Dogecoin has confronted excessive volatility amid U.S. commerce battle fears and macroeconomic uncertainty, inflicting a pointy decline in value motion. The meme coin plunged over 39% in lower than 48 hours, wiping out weeks of features and shaking investor confidence. Nevertheless, since hitting its native low, DOGE has managed to get better and tag key resistance ranges, hinting at a potential reversal.

Regardless of the chaos, high analyst Ali Martinez shared on-chain insights revealing that whales took benefit of the current dip, accumulating a staggering 750 million Dogecoin. This indicators robust confidence amongst main gamers, suggesting that institutional and large-scale buyers see the present value ranges as a shopping for alternative moderately than an indication of extended weak point.

Now, the market is watching intently to see if Dogecoin can construct momentum and reclaim greater ranges. If the value stabilizes and reclaims key resistance zones, it might pave the best way for a brand new rally. Nevertheless, one other wave of promoting strain might emerge if uncertainty continues to dominate. With whales stepping in, DOGE’s subsequent transfer shall be essential in figuring out its short-term course and potential for a breakout.

Dogecoin Struggles Under Key Ranges As Whales Accumulate

Dogecoin has been beneath aggressive promoting strain as the complete meme coin market faces important drawdowns. The value has struggled to take care of key help ranges, resulting in uncertainty in regards to the short-term development. Nevertheless, analysts stay optimistic about DOGE’s long-term outlook, predicting a powerful rally that would ship the value previous its 2021 all-time excessive of $0.73.

Regardless of the current volatility, on-chain knowledge suggests that giant buyers are making the most of the dip. High analyst Ali Martinez shared on-chain data and an analysis on X revealing that whales seized the chance in the course of the sell-off, accumulating 750 million Dogecoin. Martinez sees this as a powerful signal of confidence available in the market, indicating that huge gamers are positioning themselves for a possible breakout within the coming months.

Whereas DOGE stays under key liquidity ranges, the construction nonetheless seems to be bullish from a long-term perspective. If the value can reclaim essential resistance zones, a reversal towards greater ranges may very well be imminent. Nevertheless, the approaching weeks shall be essential in figuring out whether or not Dogecoin can get better shortly or if additional consolidation is required earlier than a push towards new highs. With whales actively accumulating, the market shall be watching intently for indicators of a renewed uptrend.

Worth Evaluation: Key Ranges To Maintain

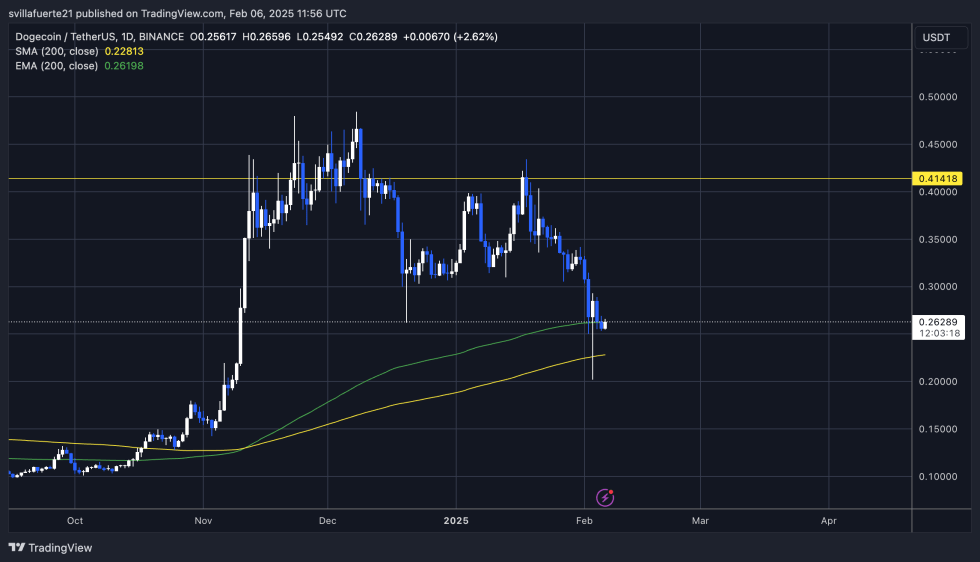

Dogecoin is presently buying and selling at $0.26 after days of promoting strain and a wave of damaging sentiment that has impacted the complete crypto market. The value is hovering simply above the 200-day exponential transferring common (EMA), an important indicator for sustaining bullish momentum. Bulls must defend this degree to substantiate short-term energy and keep away from a deeper correction.

If DOGE fails to carry above the 200-day EMA, a drop towards the $0.22 demand zone is probably going, which might result in additional consolidation earlier than any potential restoration. Nevertheless, if bulls handle to maintain robust help across the $0.26 degree, a transfer towards $0.29 may very well be imminent. A breakout above this resistance would probably set off renewed shopping for strain, setting the stage for additional features within the coming weeks.

For now, Dogecoin stays in a fragile place, with market uncertainty dictating value motion. Holding above the 200-day EMA would maintain bullish hopes alive, however a failure to take action might ship DOGE into deeper correction territory. Merchants shall be intently watching the subsequent few periods to find out whether or not the meme coin can regain momentum and push towards greater value ranges.

Featured picture from Dall-E, chart from TradingView