Amid the cryptocurrency market’s restoration, ADA, the native token of the Cardano blockchain, has considerably rebounded and is poised for substantial upside momentum. The potential reasoning behind this bullish outlook consists of its file 58% intraday worth reversal and rising curiosity from whales, long-term holders, and traders.

ADA Technical Evaluation and Upcoming Degree

In response to professional technical evaluation, ADA has skilled a major worth reversal, returning to its bullish vary and buying and selling above the essential assist degree of $0.71. Moreover, it has efficiently retested its 200 Exponential Transferring Common (EMA) on the every day timeframe, making the altcoin extra favorable for a possible bull run.

Based mostly on latest worth motion and historic momentum, ADA could face gentle resistance close to $0.85. If it efficiently breaches this degree and closes a every day candle above $0.86, there’s a sturdy risk it might soar by 45% and reclaim its latest excessive of $1.25.

Moreover, ADA has fashioned a bullish hammer candlestick sample that helps this constructive outlook and indicators a possible upcoming rally.

$82 Million Value ADA Outflow

Amid this bullish outlook, whales and long-term holders have continued their accumulation, which started up to now 24 hours when ADA skilled a pointy decline.

A serious on-chain analytics agency, Coinglass, revealed that exchanges have witnessed an outflow of $82 million price of XRP tokens up to now 48 hours. This substantial outflow amid the continuing worth restoration suggests potential accumulation, which might drive shopping for strain and additional upside momentum.

Merchants’ Robust Guess on Lengthy Place

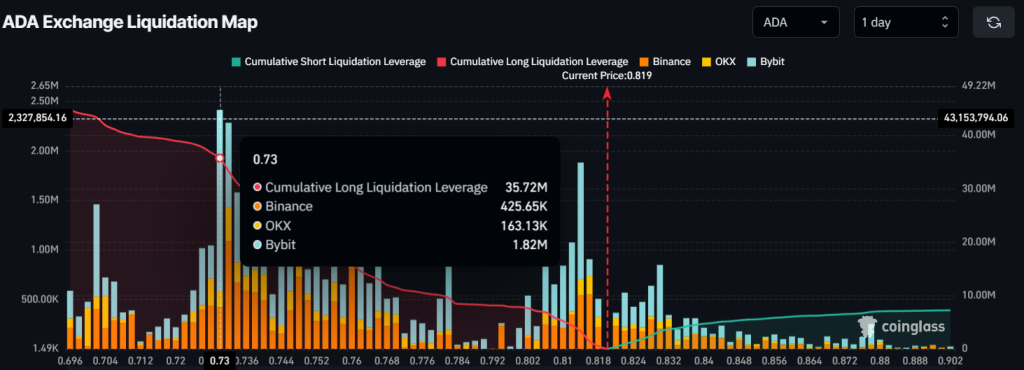

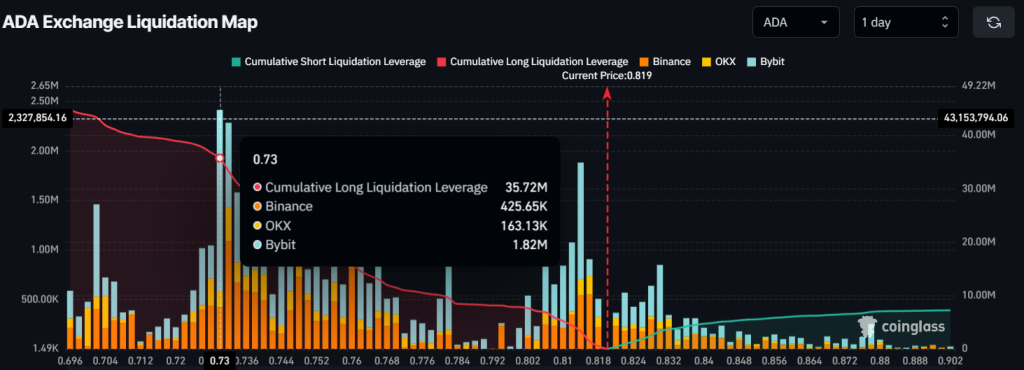

Along with long-term holders, merchants are additionally discovered to be over-leveraged on the lengthy aspect, as revealed by Coinglass information.

At press time, the $0.73 degree is the over-leveraged zone, the place merchants maintain $35 million price of lengthy positions, appearing as sturdy assist for ADA. Conversely, $0.83 is one other over-leveraged degree on the quick aspect, the place quick sellers maintain solely $3.32 million price of quick positions, ten occasions decrease than the bulls’ lengthy holdings.

When combining all these on-chain metrics with technical evaluation, it seems that bulls are again available in the market and are supporting the altcoin for important upside momentum.