Forward of the US inflation report, Bitcoin’s worth is experiencing a bearish correction. This drop is triggered by vital sell-offs amongst buyers, creating intense bearish stress within the $95K-$100K vary. In the meantime, numerous on-chain metrics point out combined sentiments relating to Bitcoin’s subsequent path, as merchants on either side proceed to closely affect the worth chart.

Bitcoin’s MVRV Ratio Dropped Throughout Upward Correction

Information that Binance, a significant world cryptocurrency change, had bought practically all of its Bitcoin, Ether, Solana, and different cryptocurrencies appeared to extend the market’s instability. Because of this, Bitcoin is at present dealing with difficulties, fluctuating across the $98K stage and lately present process a correction to $95K.

In keeping with information from Coinglass, complete liquidations for Bitcoin soared to $32.21 million, with consumers dealing with liquidations of roughly $23.7 million and sellers round $8.41 million.

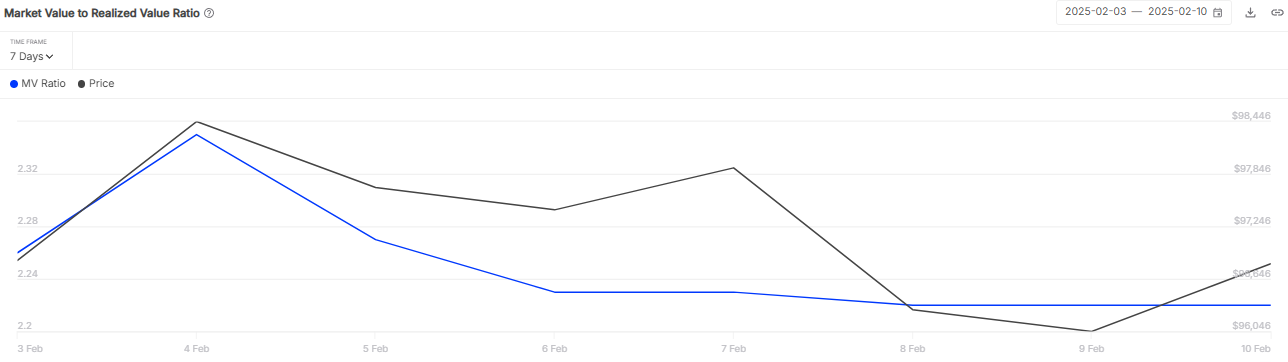

Moreover, IntoTheBlock information signifies that Bitcoin’s MVRV ratio has decreased as its worth rose over the previous 72 hours. The ratio fell from a excessive of two.35 to 2.22 whereas Bitcoin made a push towards $99K.

A declining MVRV ratio throughout a worth surge typically signifies that long-term holders are taking earnings. These holders bought their Bitcoin, which they beforehand purchased at decrease costs, thus realizing their good points. This is without doubt one of the causes behind the present bearish pullback.

Moreover, Bitcoin’s volatility fee has sharply decreased from a excessive of 38.12% to 33.52%. This drop in volatility might preserve Bitcoin’s worth steady inside a sure vary for now. Nevertheless, there are indications that Bitcoin may very well be gearing up for a possible breakout quickly.

A number of analysts view the present downturn as an opportunity to purchase Bitcoin at a cheaper price. It’s anticipated that purchasing will improve if Bitcoin reaches a dip, probably establishing a stable help stage. This might result in a major upward correction for Bitcoin.

What’s Subsequent for BTC Worth?

Bitcoin’s worth lately tried to maneuver above $98K however has since consolidated, and is now exhibiting a bearish development because it struggles to interrupt above the 23.6% Fibonacci retracement stage. As bearish domination rises, the worth of Bitcoin is aiming for a maintain under the $95K mark. Presently, Bitcoin is priced at $95,027, having decreased by 3% over the past 24 hours.

The BTC/USDT pair is dealing with steady promoting stress because it drops under the essential ascending help line. As the worth now holds under that development line, Bitcoin would possibly quickly intention for a retest of the essential help stage at $91K. Staying above this threshold may gain advantage consumers, probably pushing the worth in direction of $98K and probably even $102,000.

Conversely, if Bitcoin continues to commerce under the EMA20 development line on the 1-hour chart, there may very well be downward stress, probably driving the worth under $89K.