Information exhibits the cryptocurrency sector has witnessed an enormous quantity of liquidations after the crash that Bitcoin and firm have gone by way of.

Crypto Derivatives Market Has Simply Seen A Lengthy Squeeze

Based on information from CoinGlass, a considerable amount of liquidations associated to cryptocurrency contracts has occurred on the derivatives platforms throughout the previous day. “Liquidation” right here refers back to the forceful closure that any open contract undergoes by its change after it has amassed losses of a sure diploma (the precise share of which depends on the platform).

There are primarily two components that may considerably have an effect on the possibilities of a contract discovering liquidation. The primary one is volatility. An asset that tends to be risky is of course more durable to foretell, so the chance of liquidation might be increased.

Whereas volatility is one thing that’s probably not within the palms of a person dealer, the second issue, the leverage, is. “Leverage” is a mortgage quantity that any investor can go for in opposition to their preliminary place.

The benefit of leverage is that any earnings earned by the holder are multiplied by the identical multiplier because the leverage. Whereas this could sound profitable, it’s additionally true that any losses incurred turn into extra by the identical magnitude. Thus, it takes a smaller value transfer in the wrong way to the guess for a similar place to get liquidated when leverage is within the image.

Within the cryptocurrency sector, cash usually show volatility and speculative demand might be heavy. The result’s that mass liquidation occasions, popularly often called squeezes, occur on the common.

Bitcoin and the altcoins have displayed some sharp value motion throughout the previous day, so it’s not shocking to see that such an occasion has occurred within the derivatives market but once more.

The information for the liquidations which have taken place over the past 24 hours | Supply: CoinGlass

As is seen within the above desk, liquidations throughout the cryptocurrency derivatives sector have crossed the $2.32 billion mark within the final 24 hours. Even by the market’s requirements, it is a large determine.

Round $1.93 billion of the liquidations, equal to over 83% of the overall, have concerned the lengthy holders. Bitcoin and others have crashed on this window, so it is smart that these betting on a bullish consequence can be affected probably the most closely.

Nonetheless, shorts haven’t totally been spared, as round $387 million positions related to them have additionally been shut down with the rebound that BTC has seen from its lows.

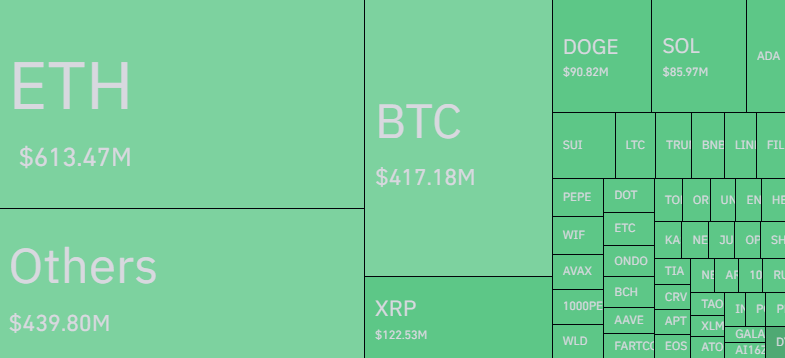

Apparently, whereas Bitcoin usually tops the checklist of liquidations, Ethereum (ETH) as a substitute has come first this time, with round $613 million in contracts associated to it concerned within the occasion.

The breakdown of the most recent liquidations by image | Supply: CoinGlass

ETH seeing virtually $200 million extra liquidations than the primary cryptocurrency is probably going all the way down to the truth that it has seen a a lot bigger value drawdown of round 16% throughout the previous day.

Bitcoin Value

Bitcoin has seen some restoration since its plunge towards the $92,000 mark as its value is now floating round $95,300.

Appears to be like like the value of the coin has gone by way of a rollercoaster previously day | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CoinGlass.com, chart from TradingView.com