On this market uncertainty, XLM, the native token of Stellar, seems bearish and is poised for a large value decline. This bearish outlook is additional supported by intraday merchants, who appear to be strongly betting on brief positions, as reported by the on-chain analytics agency CoinGlass.

Merchants’ Robust Bets on Brief Positions

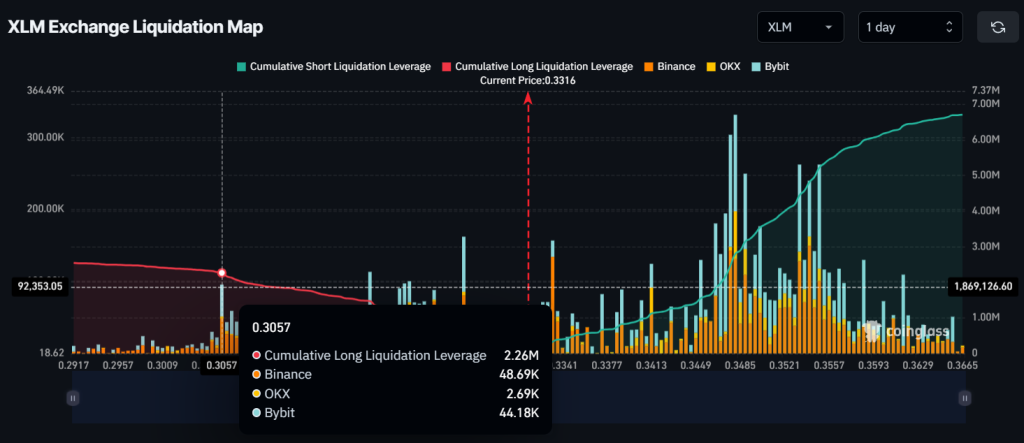

In the present day, February 6, 2024, the on-chain metric XLM change liquidation map revealed that merchants holding lengthy positions are exhausted and presently over-leveraged on the $0.3057 degree, with $2.26 million value of lengthy positions. In the meantime, merchants holding brief positions are dominating, as they’re over-leveraged at $0.355, with $5.25 million value of brief positions at this degree.

Nevertheless, these tens of millions of {dollars} value of positions might be liquidated if market sentiment shifts and the worth strikes in both path. This on-chain information clearly exhibits that there isn’t any energy on the bull’s aspect, and the bears are those main the XLM.

The potential motive behind this adverse notion is the bearish value motion and the present financial tensions between america, Mexico, Canada, and China.

XLM Technical Evaluation and Upcoming Stage

In response to professional technical evaluation, XLM has fashioned a bearish inverted cup and deal with value motion sample on the each day time-frame and is on the verge of a assist or neckline breakdown.

Primarily based on the current value motion, if XLM fails to carry this degree or breaches the neckline and closes a each day candle under the $0.32 degree, there’s a robust chance it might drop by 40% to achieve the $0.20 degree sooner or later.

Regardless of this bearish value motion, the asset remains to be buying and selling above the 200 Exponential Shifting Common (EMA) on the each day time-frame, indicating that XLM is in an uptrend.

Present Value Momentum

XLM is presently buying and selling close to $0.33 and has skilled a value decline of over 7.50% previously 24 hours. Nevertheless, throughout the identical interval, its buying and selling quantity dropped by 30%, indicating a concern of additional value declines.