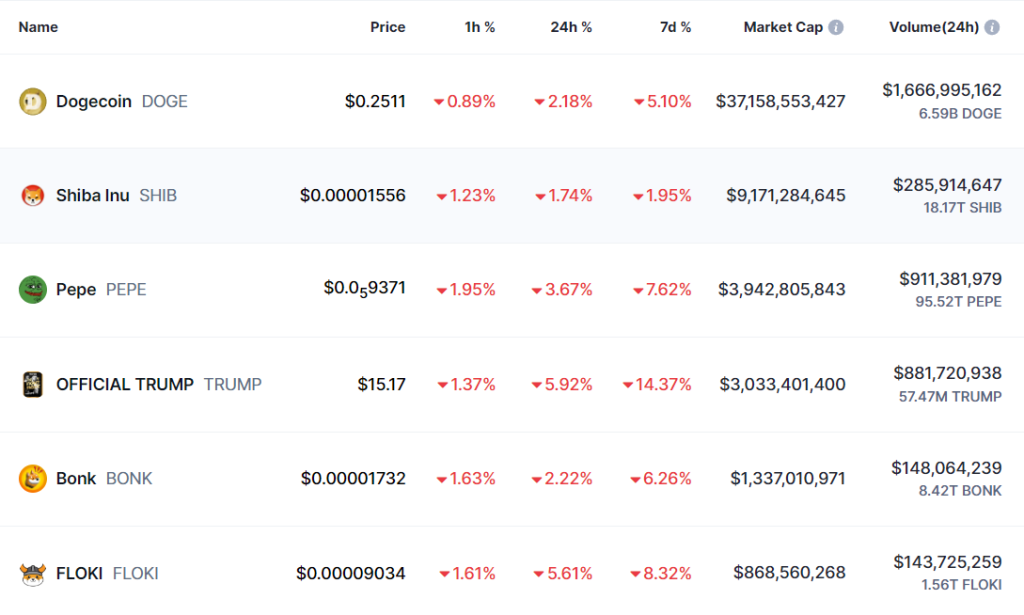

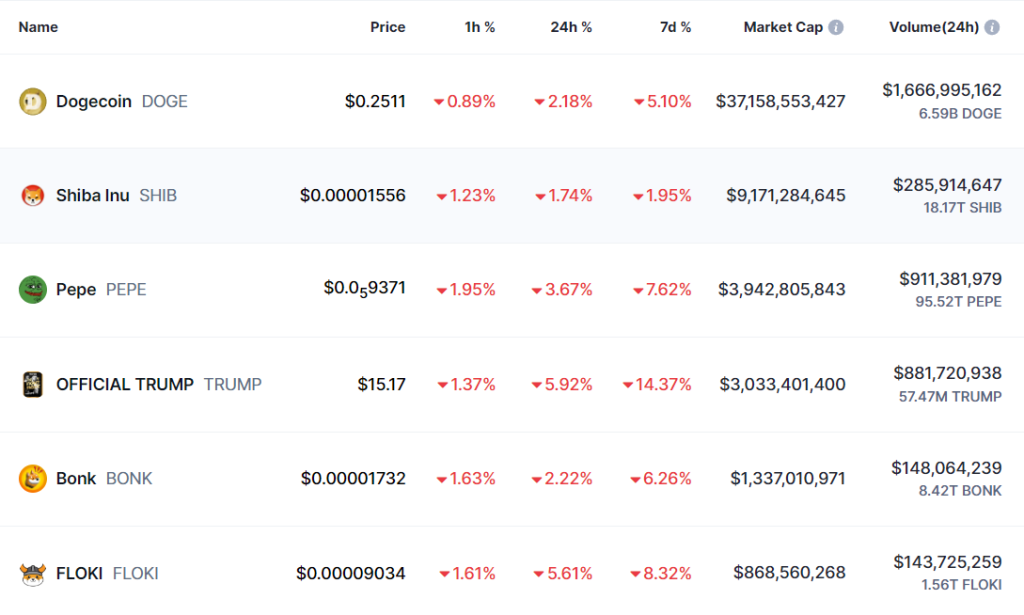

That stated, market knowledge from February has painted a reasonably sobering image, with TRUMP now buying and selling at simply $15.34 — marking a decline of over 12% over the previous week — with different distinguished memecoins additionally reflecting related downward tendencies.

As an example, market leaders like Dogecoin (DOGE), Pepe (PEPE), Bonk (BONK) and FLOKI have all skilled dips ranging between 5% and eight.5% over the aforementioned time interval, as soon as once more bringing scrutiny to the elemental utility and intrinsic worth of those currencies.

RWA market musters traction

As capital has continued to exit the memecoin sector, it seems as if traders are more and more turning their consideration (in addition to their cash) to the real-world asset (RWA) tokenization sector, with trade consultants projecting the sector to succeed in a valuation of $50 billion earlier than the tip of 2025.

Infact, the ecosystem has already demonstrated spectacular development, attaining a 32% annual development charge in 2024, its highest improve over the earlier 12 months.

Amidst this upsurge, a number of initiatives have continued to come back to the fore. As an example, Tezos has made immense strides inside this area, thanks, largely, to its groundbreaking platform, Fraktion.

Following a successful €1.1 million seed funding round backed by notable traders together with Cabrit Capital and the Tezos Basis, the challenge is actively democratizing entry to high-value property.

Moreover, Tezos has additionally made waves within the commodity tokenization sector with the launch of Uranium.io, the world’s first blockchain-based uranium buying and selling platform, developed in partnership with Curzon Uranium and Archax.

Equally, Singularity Finance (SFI) too has established itself as a transformative power within the RWA area — combining AI with tokenization rules — by its recent collaboration with Cicada to launch a $1 million fund. Furthermore, its recent launch of the $SFI token, ensuing from the merger between SingularityDAO and Cogito Finance, has created a complete ecosystem that serves a number of capabilities, together with gasoline chain token operations, node staking, and participation in a sophisticated index vault system.

If that wasn’t sufficient, SFI’s partnership with Functionland (beneath the Crestal model) has additional strengthened its place out there, serving to create a platform for establishments and people searching for to leverage the convergence of AI and blockchain know-how in RWA administration.

Lastly, Ondo Finance has emerged as a power on this market, because of the launch of its Ondo International Markets (Ondo GM) platform which brings trad-fi property onto the blockchain, providing tokenized variations of shares, bonds, and ETFs. Extra notably, their announcement of Ondo Chain, a devoted layer-1 blockchain for institutional RWA tokenization, has attracted a formidable roster of institutional companions.

As per stories, the platform’s improvement is being guided by industry giants together with BlackRock, PayPal, Morgan Stanley, Franklin Templeton, WisdomTree, and Google Cloud, amongst others. This institutional backing, mixed with further help from ABN Amro, Aon, and McKinsey, has positioned Ondo Chain as a serious participant within the institutional adoption of RWAs.

Moreover, the platform’s deal with making a “strategic reserve” with its native token ($ONDO) has demonstrated its dedication to constructing a sustainable and liquid ecosystem for tokenized conventional property.

A multi trillion-dollar alternative is within the offing

The way forward for RWA tokenization seems remarkably promising, with a latest report projecting the sector to expertise a greater than 50-fold increase by 2030, doubtlessly surpassing the $10 trillion mark. This extraordinary forecast displays the growing recognition of tokenization as a transformative power throughout the trad-fi area, providing enhanced liquidity, accessibility, and transparency to beforehand illiquid property. Attention-grabbing occasions forward!